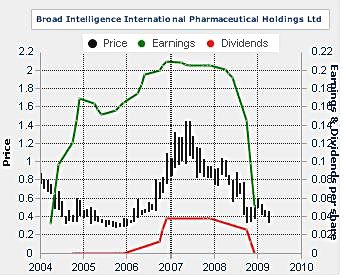

Earnings were down in 2008 but demand for Broad Intelligence's medicine has picked up from April this year, according to the company.

HONG KONG’S Broad Intelligence International Pharmaceutical Holdings is hoping China’s growing attention on fitness and wellness will reap healthy benefits for the firm down the stretch.

The Hong Kong-listed firm (HK: 1149), with production facilities in the southeastern Chinese province of Fujian, took an earnings hit last year on a slumping economy and one-off equipment expenses, but it is quite sanguine on its prognosis for the second half and beyond.

In 2008, consolidated turnover of the group was around 422 mln hkd, up just 2% year-on-year. But net profit after tax plummeted 74% to 24 mln hkd.

“We have very steady sales, but we only have 30 distributors covering 80 cities in 18 provinces. The first half (of 2009) is not good, but from April there is a rising trend. We produce a mixture of TCM (Chinese traditional medicine) and Western medicine, and with China’s increasing wealth people are demanding more and better health care products,” said Mr. Edward Chow, the company’s Financial Controller.

In an interview with NextInsight, Mr. Chow said the company was not sitting still despite a rather stagnant macroeconomic picture, especially as Broad Intelligence would continue to target the Chinese market – one which has taken a much more merciful economic hit than developed external markets.

“Our CEO plans to launch three to five new products per year, with each contributing between 3-5 mln yuan annually. Health care products will be the driving force for our sales going forward,” he said.

China stimulus package … just what the doctor ordered?

Late last year, as Wall Street crumbled and Main Streets worldwide began to follow suit, China joined the global bandwagon and announced a leviathan economic stimulus package of its own to free up the credit logjam and kickstart a consumer-led recovery.

Among the 4.5 trln yuan in the package, healthcare and pharmaceutical firms were among those earmarked for special attention. “Although there is no evidence of a sales boost yet from the stimulus package, we expect to gradually see an increase (in revenue) this year. Our second half should improve,” Mr. Chow said.

Broad Intelligence's financial controller, Edward Chow, speaking with Andrew van Buren. Photo by Mark Lee

The deepening plan for medical reform by the State Council stated that from now until 2011, 850 bln yuan would be injected to promote the main fields of medical reform, namely: medicare security, basic pharmaceuticals, basic-level medical hygiene service systems and basic public hygiene service, the company said in a statement.

The plan proposed the achievement of “Medicare Security for the Whole Nation” within three years and expects all residents in rural areas or cities will get basic medicare security by 2011.

“Thus, the pharmaceutical industry has a bright future. Since the group’s mission is to provide Chinese people with quality parenteral solutions and healthcare pharma products, certainly we will benefit from this plan,” the statement added. The group said it has “foresight.”

“Prior to this plan, we established strategies to welcome the good prospect. In 2008, the group optimized its production facilities and equipment and raised the popularity of its brand ‘Fujian Nanshaolin’ by advertising, which laid a firm foundation for its production and sale.

Admittedly, these strategies cost a lot, resulting in a higher cost of sales in the coming years and advertising activities also increased the selling expenses. Although profit for the current year will be lower by these expenses immediately, the group focuses on the long-term benefit rather than the short-term and dedicates to earning a long-lasting and favorable return for our shareholders,” Broad Intelligence said.

Mr. Chow said last year saw a lot of margin pressure due to increased costs.

“Raw material prices were up in the first half of 2008, and we had impairment costs for one product. However, labor costs have been stable over the past five years, so that’s not a problem. We also embraced promotional activities with more ad campaigns including ‘in-bus’ ads and TV ads which led to our higher selling costs for the period.”

And as 100% of the company’s products were sold over-the-counter (OTC), he said advertising was “very important” to attract new customers. In 2008, the group acquired new property, plant and equipment totaling 337 mln hkd, versus 100 mln in 2007, as well as intangible asset (patent) purchases totaling 27.4 mln hkd compared with nil in 2007.

Mr. Chow was confident that Broad Intelligence would be able to maintain current selling prices this year, and would continue to concentrate on the world’s most populous market and some of its immediate neighbors.

“For the next two to three years we’ll keep our focus on Greater China as it’s not easy to get export license approvals. It even takes an average of 1-2 years to get permission to sell products in Hong Kong.”

He also said a very unfortunate product safety failure from a competitor last year producing injectionable products (one of Broad Intelligence’s mainstays) led to such items seeing revenue fall “considerably” across the sector in the first half of this year.

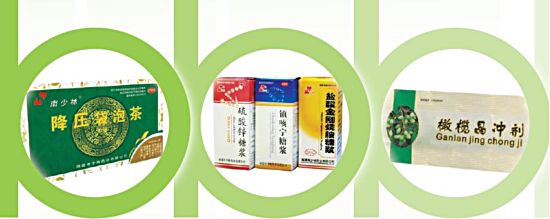

Broad Intelligence's products target a variety of infections and other ailments.

Broad Intelligence engages in the research, development, manufacture, and sale of healthcare pharmaceutical products in China. The company’s products target a variety of infections as well as pneumonia and bronchitis; gastrointestinal disorders; prevention and treatment of vitamin B6 deficiency; as well as products which improve nutrition in post-op patients.

The company’s healthcare products include anti-diabetes tea for the treatment of diabetes and the lowering of blood sugar; granules to help digestion and cure colds; and aerosols for the treatment of cuts, scratches, heat rashes, and sunburns, as well as numerous other products. Its main customers include licensed pharmaceutical distributors, hospitals, and clinics.

“Sales in healthcare pharmaceutical products even achieved significant growth last year, reflecting that it was a wise strategy to develop healthcare pharmaceutical products since 2005,” the company said in a statement.

In view of the current cloudy economic environment, the board considered that resources should be retained for contingent use. Therefore, the board does not recommend the distribution of final dividend for the year ended December 31, 2008. “Our directors are not too interested in dividends because we want to keep cash in the company for future growth,” Mr. Chow added.

In 2008, the group launched 21 healthcare pharmaceutical products (vs 21 in 2007) with turnover of around 114 mln hkd, up around 37% year-on-year. It also launched 71 parenteral (administered by means other than through the alimentary tract, as by intramuscular or intravenous injection) solution products in 2008 (66 in 2007), with turnover of around 308 mln hkd, down 6% year-on-year.

Healthcare pharmaceutical products and parenteral solution products accounted for 27% and 73% of the total turnover of the group last year, respectively. As at December 31, 2008, the group offered 92 types of products, all sold in the PRC and denominated in yuan. Customers mainly are licensed pharma distributors, hospitals and clinics in China.

Related story: DAWNRAYS: Resilient pharmaceutical business