AFTER a sharp drop in sales in 4Q08, things are beginning to look up for direct seller of consumer health and beauty products, Best World.

It chalked up net profit of S$3.3 million for 2Q09, up 61.6% compared to 1Q09 but down 28.9% compared to 2Q08.

An interim dividend of 1.2 cents per share was declared, representing 47.2% of 1H09 net profit.

1H09 revenue was S$39.7 million, down 27.4% year-on-year, while net 1H09 earnings were S$5.4 million, down 31.5%.

2Q09 revenue was S$20.8 million, up 9.4% compared to 1Q09, while net 2Q09 margin improved by 5 percentage points sequentially to 15.6%.

The company sits on strong cash reserves of about S$37.6 million and has zero borrowings.

Sales in its retail business segment, which consists of distribution centers in China, rose 66%, from S$1.4 million in 1H08 to $2.3 million in 1H09.

The company operates 44 distribution centers in China now, compared to 5 as at 30 Jun 2008.

China contributed 5.8% to 1H09 revenues.

”We are looking for good manufacturing facilities in China in order to obtain a direct selling license for our products there,” said executive director Huang Ban Chin at a briefing yesterday.

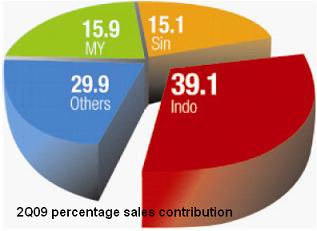

Indonesia remained the biggest revenue contributor in 1H09, accounting for 45.4%, or S$18 million.

However, this was a yoy decline of 29.3% due to:

1) price increases implemented in 2Q09,

2) a delay in the approval of several product registrations; and

3) The Indonesian government's drive to promote the use of locally manufactured products.

Mr Huang expects 3Q09 sales in Indonesia to remain muted due to the observance of the Islamic festival of Ramadan.

1H09 revenue from Singapore was S$6.3 million, down 28.6% yoy while revenue from Malaysia was S$5.2 million, down 60.6% yoy.

Not all is down, though. Revenues from the less penetrated markets such as Thailand, Taiwan, Australia and Cambodia increased 43.1% yoy to reach S$10.2 million.

This was contributed by broad based growth in all the markets less penetrated, except for Vietnam and Hong Kong. A first lifestyle center was opened in Myanmar in 2Q09.

Three products were launched during 2Q09. These were:

(1) UberAir Vac, wellness equipment that uses permanent static electricity to remove contaminants such as dust, bacteria, and viruses from the air.

(2) DR’s Secret Activist Eye Cream, a skincare product that uses growth peptides.

(3) Food Philo Colostrum Delite, a functional food that is marketed as a family health drink that contains Colostrum and Barley beta-glucan.

Colostrum is clinically proven to prevent flu, improve exercise performance and disease.

Barley beta-glucan helps to boost immunity, stimulates healthy balance of good intestinal bacteria, reduces high cholesterol, and also controls one’s appetite.

Mr Huang said he expects a stable recovery of revenue, which will be boosted by new product launches.

* Related story: BEST WORLD'S Elin Chung: The $49-m woman

* Read NRA Capital chairman Kevin Scully's just-published take on Best World at his website, here.