Goodpack's containers are used to ship natural rubber, synthetic rubber and juices around the globe.A New York-based foreign fund has emerged as new substantial shareholder of Goodpack while another foreign substantial shareholder, The Capital Group Companies, has raised its stake further.

Goodpack's containers are used to ship natural rubber, synthetic rubber and juices around the globe.A New York-based foreign fund has emerged as new substantial shareholder of Goodpack while another foreign substantial shareholder, The Capital Group Companies, has raised its stake further.

* On June 26, Mason Hill Advisors, LLC became a substantial shareholder with a direct and deemed interest totalling 25.9 million shares. The direct and deemed stakes are 0.14% and 5.42%, respectively.

The indirect interest of Mason Hill arose from its controlling interest in Equinox Partners, LP and Kuroto Fund, LP.

In a filing to the SGX yesterday (June 30), Goodpack said the purchase that lifted Mason Hill’s exposure above 5% involved 3.5 million shares bought at 90 cents a share.

* Between 6 Oct and May 25, The Capital Group Companies raised its stake from 6.0018 % To 7.1169 %, according to the US fund manager’s note to Goodpack on May 26.

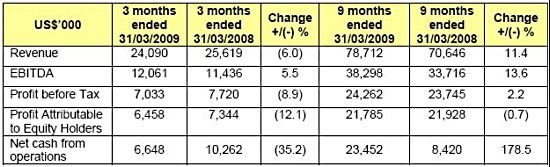

In its announcement in May, Goodpack said it posted an 11.4% increase (16.2% increase excluding the impact of foreign currency translation) in revenue to US$78.7 million for the nine months ended March 31.

Net profit was down marginally by 0.7% at US$21.8 million.

Goodpack’s synthetic rubber division recorded the highest growth amongst the Group’s three main product verticals (Synthetic Rubber, Natural Rubber and Juices) as the company continued to gain more market share.

The juices division too experienced an increase in revenue arising from new customers but revenue contribution from the natural rubber division slipped as the global automotive industry slowed down.

Overall, the increase in demand for the synthetic rubber and juices divisions more than offset the hold back in demand from the natural rubber division.

Read: GOODPACK: The man behind its sterling results