AFTER ATTENDING a presentation by Techcomp’s CEO, a fund manager gave this written feedback: “Techcomp perked my interest to warrant reading up on the company and its business model. It's a new name to me.”

It’s not surprising that he didn’t know about Techcomp, even though it has been listed on SGX since 2004.

Headquartered in Hong Kong, Techcomp is the only SGX-listed company that manufactures and distributes scientific instruments – a business that is stable and growing ('We are not affected by economic ups and downs," according to Richard Lo) but relatively little understood in the Singapore investment community.

Techcomp CEO and President Richard Lo spoke to analysts and fund managers on Thursday afternoon (June 11) during a roadshow organized by Financial PR.

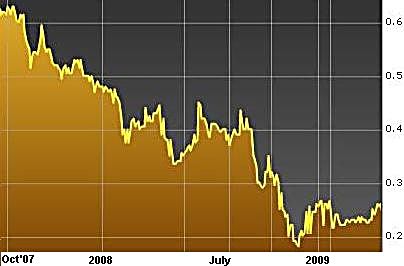

Techcomp suffered a bad beating last year from forex losses due to a massive 26% surge in the yen in a few months – which marked the first time in its 20-year history that revenue growth (of 23%) was not matched by bottomline growth.

“The drop in profit really frustrated every member of the team. Everybody has worked harder and we have very good results in the past five months,” said Mr Lo.

For FY08, Techcomp maintained its final dividend payout of S$0.012 “because we believe we would have very strong operating cashflow this year,” explained Mr Lo.

Techcomp is set for a good first half this year with record sales, according to Mr Lo.

| Techcomp’s financials | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 |

| Revenue (US$’000) | 38,752 | 41,917 | 44,617 | 54,842 | 65,819 | 81,029 |

| Net profit (US$’000) | 2,991 | 3,667 | 3,687 | 4,350 | 6,011 | 3,008 |

| Net profit margin | 7.7% | 8.7% | 8.3% | 7.9% | 9.1% | 3.7 |

| EPS (US cents) | 2.99 | 3.15 | 2.73 | 3.22 | 4.30 | 1.99 |

Mr Lo dealt with why Techcomp’s business – which carries out its manufacturing in Shanghai and distributes its products in China and rest of Asia - is resilient.

In fact, “since we were established in 1988, we have enjoyed growth of more than 20% a year.”

The barriers to entry for the industry of manufacturing laboratory and life sciences equipment are high.

“We are among very few China-based companies that can make instruments up to international standard,” said Mr Lo, adding that most of the world’s supply of scientific instruments comes from the US and Europe.

Those developed countries already have an established network of suppliers of high-quality parts for the instruments. That’s not the case in China, where the quality of the parts varies widely.

“We took years to find high-quality suppliers in China and perfect our quality control system.”

Having parts of the right quality, Techcomp’s plant in Shanghai can compete with players in the US, for example, as Techcomp’s cost is about 50% lower.

With such advantages, Techcomp has been enjoying increased outsourcing by US, European and Japanese companies.

Another barrier to entry is represented by the users of the instruments - scientists and engineers - being conservative, preferring established names to new ones when it comes to laboratory instruments.

The business stability is reflected in its consistent net profit margin in past years, ranging from 7.7 to 9.1%, said Mr Lo.

Techcomp has 2 business segments: distribution (17% of total revenue in 2008) and manufacturing.

Mr Lo emphasized that Techcomp now has new hedging mechanisms in place to prevent losses from forex fluctuation.

“Even if there is another big forex fluctuation, we will not be affected. First, we will transfer any price increase to the customer faster. Second, we will book the forex six months in advance and charge the customer accordingly to avoid effects of any fluctuation. Third, we agree with our business partners to share the difference from any forex fluctuation.”

A growth driver this year is Techcomp starting mass production of biological safety cabinets for NuAire, a US company which has been in the biological safety cabinets business for the last 30 odd years and which is experiencing strong demand arising from the H1N1 pandemic. “We anticipate that this will contribute some good profit to our company this year,” said Mr Lo.

Techcomp’s 50-50 joint venture with Bibby Scientific, which had suffered a loss last year arising from preparation costs, will contribute profits too this year, said Mr Lo.

Techcomp manufactures products for Bibby’s. Techcomp’s sales of its own products in Europe are rising as a result of the JV.

Mr Lo concluded: “We are pleased to say that up to now, our business is slightly better than expected at the topline and bottomline.”

Some of the questions and answers following Mr Lo’s presentation:

Q: If you are having good sales, can you talk about what your working capital requirements are like?

Richard: Our internal target is to grow our business within our normal range of more than 20% but the working capital at a lower rate. So far we are doing a good job. That’s why we expect strong operating cashflow this year.

Q Why aren’t you announcing quarterly results?

Richard: That's a requirement for companies with market caps of more than $100 million. We have had a lot of internal discussion about voluntarily announcing quarterly results. But this year we have a very strong desire to control expenses.

I personally like quarterly announcements as we can explain our business better. For example, the most common question asked by investors is: Why are your accounts receivables so high? My answer is - the record date is the last day of the year, and the last quarter of the year is when we normally get 30-40% of the whole year’s revenue.

Q Why the seasonality?

Richard: In China, where we get 70% of our turnover a year, our clients spend the balance of the budgeted amounts at year-end.

Q Can you clarify about the company’s loans? They went up a lot last year.

Richard: As a whole, we have a very healthy balance sheet. We are net cash. Most of the loans are short-term trade financing.

Recent stories:

TECHCOMP wins US$3m UN tender 'as record sales in Jan stretch into May'

TECHCOMP: From HK$50K to S$70 million in 20 years (The story of Richard Lo)