Oil from the palm fruit is one of the most inexpensive edible oils today.

Oil from the palm fruit is one of the most inexpensive edible oils today.

CRUDE PALM OIL prices jumped 2-3 times over the past 15 months but brokers believe the odds favor the current up-cycle continuing at least another year or two.

In the past 2 weeks, two brokers initiated coverage on Indofood Agri (“IndoAgri”, market cap about S$3.5 billion) bringing the total of brokers with 'buy' or 'outperform' calls on IndoAgri to 7.

DMG put up a buy call on IndoAgri with a price target of S$3.34 on 2 Jun while UOB Kayhian initiated coverage with a S$3.55 target on 30 May.

80%-85% of crude palm oil produced globally is manufactured into edible oils such as margarine, cooking oil and vegetable shortening, according to Goldman Sachs. The remaining output becomes oleochemicals for cosmetics, soaps, surfactants and biodiesel.

IndoAgri is the leading producer of cooking oils consumed in Indonesia, with a 38% share of its branded edible oil and fats market.

It is also a leading producer of crude palm oil in Indonesia.

Indonesia is now the world’s largest producer of palm oil, having overtaken Malaysia in 2006, as the latter has limited land available for growing crops.

With a population of 230 million (world no.4), Indonesia consumed a quarter of the 16.4 million tons of palm oil it produced last year.

Well-managed and integrated agribusiness

90% of earnings before interest, taxes, depreciationand amortization come from plantation

90% of earnings before interest, taxes, depreciationand amortization come from plantation

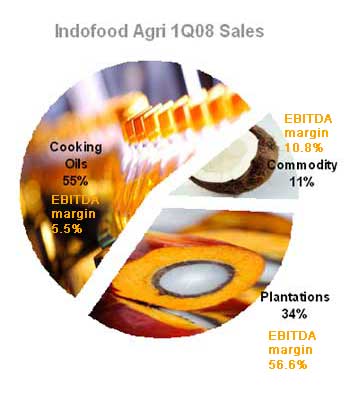

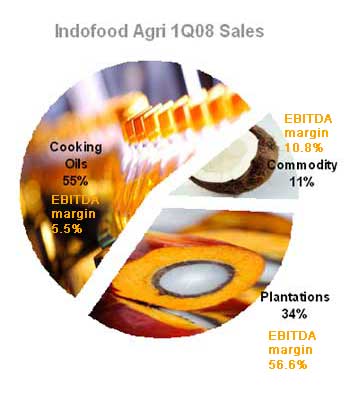

IndoAgri generated about S$433.9 million in sales in 1Q08.

Production of cooking oils contributed 55% to the top line.

Plantation of crops, mainly oil palm, contributed 34% to top line. Yet the same segment accounts for as high as 90% of earnings before interest, taxes, depreciation and amortization (EBITDA).

High EBITDA margins afforded by the plantation business prompted IndoAgri to acquire 64.4% in London Sumatra, a plantation company listed on the Jakarta Stock Exchange.

The acquisition was completed in December 2007 and increased IndoAgri’s landbank by two-thirds to 406,519 hectares.

One reason EBITDA margins are high is because seedlings are developed in-house.

As a result, IndoAgri’s fresh fruit bunch yields of 28-30 tons per hectare are higher than the industry average of 20-22 tons.

Its oil extraction rate of 24% is also higher than the typical 21%-23%.

Commodities (milling coconut oil from copra) contributed 11%.

Managing exposure to palm oil prices

A stronger palm oil price upcycle than previous ones.

A stronger palm oil price upcycle than previous ones.

A quarter of IndoAgri’s external sales come from crude palm oil and palm kernel.

Palm oil prices have already jumped from a previous trough (2004-2006) of US$400 a ton in the past two years to US$1,200 or more currently.

Considering that seven in ten palm oil price cycles last three to four years, palm oil prices may be nearing its peak.

Nevertheless, palm oil prices are on a secular up trend: the previous trough’s dip from its peak was much smaller than in past cycles, notes its CEO Mark Wakeford.

To reduce its exposure to palm oil prices, IndoAgri is diversifying into sugar. (Read about this in the recent NextInsight story: INDOFOOD AGRI: More than just palm oil )

Why the secular up-trend in palm oil prices?

Palm oil prices are on a secular uptrend, says CEO Mark Wakeford. Photo by Sim Kih

Palm oil prices are on a secular uptrend, says CEO Mark Wakeford. Photo by Sim Kih

Palm oil, being the most inexpensive edible oil, is also the most widely consumed edible oil today. In fact, 25% of edible oils consumed globally is palm oil.

Soya bean oil is a close contender, and accounts for 24% of edible oils consumed.

As oil palm trees thrive in abundant sunshine and a mean temperature of 29-32 degree Celcius, suitable planting locations are limited to within 20-degrees of the Equator, such as in Malaysia or Indonesia.

A minimum rainfall of 2,000 mm evenly distributed throughout the year is also necessary.

Food consumption and energy usage are accelerating, especially in China and India, which account for a whopping 36.8% of the world’s population. These two huge and rapidly developing economies respectively consumed 15% and 10% of the world's palm oil in 2007.

On the other hand, supply growth is slowing due to competition for acreage with grain products and wheat. Malaysia and Indonesia produced 85% of the world's palm oil last year.

Weather failure in key planting locations also affects production levels.

The rising demand trend and limitation in supply is why analysts believe prices of palm oil will go on upward.

For plantation owners, inflationary pressure will hit major cost items such as labor and fertilizers.

Yet, the outlook for crude palm oil prices is so compelling 7 brokers have 'buy' or 'outperform' calls on IndoAgri.

| Report Date | Call | Broker | Target Price | Valuation Basis | Upside |

| 12-May-08 | BUY | AmResearch | $3.60 | 51% | |

| 30-Apr-08 | OUTPERFORM | CIMB-GK | $3.10 | 18X PE | 30% |

| 4-Mar-08 | OUTPERFORM | Credit Suisse | $3.20 | 20.5X FY08PE | 34% |

| 29-Apr-08 | BUY | Goldman Sachs | $3.25 | 36% | |

| 12-Mar-08 | OUTPERFORM | Macquarie | $3.90 | 17X FY08PE | 63% |

| 2-Jun-08 | BUY | OSK-DMG | $3.34 | 14X PE | 40% |

| 30-May-08 | BUY | UOB Kayhian | $3.55 | 16X FY09 PE | 49% |

AmResearch

“Operating margins will improve as a result of acquiring London Sumatra” says AmResearch analyst Gan Huey Ling.

CIMB-GK

CIMB-GK has an overweight rating on the plantation sector, and believes crude palm oil prices will remain strong. Indofood Agri is its top pick for the Singapore bourse.

The broker likes its exposure to rising crude palm oil prices and cost savings from merger with London Sumatra arising through lower transport and admin expense.

Credit Suisse

Credit Suisse is expecting strong FY08 results for the following reasons:

2) Rising prices of (upstream) commodities such as crude palm oil

3) High production yields at IndoAgri’s plantations

4) Cost savings arising from the merger with London Sumatra in the next two to three years could lift bottom line 5%-10%.

The investment bank believes IndoAgri’s management is right in opting for margin preservation over market share for the company’s cooking oil refining division.

Goldman Sachs

Indofood Agri is Goldman Sach’s top pick in the plantation sector.

The US investment bank likes Indofood Agri’s

2) Strong long term growth potential from its plans to expand plantation acreage (total land-bank is 3.5X its 2007 matured area), and

3) Potential cost savings arising from acquiring London Sumatra

Macquarie

Indofood Agri is also one of Macquarie’s top picks, for the Singapore bourse.

The Australian broker believes crude palm oil prices will continue rising due to a tightening edible oil market.

Also, Indofood’s acquisition of London Sumatra will result in economies of scales as follows:

1) Cost of raw materials will decrease through bulk procurement of key items such as fertilizers and diesel fuel

2) Combining expertise of both companies’ management may improve plant yield and reduce overheads

3) Bringing London Sumatra’s fruit transport in-house will reduce transport costs

OSK-DMG

OSK-DMG believes Indofood Agri's position as a leading producer puts it in a sweet spot to reap gains from the global trend of high consumption of palm oil and high crude palm oil prices.

UOB Kayhian

UOB Kayhian likes the synergies IndoAgri gains from acquiring London Sumatra. London Sumatra’s strength in R&D will enable it to produce high-quality seeds, translating to higher plant yield.

"Cost of crude palm oil for its cooking oil segment will also decrease," says its analyst Stefanus Darmagiri.

He likes IndoAgri’s enormous landbank of over 400,00 acres, with almost half at prime maturity of 7-20 years.

"This, coupled with plans to plant another 35,000 acres in FY08, will ensure high production levels in the next few years."

Source: Bloomberg, 11 Jun 2008

Source: Bloomberg, 11 Jun 2008