| ♦ Healthcare business growing by leaps and bounds | |

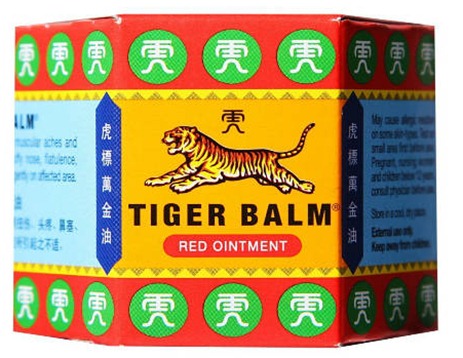

Photo: Company Haw Par Corporation (HPAR SP) has a solid healthcare business that is growing by leaps and bounds, with the potential to eventually match its large investment portfolio. Photo: Company Haw Par Corporation (HPAR SP) has a solid healthcare business that is growing by leaps and bounds, with the potential to eventually match its large investment portfolio. Its healthcare products are manufactured and marketed under its various established brands - Tiger Balm and Kwan Loong. Tiger Balm is a renowned ointment used worldwide to invigorate the body as well as to relieve aches and pains. The group has leveraged on the Tiger Balm brand and introduced numerous product extensions such as medicated plaster, joint rub, neck and shoulder rub and mosquito repellent patch. These new products have been wellreceived and currently account for some 60% of the healthcare division’s sales. In the past 5 years, sales and operating profit of the healthcare division have grown at a CAGR of 14% p.a. and 24% p.a. respectively, to S$152m and S$48m. We reckon the healthcare business is worth a cool S$1bn valuation on a standalone basis. Haw Par also owns an investment portfolio comprising of a 4% stake in UOB Group, a 5% stake in UOL Group and a 5% stake in UIC and other investments, worth a collective S$2.1bn.

In total, we estimate the sum-of-parts valuation of the stock at S$16.40. At S$8.30, Haw Par is currently trading at a deep discount of 50% to its fair value. With a strong set of FY15 results (net profit +54% to S$183m), the group has also declared a special dividend of S$0.15/share in additional to the ordinary dividend of S$0.20/share, bringing the full year payout to S$0.35/share. |