Excerpts from latest analyst reports...

Kim Eng Research highlights S-chips that are expected to report positive results

Reigniting interest in S‐chips – According to the China Federation of Logistics and Purchasing, the nation’s Purchasing Managers’ Index (PMI) rose to 54.7% in October from 53.8% a month earlier, fuelled by rising domestic demand and stable exports. A reading above 50% indicates expansion. We note that the index has been in expansionary territory for 20 consecutive months.

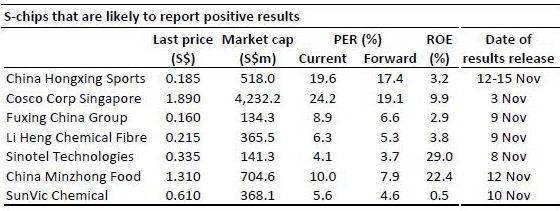

In our view, this may reignite investor interest in S‐chips, particularly those with strong fundamentals and good earnings prospects. In the table below, we feature some of these companies that are expected to report positive results in the next 1‐2 weeks.

Hot Stock: Fuxing China

Kim Eng Research analyst: Eric Ong

New killer product. Fuxing has started marketing its Super Durable Zipper after it successfully registered a patent for this new product. The group plans to scale up production by investing up to RMB20m for 100 sets of machinery planned by end‐FY10, with an estimated maximum capacity of 2,400 tons per annum.

Realigning resources. With the termination of its knitting wool operations in April 2010, Fuxing will divert more resources towards expanding its finished zipper production in Shanghai and Qingdao plants. According to management, these locations are close to many potential customers, thus providing huge opportunities for the group.

Strong financials. With its strong net cash position of RMB600m, Fuxing is actively looking at M&A opportunities to invest in related businesses within the supply chain of its zipper products. But management has also committed to paying out not less than 40% of each year’s net profit as dividend from FY10.

Recent story: FUXING: China’s No.2 zipper firm 2Q net nearly triples, 2010 looking good