Report dated June 15: Key indicators are trending positively

Source: UBS strategist Niall MacLeod in an Asian Equity Strategy report dated June 15.

INVESTORS WHO missed out on the market rally in recent months look like they will get their chance to get into the game with the current market correction.

And it’s not a downtrend. In fact, the rally ain’t over, according to UBS Research in a report dated yesterday (June 15).

4 reasons offered by UBS analysts Tan Min Lan and Ling Vey Sern:

* Firstly, valuations are still 10-15% below mid-cycle. Banks and properties should still benefit, although the sectors’ dramatic outperformance against telcos (c65% in 3 months) should wane the next 3 months.

* Secondly, key indicators are still surprising on the upside – May Purchasing Managers' Index crossed 50, while hiring intentions for 3Q09 turned positive unexpectedly.

IBES earnings per share upgrades now exceed downgrades for second straight month.

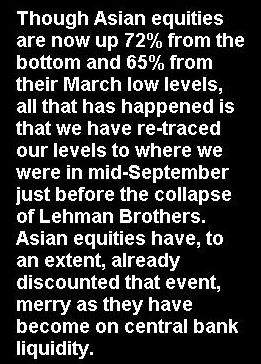

* Thirdly, idle balances to market cap remain in a range consistent with a positive market. Demand deposits (checking accounts that pay zero interest) hit a high of 24% of market cap in Feb-09.

With the market rallying 63%, the ratio has dropped to c17%, but still above peaks of 13-14% in Sep-92, Mar-98, and Mar-03, which marked the start of previous market rallies.

* Fourthly, household wealth has fallen just 5% in 2008 despite what remains the deepest recession on record.

“Taken together, we reiterate our view that the market should trade to its midcycle value which implies an index level of 2,650 on the FSSTI by mid-2010,” according to UBS.

“In the absence of negative data points in the form of renewed growth weakness, rising inflation or withdrawal of policy easing, we think it is premature to judge the rally over.”

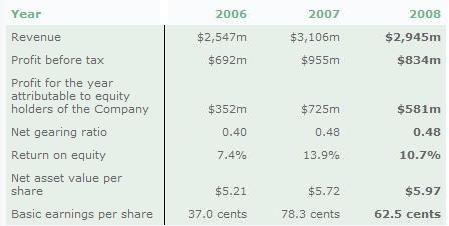

Financials of CIty Dev, the top property pick of UBS.

UBS' preference is still for properties and banks, where the research house believes scope for fundamental upgrades in estimates remain.

But UBS continues to underweight the transport sector with a ‘sell’ on NOL and a ‘neutral’ on SIA.

Within real estate, UBS’ top pick remains City Dev (UBS Key Call).

”We believe liquidity and accumulated wealth are underpinning the resurgence in physicalproperty demand. Among SREITs, we like CDL Hospitality Trusts trading at a 2009e dividend yield of 9.6% and discount to book of 38.5%.”

UBS thinks banks should continue to benefit from the steep yield curve, as well as scope for better than expected provisioning. DBS and UOB remain attractive at 1.2X and 1.7X 2009e price/book. Meanwhile, SGX should benefit as idle liquidity is re-deployed into the market.

Other stocks we like with a combination of growth cyclicality and good dividend yield are SPH, Keppel Corp, and Venture Corp.

Recent stories:

PROPERTY STOCKS: Rise is too far, too fast, says Nomura

UBS: Correction risk rises but rally far from over