Excerpts from latest analyst reports….

Deutsche Bank initiates coverage of China Fishery Group ($2.09) with $2.60 target price

Analyst: James Tan

* Attractive growth and undemanding valuations; we initiate with Buy - China Fishery Group (CFG) looks poised to capitalize on increasing consumption of fish and rising fish prices.

It is a leading integrated commercial fisher operating in North Pacific, South Pacific and Peruvian waters.

We expect the company to deliver a 3 year earnings CAGR of 31% driven by a full catching season in the South Pacific, efficiency gains from its fishmeal and fish oil business in Peru and to benefit from an increase in fish prices over the long term.

We initiate with Buy and a target price of S$2.60, implying a potential total return of 28%.

* Integrated commercial fisher with a sizeable trawling fleet and catch quota – The company is one of the largest integrated commercial fishers with fishing rights to vital sustainable fishing grounds around the world.

CFG has a 20% market share of Pollock in Russia and a 17% market share in the South Pacific (Jack Mackerel) and Peru (Anchovy) via quota allocations and fishing licenses. CFG utilizes state-of-the-art technology on board its vessels and uses trawling and purse seining fishing methods to capture and process fish onboard and on land.

* Potential catalysts to prompt a re-rating of the stock - CFG plans to (1) acquire more fishing quotas (in 1Q11) in Russia; (2) reverse start-up costs in the South Pacific; (3) expand its fishmeal and fish oil business in Peru; and (4) target new fishing species and regions in Mauritania and Alaska.

We believe that the price outlook for its three key catches – Alaska Pollock (eight-year CAGR of 9%), Jack Mackerel (nine-year CAGR of 13%) and fishmeal (12-year CAGR of 7%) – remains positive. This is driven by population gains, higher living standards, increasing health awareness and rising demand from aquaculture.

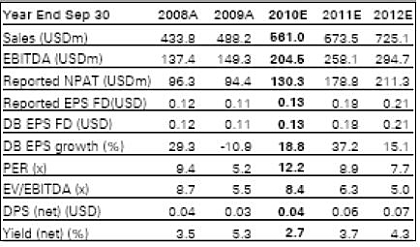

* Trading at 12.2x and 8.9x FY10-11E PE; three-year EPS CAGR growth of 31% - Our target price of S$2.60 is based on an 11x PE multiple on our FY11SepE EPS. We have cross checked our PE multiple using an ROE/COE model (ROE-g / ROE*(COE-g)) and DCF as a secondary valuation. The stock is trading at a 40% discount to its global peers and a 70% discount to its Chinese peers. Downside risks are climate change, regulatory, fuel costs, quotas and fish prices.