Among his picks are warrants, which are highly-leveraged instruments, and they have gone on to soar. Yongnam warrant alone accounted for $40,000 (40% of the theoretical $100K starting capital) of his portfolio's fantastic gain.

Interestingly, one of his other picks – Sinotel – is also a bet chosen by two other participants. Sinotel is a service provider for the nascent 3G network in China, and looks set to be a high-growth business.

Aside from Sebastian, there is Level 13 who continues with the game from the previous round. The newcomers are ‘neontet’ and ‘shuishui’.

All four participants pooled $100 each for the prize monies of $250 and $150 to be awarded at the end of six months. With the market as buoyant as it is now, their portfolio gains are likely to be exciting.

(The participants do not recommend that readers follow their stock picks as this is just a game and it has no financial downside for the participants).

Details of the picks:

| Stock | Number of shares | Purchase price (May 18) ($) | May 29 closing price ($) | Value of holding ($) |

| Yanlord | 10,000 | 1.76 | 2.18 | 21,800 |

| Straits Asia | 15,000 | 1.16cd | 1.49xd | 22,350 |

| Sinotel | 50,000 | 0.205 | 0.235 | 11,750 |

| Guthrie GTS | 30,000 | 0.28 | 0.35 | 10,500 |

Warrants | ||||

| Yongnam wrt 121214 | 1,000,000 | 0.035 | 0.075 | 75,000 |

| SGXBNPeCW090713 | 20,000 | 0.55 | 0.745 | 14,900 |

| Shares + warrants | 156,300 | |||

| Cash | 500 | |||

| Total | 156,800 (+56.8%) |

Sebastian Chong has invested actively in equities since the 1970s. He is managing director of Financial Info Analysis Pte Ltd, a company he founded after he retired as an accounting professor at the National University of Singapore. He now runs his popular investing website, www.shareowl.com

Sebastian says:

As participants in this round of Stock Challenge were allowed to buy stocks from Friday 15 May onwards, I took the opportunity to jump in with full ammunition on the morning of Monday 18 May. That morning saw an unnerving pullback in stocks but I knew it was not the time to be fearful. True enough, by the close of that same day, many stocks had surged. Decisiveness pays when one has done enough homework on both the macro and micro fronts.

I arrived in New York on 16 May for a holiday and the cab drivers I spoke to were optimistic about the recovery of the US economy. They said they could feel the economy picking up from the demand for taxis. I also saw long queues at good restaurants – both physical and virtual. A virtual queue means that for some fine dining restaurants, you have to place your online or phone reservations two to four weeks in advance.

And on Saturday 30 May, there were queues from 2.30 pm till 5.30 pm at Frasers service apartments at Paris (at the La Defense branch) – mostly people from UK who took the bullet train from London to enjoy the long weekend in France. The restaurants in New York, London and Paris that I saw were doing bustling business.

As the outlook for stocks is quite bullish, I do not mind staying up late at night in the hotel room monitoring SGX listed stocks from New York, London and Paris and updating my website, Shareowl.com, regularly and of course picking stocks and warrants for this new round of Nextinsight’s Stock Challenge. By the second week of June, I’ll be back in Singapore.

The risks this round are certainly far less than in the last round that commenced in October 2008. Last round I spread the $100,000 virtual money over 13 stocks. Diversification was critical then since the chances of both small and large caps being hit by bad news and bad reception by the market between October and April were high.

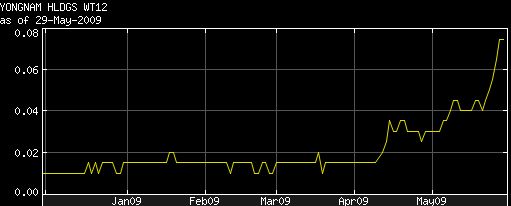

Yongnam warrant expiring in Dec 2012

This round, I am happy enough with just 4 stocks and 2 warrants. As can be seen from the table above, I allocated $35,000 to Yongnam 2012 Dec 14 warrant. I whacked 1 million units at 3.5 cents on 18 May. By 29 May, the warrant had shot up to 7.5 cts as the mother share surged from 18 cents to 23 cts.

Since the warrant expires only in December 2012, it is low risk compared with the six-month covered warrants on SGX listed companies issued by investment banks. The long term Yongnam warrant is now the biggest item in my personal real portfolio because it has trebled from my average price of 2.5 cents to the current 7.5 cents. The exercise price is 25 cents and the mother is already at 23 cents.

Believe it or not, my theoretical target price for this warrant is $1.20 (barring unforeseen long drawn disasters for the global economy or for Yongnam by Dec 2012 based on a mother share price of $1.50). But having said that, I would not buy any Yongnam warrants once the mother share price goes above 50 cents and the warrant is price at about 25 cents because by then the gearing is not attractive enough for me.

I would most likely switch to the mother share when the warrant hits 60 cents when the mother touches 82 cents or so. By then the warrant would be trading at a discount whereas presently it is trading at a handsome premium because of the gearing of about 3 times (23 cents for the mother divided by 7.5 cents for the warrant.)

Yongnam’s strong earnings growth is premised on high infrastructure spending by the Singapore and overseas governments on MRT, roads and flyovers, airports, and other construction projects. Yongnam is gaining international reputation for its expertise and timely and proper executions of projects requiring its supply of steel struts and specialist civil and structural engineering consultancy services. Its major markets are currently Singapore, Dubai and India.

It is likely to break into other foreign markets in a big way. Its business is highly scalable and its capable management (cum major shareholder) is the main driving force of this company. Its closest competitor in Singapore is only one-fifth of its size.

SGX warrant BNPeC2009July13

This covered warrant is very short term and hence I did not whack it like the Yongnam 2012 warrant. I put in only $11,000 on this warrant. My entry price was 55 cents and the price on Thursday 28 May was 74.5 cents. Unfortunately it has been seeing decreasing trading liquidity and hence there was no transaction on 29 May.

Otherwise, its theoretical price would have been closer to 78 cents since the mother share went up quite a bit on Friday. With hindsight, I should have chosen another covered warrant on SGX that expires in September or later. Between 18 May and 29 May, participants in Stock Challenge were not allowed to sell or else I would have taken profit and switched to a longer term warrant. This coming week I will probably do so.

This is the lord of lords when it comes to China high end residential and some commercial property. Its primest properties are in Shanghai, many with sea views, followed by second tier and promising cities like Tianjin, Nanjing and Chengdu. Yanlord’s land bank was acquired mostly on the cheap a few years before land prices peaked in 2007. And the beauty of Yanlord is that currently, only one third of its land bank is under development.

Hence the vast and cheap land reserved for future development is simply astounding. I had already gone into Yanlord at $1.17 for my own real portfolio and am still holding. Nonetheless, at $1.76 on 18 May, I reckoned it was still cheap. Even at $2.18 on 29 May, it is still far from expensive. But be prepared to hold for the long term since this can be volatile stock and if the STI were to pull back to below 2,000, Yanlord is sure to plunge in share price.

This coal mining stock with increasing output of good grade coal in Indonesia (Sebuku and Jembayan in south and east Kalimantan respectively) is still one of the cheapest coal mining stocks listed anywhere in the world. Thailand’s oil giant, PTT recently made a general offer of 80.5 cents for SAR. No one in his right senses would accept such a ridiculous offer. The stock price has nearly doubled from that level in just a matter of weeks.

PTT was obviously not serious in acquiring SAR. It made the general offer because it was required to do so since it bought a large stake in SAR’s unlisted parent company which was in turn a subsidiary of Australian listed company, Straits Resources. I believe SAR will hit $2.00 by year end and $4.00 by 2012.

The current stock price of 23.5 cents seems ridiculously low. The PE based on 2008 earnings is just 3 times and the share price is still below the net tangible asset (NTA) backing per share. Sinotel works on mobile network applications for giant telcos in China like China Mobile, China Unicom and China Telecom. Because these 3 players have been given licenses to switch to 3G, 3.5G etc. there is a lot of work to be outsourced to network integrators and enablers like Sinotel. The net profit margin for Sinotel was a very high 30% for 2008 but I am sure this margin will come down drastically because of the higher volumes of business going to them from the telco giants.

There are hundreds of players in China like Sinotel. Although I like this stock, I won’t put too much money on it. The telco giants also take as long as 12 months to pay Sinotel and other tiny players. That explains why the PE and Price/NTA of Sinotel are very low.

Guthrie GTS

This is a safe stock with high earnings growth in 2009 over 2008. This is due to the opening of the Jurong Point extension (which more than doubled rentable space) in December 2008 and Tampines One in April 2009. Guthrie has a 50% stake in Jurong Point old wing and 25% in the new wing. Its stake in Tampines One is around 21%. It also completely sold off its condo blocks called the Centris by mid-2007 but will continue to recognize profit on the sale in 2009 but not in 2010.

From 2010 onwards, I reckon the profits will be flat but very steady unless Guthrie embarks on new projects. At current 35 cents, PE is around 7 times 2009 earnings. The NTA is at least 56 cents. This is a safe counter with good dividend yield as the quality of earnings is high. In a few years time, Guthrie’s retail rental income rates and retail mall values are likely to go up. This stock is even safe enough to put a little bit of CPF money in.

The coming months should be interesting. Let me stick my neck out and suggest that the STI could hit 2,800 before Christmas. The most important thing is to have holding power and to select the right stocks. Forget about waiting for the STI to fall back to 2,000 points.

*****

| No. of units | Purchase price | May 29 closing | Value | |

Oceanus | 100,000 | 22 cents | 30 cents | $30,000 |

| Oceanus | 50,000 | 31 cents | 30 cents | $15,000 |

| Sinotel | 100,000 | 22.5 cents | 23.5 cents | $23,500 |

| HSI MBL....PW091230 | 20,000 | 44 cents | 35 cents | $7,000 |

| Rickmers Maritime | 50,000 | 50.5 cents | 58 cents | $29,000 |

| Cash | $5,950 | |||

| $110,450 |

Neontet is inclined towards high-growth small- and mid-cap stocks, preferring to stay away from most blue chips. He has had a good time investing in small- and mid-caps despite being burnt by some S-chips and Singapore companies with corrupt management.

He says:

Overall, I am pleased that the portfolio is up 10.5%.

Oceanus: It’s one of the more fascinating businesses on the Singapore Exchange. Rearing abalones on a gigantic scale looks like a very profitable venture. It’s very different from large-scale manufacturing in one key aspect: the profit margin from the abalones looks very much more palatable, as the demand exceeds supply and abalones are high-premium products. By venturing downstream into processing abalones and setting up a restaurant chain, Oceanus is adding layers of profit margin to its core business of rearing abalones. That is what makes many investors salivate.

Sinotel: China has embarked on setting up a national 3-G network, and Sinotel is providing its services to the big telcos. Sinotel is likely to be lifted by the giant waves and its order book to-date reflects that. However, my worry is that its working capital requirements are big too, and receivable days are oh so long. Translation: low or no dividend payout and a shaky balance sheet.

Rickmers Maritime: If profits continue to go up quarterly and the DPU is not adversely cut back to conserve cash, then Rickmers is a sexy dividend yield play at more than 22% yield currently. Its charters are locked in for many more years, so its revenue stream looks pretty safe, but it does have financing needs for vessels it has ordered and which will be delivered in the near future. At 58 cents, it is still a discount to its Net Asset Value of 84 cents.

Hang Seng Index put warrant: The Hang Seng Index has shot up substantially from its March low and looks ripe for a correction. That’s why I decided to buy the put warrant but on hindsight, maybe I should not have. The market has continued to rally and the warrant is in bad shape.

*****

| Stock | Number of shares | Average Purchase price ($) | May 29 closing price ($) | Value of holding ($) |

Techcomp | 100000 | 0.23 | 0.225 | 22,500 |

| Cash | 77,000 | |||

Total | 99,500 (-0.5%) |

Level 13 is a 31-year-old investor and a business analyst with 4 years of investing experience. Check out his blog for insights on financial matters (mainly equities).

Level 13 says:

My stock pick should be a familiar name to regular readers of Next Insight website. Their writers have done a good job on the write-up of Techcomp’s business nature and outlook

1) Possible to grow further:

Techcomp is still a minnow compared with large scale competitors like Japan’s Shimadzu whose PER is normally at an average of 20 times. In the last five years, about 70% of its net profit came from the second half, and I believe the trend will continue this year.

2) Undemanding financial ratios:

Suppose we add back the exceptional foreign exchange loss in FY2008, and then assume no growth in profit this yr, the forward P/E is only 5.2. Currently it is trading at a P/BV of 0.62. The return on invested capital for FY2008 was a respectable 13.8%.

3) Competent management & large insider wwnership:

The founder owns more than 50% stake in the company.

4) Paying consistent dividend since FY2005.

5) Fundamentally strong balance sheet:

It has low debt and a net cash position (cash – total debt) of about USD0.8 million.

*****

| No. of shares | Price bought at | Closing price on May 29 | Value | |

| Celestial | 119,000 | 21 cts | 16.5 cts | $19,635 |

| China Sky | 161,000 | 15.5 cts | 15.5 cts | $25,000 |

| Sino Techfibre | 167,000 | 15 cts | 15 cts | $25,000 |

| Sinotel | 116,000 | 21.5 cts | 23.5 cts | $27,260 |

| Total | $96,895 (-3.1%) |

Shuishui, who is in his mid-30s, has been a stock investor for many years. A Singaporean, he has close ties with China as his parents and relatives are living there. He has taught himself how to analyse financial statements.

1) Sino Techfibre: Its price/book is 0.21, price/sales is 0.29 only. For the past 5 years, sales have been growing every year and gross profit margin was around 47.5% last year.

Group R&D team working closely wth Qingdao University and China Textile Academy on development of new PU products. Lastly, group had a joint technology R&D wth People’s Liberation Army and group is linked up with China’s navy, China tax department and China commerce/industry, hence strong support.

2) Celestial Nutrifoods: Price/book is 0.37 while price/sales is 0.35. For the past 5 years, sales have been growing every year and gross profit margin was around 37.9% last year.

At the end of 2008, group had negative working capital but it’s not necessarily bad. It could indicate the group is very efficient at turning over inventory. Presently, the group is facing convertible bond redemption of 235 million around 12 June. At around $0.230, stock is dirt cheap and selling at a deep discounted price.

Now trading around 0.165 - super cheap to me and am considering going in early June.

3) China Sky: Price/book is 0.25 while price/sales is 0.35. Group gross profit margin was around 33.9% last year. Sales have been growing every year between 2003 and 2007. Last year, it dropped by 7.9% due to slightly slow export. However, local sales are still strong.

Group earnings should pick up before 3Q. Stock is now trading at deeply discounted price around 0.155 compare to Oct' 07 when it was trading around $2.35.

4) Sinotel Technologies: It is helping to build China’s 3G/3.5G infrastructure and set to lock in profit from 1Q 2009 all the way to 3Q 2010.

Small company with strong support from China Unicom. It’s a very good defensive stock to add to my portfolio.

Final story from the previous Stock Challenge: STOCK CHALLENGE: Sebastian is numero uno! No.1!