So said Thomson Medical Centre (TMC) CEO, Mr Allan Yeo, as he showed us around the hospital recently. We were cheered by the sight of new-borns comfortably snuggled in their cots.

We had tough business questions in our minds too, such as: What differentiates TMC from other hospitals? Will means testing really drive business to hospitals such as TMC? How can TMC’s business grow?

SIAS analyst Alan Lok, who is single, looking attentively at the babies at Thomson Medical Centre. Photo by Morpheus.

Company Profile & Business Model

Established in 1979, the 140-bed women’s and children’s private hospital at Thomson Road provides a comprehensive range of facilities and services for primary, secondary and tertiary healthcare, focusing on Obstetrics and Gynaecology (O&G) and paediatric services. TMC’s business activities can be divided into 2 main segments - hospital operations & ancillary services, and specialised and other services.

For its hospital operations and ancillary services, the main income stream comes from the provision of inpatient services such as accommodation, nursing procedures and the use of facilities such as operating theatres and labour suites.

The specialised and other services segment comprises the operations of Thomson Fertility Centre, Thomson Pre-Natal Diagnostic Laboratory, Thomson Aesthetics Centre, Thomson Women’s Clinics and Thomson International Health Services (which currently provides hospital consultancy services to Hanh Phuc International Women and Children Hospital in Vietnam).

What differentiates TMC from other private hospitals like Raffles Medical and Parkway?

In TMC, doctors are key customers. They refer their O&G patients to TMC for diagnostic imaging and laboratory services as well as inpatient and related services.

On the other hand, Raffles Medical adopts a patient-model where the companies engage the doctors to treat the patients. In this case, the number of patients is widely used a parameter to the companies’ profitability. This also applies to TMC.

Briefing us on a development, Mr Yeo said: “Typically, TMC attracts senior doctors who have already established a stable client base. This supports the niche mid-high end market that TMC is targeting.”

TMC has been successful in its branding efforts. It has won several brand awards over the past few years, which has helped to build up its brand image. “Despite increasing our rates to reflect our brand equity and partially cover the inflationary cost, TMC’s rates are still very competitive - competitive as reported in the quarterly MOH data on hospital bill sizes,” Mr Yeo added.

Average bill size for deliveries at private hospitals

| 1-bedded ward | 4-bedded ward | ||||

| Hospital | Normal Delivery | Caesarean | Hospital | Normal Delivery | Caesarean |

| Eastshore | $3,094 | $5,649 | Eastshore | $2,315 | $4,755 |

| TMC | $4,012 | $6,000 | TMC | $2,514 | $4,236 |

| Mt Alvernia | $4,064 | $6,001 | Mt Alvernia | $2,585 | $4,448 |

| Raffles | $4,375 | $7,039 | Raffles | $3,382 | $5,450 |

| Gleneagles | $4,514 | $7,436 | Gleneagles | -- | -- |

| Mt Elizabeth | $4,655 | $7,280 | Mt Elizabeth | -- | -- |

Average bill size for deliveries at public hospitals

| Ward A | Ward B2 | ||||

| Normal Delivery | Caesarean | Normal Delivery | Caesarean | ||

| SGH | $2,548 | $5,032 | SGH | $1,009 | $1,437 |

| KKH | $3,193 | $5,460 | KKH | $1,102 | $1,802 |

| NUH | $3,644 | $5,542 | NUH | $966 | $1,244 |

| Ward C | |||||

| SGH | $1,045 | N.A | |||

| KKH | $865 | $1,278 | |||

| NUH | $746 | $1,027 | |||

Source: Ministry of Health

Dr Cheng Wei Chen, chairman, Thomson Medical, receiving the 2007 Singapore Prestige Brand Award. Photo by William Lim / SageStudio.

As we walked through the hospital, Mr Yeo highlighted that its renovation and expansion exercise of its facilities, including in-patient wards, is ongoing. The most recent addition is the setting up of a Premier Ward comprising 5 suites and 1 deluxe room at Level 6. The Premier Ward occupies the space of its former administrative offices, which have been relocated to the HDB estate across the road. Its Thomson Lifestyle Centre was also moved in May this year to Novena Medical Centre.

The in-patient wards have been renovated to give a warm and relaxing ambience, similar to that of resort hotels. TMC will be adding two new operating theatres next year to meet rising demand.

TMC recorded 4,413 deliveries in 1H08 (August year-end). This is a 15% increase over 1H07 with a historic high of 818 deliveries in November 2007.

On average, TMC records about 700 deliveries per month, which is the highest amongst the private hospitals. Although KK Women's and Children's Hospital has a higher number of deliveries, this includes subsidized patients.

On how much the Group's business can grow with just one hospital, Mr Yeo acknowledged that TMC needs space to grow but stressed that there are many initiatives that can be conducted outside the hospital’s premises. Take, for instance, its Thomson Fertility Centre, which registered an overall increase in patient load, especially regional patients.

Another initiative is the outpatient clinics. The Company has set up seven O&G clinics throughout the island, with its newest Thomson Women’s Clinic being set up at AMK Hub.

“Although the new clinic has been in operation for only 6 months, we have seen high patient load and healthy referrals to TMC,” Mr Yeo added.

In addition, the Company is working hard on its Vietnam consultancy project. Construction for the Hanh Phuc International Women and Children Hospital began in August 2007 and is expected to be completed by 3Q 2009. TMC is the principal consultant to the hospital and will be providing management services to the hospital for 5 years, from the date the hospital is ready for operation.

Once the hospital starts operations, the contribution from TMC's consultancy services (including management fee) is expected to increase. TMC has an option to buy a 25% stake in the hospital in the first three years of operations.

Means Testing – Driving more customers to private hospitals?

Questions were asked about the impact of means testing, which will commence in January 2009. Mr Yeo felt that the impact is likely to be positive for private healthcare providers. Under this scheme, the amount of subsidy that a patient enjoys at public hospitals is based on the patient’s monthly income. Those earning $3,200 or less will enjoy full subsidy at public hospitals.

Thereafter, it is a sliding scale of declining subsidies for those earning salaries increasing from that base, up to $5,201. Those earning $5,201 and more will enjoy subsidies of 65% in a C-class ward and 50% in a B2-class ward. Mr Yeo felt that some patients who qualify for little or no subsidy may find the cost of visiting a public hospital for O&G services comparable to that of a private hospital. This will encourage such patients to choose a private hospital for O&G services over a public hospital.

Financials

| S$ million | 2005 | 2006 | 2007 |

| Revenue | 41.2 | 46.5 | 52.4 |

| Gross Profit | 17.4 | 19.7 | 22.6 |

| Profit from Operations | 7.8 | 9.4 | 11.8 |

| Profit before tax | 6.6 | 8.7 | 11.4 |

| Net Profit | 5.3 | 6.8 | 9.5 |

| Dividend Per Share (cent) | 1.0 | 1.7 | 2.5 |

| Margins (%) | |||

| Gross Margins | 42.3 | 42.3 | 43.2 |

| Operating Margins | 18.9 | 20.1 | 22.5 |

| Net Margins | 12.9 | 14.6 | 18.1 |

TMC has recorded stable growth over the past 3 years. While revenue growth has been moderate, ranging from 31.5% to 12.6%, the net profitability has almost doubled. This is clearly illustrated by the 520 basic point increase in net margins. The Company has also been consistently paying out 50% of its net profit as dividends.

When asked about capex, Mr Yeo highlighted that the Company has invested approximately S$3 million in the recent renovation exercise and upgrading of medical equipment. Going by the financials, the Company’s operating efficiency has clearly improved over the past few years. Credit goes to the management for turning one of the most trusted names in O&G into a Singapore Brand, ready to take on the regional markets.

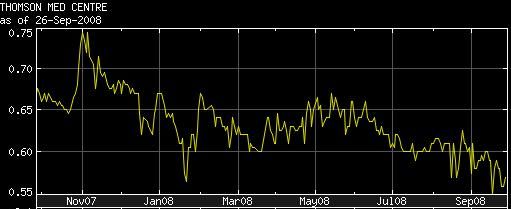

Holding steady

Previous story: THOMSON MEDICAL is a defensive "buy": Phillips Securities