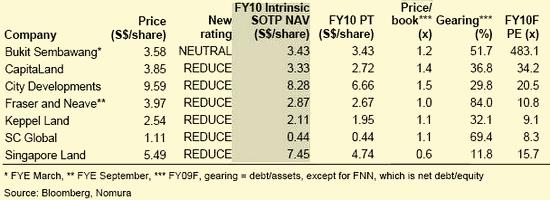

Source: Nomura report dated June 9

PROPERTY STOCKS have soared in the current market rally – good if you are sitting on gains but Nomura Singapore analysts Tony Darwell and Sai Min Chow say it’s time to ‘reduce’ your holdings.

The view is not shared by DMG & Partners, which upgraded the sector to 'overweight' yesterday (June 10). Another bull is Merrill Lynch.

More on the DMG and Bank of Amercia-Merrill Lynch call later but first, in a report dated June 9, the Nomura analysts said the surge in property stock prices has been simply too fast and too far relative to the underlying fundamentals of the Singapore property market.

”While we are mindful of recent optimism in the Singapore physical residential sector, we believe such sentiment is misplaced. We retain our bearish stance on the sector.”

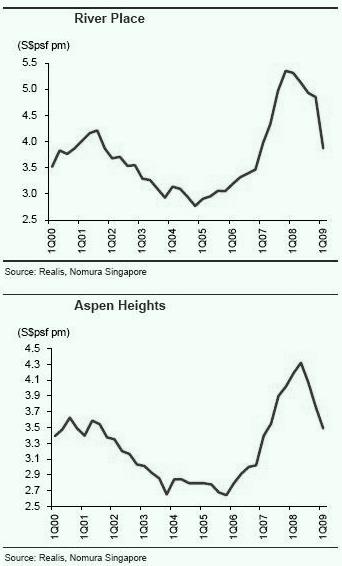

Rental falls for selected estates. Source: Nomura report

Nomura believes the recent rebound in pre-sale volumes has been underpinned by price discounting and a perception of “value” among investors who note the absolute declines in property prices.

Developers are stimulating demand through an “interest rate absorption scheme” whereby they pay the mortgage interest payments on the drawn down mortgage on behalf of the owner until the temporary occupation permit (TOP) is granted.

But while asset prices are down circa 21%, rents have fallen in tandem.

While the significant fall in asset prices has prompted developers to defer new completions, committed supply remains on the rise. That spells additional risks to asset prices, as developers cut prices to clear inventory.

Then there is the real and somewhat ignored risk of deferred payment scheme (DPS) default.

Under the DPS, buyers of pre-sale properties paid an initial deposit of 10-20% of the purchase on signing of the sale and purchase agreement. The 80-90% balance would be paid on completion of the residential development.

The government disallowed the DPS scheme in October 2007.

Rental rates are falling and luxury property rents have been pushed back more quickly than expected by“hidden supply” via the return of enbloc sales at a time of weakening demand. “This has been markedly under-estimated by the market,” according to Nomura.

The market is also under-estimating / ignoring the potential impact of higher inventory of saleable stock as DPS buyers faced with cash-shortfalls look to de-leverage prior to TOP.

The DPS had encouraged pre-sale purchasers to acquire multiple properties. “This leverage needs to be unwound and in our view poses risks to underlying asking prices as deleveraging occurs,” said Nomura.

The release of such units at a time when the market is grappling with the issue of inventory clearance of “launch ready” units will further dampen price recovery expectations, said Nomura.

“We maintain our view of asset prices ultimately bottoming in 2010F, and so believe expectations that such a point has already been reached are premature given the extent of available launched and “launch-ready” inventory.”

On the other hand, China properties have the scope to rise in 2H09F into 2010F (albeit after a period of volume recovery, and inventory clearance).

”Wee Liat, head of our China property team, sees residential prices rising by 10% in 2009F, with gains being consolidated in 2010F, when prices are seen rising by 15%. Singapore developers with exposure to China, notably CapitaLand, Keppel Land and Fraser & Neave, will be primary beneficiaries — though such benefits appear more than reflected in current stock prices.”

***

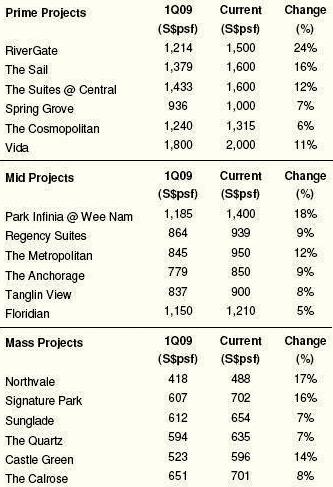

Source of Q1 data is URA, while current prices are DMG's estimates.

DMG: Upgrade property to OVERWEIGHT, Top Buy CDL. Buy KepLand and CapLand

DMG & Partners has turned bullish on property, upgrading the sector yesterday (June 10) to OVERWEIGHT, on the back of (1) bottoming of physical prices in 1Q09, (2) narrowing mid to prime price differential driving interest in prime properties, (3) evidence of mass market volume flowing to mid and prime properties and (4) a return of foreign buying interest.

”On the ground, confidence is now strong, evidenced by a shift from fleeting enquiries three months ago, to immense demand, particularly for launches over the past three weeks,” said its analyst, Brandon Lee.

While property stocks have already risen 91.4% quarter-on-quarter and 18.3% month-on-month, there is still strong upside potential for the blue chip developers, he said.

”We set our target prices at a 0 – 20% premium to revised RNAV.”

The research house’s top buy is City Developments (S$9.09, TP: S$12.34), while Keppel Land (S$2.48, TP: S$2.98) and CapitaLand (S$3.67, TP: S$4.22) are ‘buys’.

DMG expects capital values to recover 8% and 17% in 2009 and 2010 amid improved physical market dynamics.

“We estimate that physical prices bottomed in 1Q09, the same quarter developers cleared inventories by lowering prices 10 –30%. A favourable takeup together with higher secondary market prices resulted in sharp upward price adjustments by developers in 2Q09, but this has not dampened demand.

Furthermore, supply for the next three years has plunged 41.5% year-on-year, reducing concerns over a supply glut.

***

“Sharp 20% recovery in prices”

Merrill Lynch's report dated June 8 said: “We are forecasting a sharp 20% recovery in the Singapore residential market from trough which we expect to occur in 3/4Q 2009."

This should support share price momentum for Singapore developers in the next 6-12 months as stocks, which are highly correlated to residential pricing, lead moves in the physical market, it added.

”We believe the sector will continue to re-rate as visibility of pricing growth improves.”

The research house's top pick in the sector remains CapitaLand as the analysts believe it has the greatest potential to re-rate in an upturn. The house also has a Buy on City Developments for its Singapore residential exposure.