What CIMB says...

Dyna-Mac (DMHL SP; S$0.685) - Too hot to handle?

• Dyna-Mac Holdings? More like Dynamite Holdings. Hit a 52-week high of S$0.685 today on volume of 54.4m shares.

• Perspective - that means the shares are up 96% in just 1.5 months post listing.

• On Monday, we highlighted the risk that valuations for Dyna-Mac were now close to Keppel Corp and SembCorp Marine.

• Risk of profit taking is very real on the stock given the run up in valuations and 96% gain since IPO.

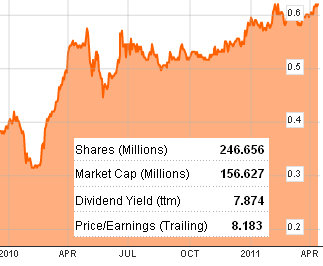

Innotek (INNOT SP; S$0.635) - 52-week high - don’t get scalded

• Innotek rose 2.4% to close at S$0.635, a 52-week high.

• We have always liked this stock (our first report dates back to 2009).

• However, everyone who claims to be in the market (speculator, punter, trader, investor, flipper etc) must know Innotek’s below book valuation and 5cts DPS, thus dividend yield story by now.

• But no one wants to be the bearer of bad news - we like the Company but you need to know this:

> Demand for TV components expected to soften in 1Q11. Group expects performance in 1Q11 to be challenging (per FY10 results commentary);

> Due to the Japanese earthquake affecting its OA, TV and automotive customers, expect delays and this will add to 1Q11 challenges. Its HK peer, EVA Precision (838 HK) has similarly mentioned production/customer delays in their FYE Mar 10 results commentary;

> Exchange rate translation impact. USD/SGD averaged 1.2765 in 1Q11 versus 1.3024 in 4Q10 (Source: Bloomberg);

> Lastly, if you are just in for the 5cts DPS, note that the stock trades ex-dividend on 5th May and the dividends will be paid on 23rd May (Source: www.sgx.com).

• Although we don’t expect the challenging 1Q11 to derail Innotek, it does mean that second half is likely to be stronger than the first half.

• From a momentum perspective, there is a risk of share price correction post 1Q11 results.

Techcomp (TCH SP; S$0.50)

• Looks like dual-listing still holds some sway.

• Techcomp hit a 52-week high of S$0.50 after further updates of the progress for its dual-listing by way of introduction.

• We were early BUYers, TP S$0.83. As far as we can tell, we give you on the ground research.

Nobody other than us covers this stock (per Bloomberg).