This article was originally published on SGX's investor education portal, My Gateway, and is republished with permission.

|

According to the Global Industry Classification Standard (GICS®), more than one in 10 stocks listed on SGX are categorised to the IT sector. These stocks span a range of sub-segments, including semiconductor manufacturers, software and services providers, tech hardware and equipment manufacturers, Internet and gaming providers, as well as telecoms service operators.

Nasdaq-listed Apple Inc is the world’s largest IT company with a market capitalisation of US$555 billion (S$750 billion). Given its position as one of the biggest customers in the global electronics supply chain, the iPhone and iPad maker’s financial results have a significant impact on its suppliers and partners, most of which are based in Asia.

There are eight SGX-listed IT companies which have direct or indirect revenue exposure to Apple, and these stocks have a combined market capitalisation of S$78.7 billion. They have generated a dividend-inclusive total return of 2.4% in the 2016 year-to-date, bringing their one-year, three-year and five-year total returns to 45.9%, 108.2%, and 82.4% respectively. The eight stocks also averaged a dividend indicative yield of 3.9%, with two of the eight stocks currently not paying dividends.

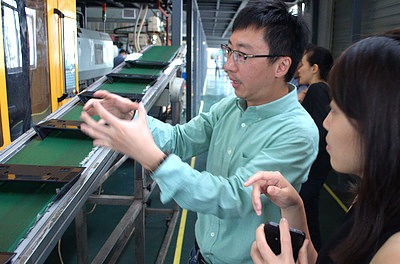

Components supplier Broadway Industrial Group Ltd and contract electronics manufacturer Hi-P International Ltd are included in Apple’s top 200 suppliers, which together represent 97% of the US company’s global procurement expenditure for materials, manufacturing and product assembly in 2015, data from Apple’s supplier responsibility 2016 progress report showed. @ Memtech's factory in China. Apart from parts for Apple, Memtech also produces casings for routers (above). Memtech executive director TM Chuang (above) explains the production to Singapore analysts. NextInsight file photo.Memtech International Ltd is a supplier of headband moulds for audio products maker Beats Electronics, which was acquired by Apple in 2014, while Fischer Tech Ltd, a supplier of high-volume precision engineering plastic components, also counts the US company as a customer.

@ Memtech's factory in China. Apart from parts for Apple, Memtech also produces casings for routers (above). Memtech executive director TM Chuang (above) explains the production to Singapore analysts. NextInsight file photo.Memtech International Ltd is a supplier of headband moulds for audio products maker Beats Electronics, which was acquired by Apple in 2014, while Fischer Tech Ltd, a supplier of high-volume precision engineering plastic components, also counts the US company as a customer.

Singapore’s three largest telecoms operators – Singapore Telecommunications Ltd, StarHub Ltd and M1 Ltd – also distribute Apple’s iPhones and iPads, while Epicentre Holdings Ltd is a retailer of a wide range of Apple products.

The table below details the eight technology stocks on SGX with direct and indirect exposure to Apple, sorted by market capitalisation. Note that clicking on a stock name will take you to its profile page on StockFacts.

| Name | SGX Code | Market Cap in S$M | Total Return YTD % | Total Return 1 Yr % | Total Return 3 Yrs % | Total Return 5 Yrs % | Dvd Ind Yld % | P/E | P/B | ROE % |

| Singtel | Z74 | 68,876 | 17.4 | 4.7 | 25.1 | 67.9 | 4.1 | 17.8 | 2.8 | 15.6 |

| StarHub | CC3 | 6,763 | 9.2 | 4.5 | 6.7 | 80 | 5.1 | 17.2 | 24 | 153.9 |

| M1 | B2F | 2,492 | 2.9 | -12.2 | -3.1 | 33.8 | 5.8 | 14.6 | 6.2 | 43.5 |

| Hi-P International | H17 | 306 | -26.7 | -27 | -54.8 | -58.8 | 0.8 | N/A | 0.6 | -7.8 |

| Memtech | BOL | 90 | 2.6 | 377.6 | 814.3 | 374.1 | 5.7 | 9.6 | 0.6 | 6.6 |

| Fischer Tech | BDV | 87 | 70.2 | 65.9 | 155.1 | 309.6 | 1.9 | 6.6 | 0.8 | 13.2 |

| Broadway Industrial | B69 | 47 | -45.4 | -49.5 | -64.1 | -73.3 | N/A | N/A | 0.3 | -43.1 |

| Epicentre Holdings | 5MQ | 14 | -11.4 | 3.3 | -13.9 | -74.3 | N/A | N/A | 2.6 | -49.8 |

| Average | 2.4 | 45.9 | 108.2 | 82.4 | 3.9 | 13.2 | 4.7 | 16.5 |

Source: Bloomberg and SGX StockFacts (data as of 27 July 2016)

Singapore Telecommunications Ltd (Z74)

Singtel provides integrated infocomms technology (ICT) solutions to enterprise customers primarily in Singapore and Australia. It operates through three business segments: Group Consumer, Group Enterprise, and Group Digital Life.

StarHub Ltd (CC3)

StarHub, an integrated info-communications company, provides information, communication, and entertainment services for consumer and corporate markets in Singapore. It also manages an HFC network that delivers multi-channel pay TV services, as well as ultra-high speed residential broadband services. The company also provides a wide range of business solutions as well as data center and cloud computing solutions.

M1 Ltd (B2F)

M1, together with its subsidiaries, provides mobile and fixed communications services in Singapore. It also offers connectivity solutions, managed services, cloud solutions, data center services, and other enterprise solutions for corporate customers.

Memtech International Ltd (BOL)

Memtech provides component solutions for the mobile phone, IT equipment, and automotive industries. The company operates in three segments: Keypads, Plastics, and Touch Screen Panels. It serves mobile phone manufacturers in the People’s Republic of China, South Korea, Japan, Singapore, Taiwan, the United States, and Europe.

Fischer Tech Ltd (BDV)

Fischer Tech manufactures and sells precision engineering plastic components for electronic products in China, Singapore, Thailand, and Malaysia. It operates through two segments, High Precision Plastic Injection and Mould Design and Fabrication. The company services the automotive, computer peripherals, healthcare, and consumer product industries.

Broadway Industrial Group Ltd (B69)

Broadway engages in the manufacture and sale of foam plastics and packaging products, expanded polystyrene related products, and precision machined components; and the sub-assembly of actuator arms. The company operates in three segments: Foam Plastics, Hard Disk Drive (HDD), and Precision Engineering Solutions.

Hi-P International Ltd (H17)

Hi-P operates as a vertically integrated contract manufacturer serving the telecommunications, consumer electronics, computing and peripherals, and medical and industrial devices. The company engages in the design and fabrication of mold; precision plastic injection molding; and assembly and provision of ancillary value-added services, primarily surface finishing services. It has operations primarily in the People's Republic of China, Poland, Singapore, Thailand, Taiwan, Europe, Malaysia, the United States, and the Americas.

Epicentre Holdings Ltd (5MQ)

Epicentre engages in the retail of Apple brand products, and third party and proprietary brand complementary products. The company sells the iPod, iPad, iPhone, Macbook, Apple TV, Apple watches, and Apple Care products, as well as Apple and non-Apple branded accessories. It also provides IT solutions to education institutions; and retail, trading, repair, and service of consumer electronics and digital lifestyle products. It operates seven EpiCentre stores in Singapore and three EpiLife stores in Singapore; and six EpiCentre stores in Malaysia.