|

|

Attractive 8.7% recurring yield ex-distribution.

Including one-off items, we look forward to the forecasted distribution accrued for the period Aug-14 to Mar-15, amounting to JPY5.49b (~5.65 S cents) that will be paid by June. Without the one-off items, AGT estimates a recurring distributable income of JPY6.06b (6.23 S cents) in FY15, or 8.7% yield ex-distribution.

AGT had slightly weaker results in Aug-Dec 2014 due to the unusual bad weather. Moving forward, results may improve as utilization rates have been steadily improving. AGT encourages the growing senior population to play on weekdays (utilization on weekends may be full depending on the season). Also, AGT has been attracting female golfers to the male-dominated sport, and may roll out promotions to the younger crowd during summer when utilization is lower.

Upside catalysts with huge acquisition pipeline and Olympics.

AGT targets to acquire JPY50b of assets by Mar-2017, adding on to the existing portfolio of JPY160b. We believe that such acquisitions will be highly accretive at 5% net yield (pre-tax) as AGT is looking to acquire at 8.3% net operating income yield (in-line with its current portfolio) while management intends to fund acquisitions by taking debt, which we think may cost 3%-3.3%. Other upside catalysts include the addition of golf into the Olympic Games 2016 and the Olympics Games 2020 that will be held in Tokyo.

Sheltered from several macro risks.

~77% of debt are hedged till at least 2017, and we believe borrowing costs may remain low in Japan for a long time given the ultra loose monetary policy. Consumption tax hike has not impacted sales, and AGT could fully pass through the tax to customers.

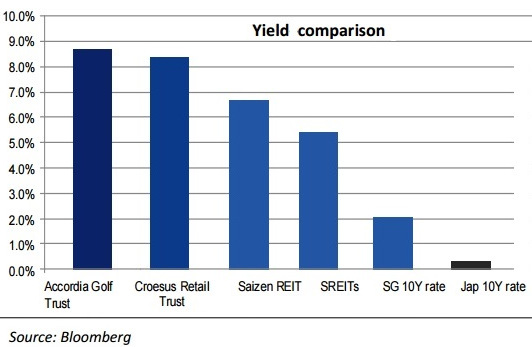

Priced at attractive 8.7% yield ex-distribution compared to REITs.

Due to a lack of listed golf comparables, we examine the differences with SREITs. Aside from differences in the REIT and the business trust structure, AGT’s golf assets may not be as easily transacted and liquid as properties that are owned by REITs. However, 80% of AGT’s golf courses are on freehold land instead of leasehold seen in most REITs.

As opposed to REITs with rental escalations clauses, we think that AGT could increase its revenue through higher utilization and materializing the huge acquisition potential. If investors could hedge the currency risk, AGT offers 290bp pickup compared to the average SREIT which typically yield ~5.8%, which is extremely attractive and more than compensates for the differences, in our view.