Report released on May 8

MACQUARIE RESEARCH has good news for investors fearful they may have cowered on the sidelines too long amid various regional share market rallies across Asia – there are still some reasonably affordable places to put money.

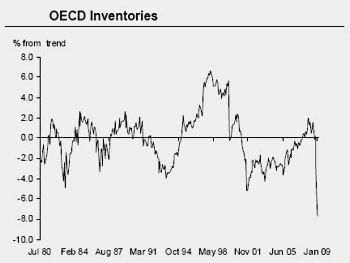

In a note to investors a few days ago, it said a resurgence in industrial activity is imminent, which will have a strong and pervasive impact across Asia.

This will at first be propelled by inventory restocking and may be extended by a genuine recovery in end demand later in the year.

Source: Datastream May 09

“The bounce will be strong because the starting point for inventories is so low,” Macquarie said.

The dominant theme for the moment is identifying “cyclical laggards,” it said, adding that the cyclical stocks that were the first movers were those linked to fiscal policy, particularly the cement, steel, construction and financial companies in China.

“These will now underperform as money flows to stocks that will benefit from a much broader recovery, predominantly in transport, technology and banks. The other trades take into account Chinese initiatives to address social welfare reform, particularly at the moment through healthcare.”

The note added that these measures in China, a country with a somewhat infamously entrenched tradition of saving, are necessary to rebalance the economy towards domestic demand, and will boost consumption relative to savings over time.

Macquarie brought to the forefront 10 top trading prospective groups in the region, with China’s resilient economy and its stimulus measures playing a prominent role in determining some favorites.

Short fiscal policy stocks vs the regional index

Shares linked to fiscal policy stimuli in the region, notably those tied to China’s initial 4.5 trln yuan package, have been the greatest beneficiaries to date from the recovery, and this phenomenon makes sense as “for several months this was the only source of good news.”

The chief beneficiaries were in China have been upstream commodities like cement and steel, as well as the construction sector which is so critical in the country to stabilizing employment figures.

But is said “valuations in these sectors are now stretched, and flows are likely to be out of these stocks to those that will benefit from a broader cyclical recovery.”

Examples include: China Communications Construction Corporation (Neutral), China Railway Group (Underperform), Maanshan Iron & Steel (Underperform), Angang Steel (Underperform) and Anhui Conch (Neutral).

Short Chinese banks vs other banks in the region

Thawing credit helped Chinese banks significantly for the first three months of the year, but this growth is now behind them as they are likely to be forced to be less generous with their loans for the rest of the year.

At the same time, asset quality concerns, which have held back other banks across the region, will ease and growth may start to pick up.

“Our preferred banks are in Korea, Taiwan, Singapore and Malaysia. As Asian firms expand production their working capital needs will also rise,” Macquarie said.

Lenders of note include: ICBC (Neutral), Bank of Communications (Neutral), China Merchants Bank (Underperform), China Construction Bank (Neutral), DBS Group Holdings (Outperform), HSBC Holdings plc (Neutral), OCBC (Neutral), UOB Bank (Neutral) and Bank of China (HK) (Outperform).

Macquarie says selected bank stocks in Singapore look good.

Long technology vs short material stocks

Technology companies are much better positioned than materials companies for the next phase of the recovery.

“Inventory restocking will be much more powerful in technology than materials because production cuts were aggressive in technology, so inventories fell. However, production cuts were very limited in the materials sector, so inventories have accumulated,” Macquarie said.

Technology companies are also cheaper than materials companies, the note added. Macquarie is Underperform on Jiangxi Copper, Yunnan Copper and Zijin Mining, and Outperform on AU Optronics, ASE, Wistron, Quanta, Hon Hai Precision, ZTE Corporation and Lenovo Group.

Long tech hardware vs short semiconductor companies

Hardware counters are better positioned in the tech sector than semi-conductor peers.

“Semi-conductor companies were the initial beneficiaries of the restocking bounce, and it will now spread further downstream, in our view. The hardware companies also remain cheap, relative to history.”

Outperforms include Chi Mei Optoelectronics, Lite-On Technology, Hannstar Display and Chunghwa Picture Tubes, while chipmakers Samsung Electronics, Hynix and ASM Pacific are all Underperform.

Long transportation companies vs the regional index

The note pointed to listed transportation firms a being “clear laggards” in the current cycle.

“Restocking of US consumer goods must be positive for container shipping and ports, and airlines will benefit once swine flu concerns disappear and business travel returns.”

China Shipping Development, China Southern Airlines, STX Pan Ocean, Sinotrans Shipping and Hutchison Whampoa are Outperform while Orient Overseas is Neutral.

Long Singapore vs the regional index

The beta in Singapore tends to be underestimated but since exports are a high multiple of GDP, it should be a major beneficiary of changing perceptions of global growth. The note added that selected stocks in the banking and property sector are the best plays on this.

Long Japan vs Asia ex Japan

The Japanese domestic economy and exports have been hit hard by the downturn, and the market contains many large exporters heavily exposed to external demand.

“We are confident of a domestic recovery and also that exporters will be major beneficiaries of a global recovery, particularly if it is accompanied by weakness in the yen. We think this would also flow through to perceptions about banking health.”

Long Taiwan cross-straits basket

The PRC’s top cellular service provider China Mobile’s investment in Taiwan-based Far EasTone and changes that allow Chinese QDII investment in shares on the island show that cross-strait tensions are easing for real this time.

“We think the beneficiaries will be banks, brokers, asset plays and transport stocks,” Macquarie said. Sinopac Financial Holdings, Taiwan Fertilizer and China Oilfield Services are all Outperform.

Long healthcare companies

“We expect policy support in the developed as well as emerging worlds. In China, the policy imperative over the next few years will be to boost consumption by reducing precautionary savings,” Macquarie said.

One way to do that is to increase the social safety net of pensions, unemployment protection and healthcare. It added that China’s plans are well in train, and spending is forecast to double as a percentage of GDP as health insurance is rolled out across the country.

“Rising healthcare spending in the G7 may spill over to the Asian hospital and medical device companies.”

Analysts visiting China Zaino's showroom displaying its backpacks and luggage. File photo.

Long China consumer stocks

Macquarie said it expects consumption and household credit growth will become dominant themes of the next cycle because governments will implement other policies to boost consumption as the country moves to “decouple” itself from the decades old export-oriented growth model.

"One reason that savings rates are high in developing Asia is that social welfare systems are poor. It is sensible to have high precautionary savings if you are faced with limited healthcare, pensions and unemployment benefits. We expect redoubled government efforts to improve social welfare could reduce savings rates, particularly in China where healthcare reform is already well underway and pension reform is happening slowly.”

It added that the world’s most populous country is also subsidizing appliance purchases by rural households, and is likely to introduce changes to the tax system also. Anta Sports and Golden Eagle Retail Group are both Outperform.

Recent story: SIAS Research seminar: Will the green shoots wither or thrive?