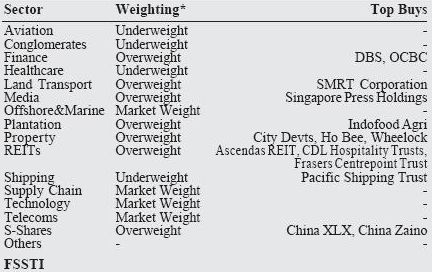

* Refers to business prospects & earnings growth of the sector for the next 12 months. Source: UOBKH

ANYONE TRYING to make sense of the current market could do well to compare it with how it behaved during the Asian financial crisis some 10 years ago.

That’s what UOB Kay Hian did in a report released yesterday (July 6).

“Thus far, the market's behaviour in the current recession has uncannily mirrored that of the Asian financial crisis. Then, the Singapore market bottomed out at 0.7x Price/Book in Sep 98, rallied to 1.4x Price/Book in Jan 99 and took a breather for three months before the next leg-up.”

This time round, the market bottomed out at 0.8x in March and then rallied for three months.

The market is now taking a breather at 1.4x P/B, awaiting more macroeconomic data points on the strength of the global economic recovery (beyond the current re-stocking cycle) before its next move, noted UOB Kay Hian.

There is a difference this time. “With global economies synchronized in recession, it may take a longer time to get out of the woods this time round.”

UOB Kay Hian’s report said the two integrated resorts (IR) - Marina Bay Sands and Resorts World@Sentosa - scheduled for phased opening at end-09 and early-1Q10 are economic catalysts unique to Singapore.

“Our ground checks suggest that local companies are quietly getting ready for this big event. Some are already in talks to provide support services to the IRs. We expect the investment IR theme to make a strong comeback as the opening of the IRs looms.”

UOB Kay Hian’s recently-released 2H09 Singapore strategy report titled "It's Showtime" detailed a list of IR beneficiaries. Our article on that report can be found by clicking IR big bang: What stocks could benefit?