Nordic executive chairman Chang Yeh Hong presenting to OCBC remisiers and investors last Friday. Photo by Colin Lum.

Nordic executive chairman Chang Yeh Hong presenting to OCBC remisiers and investors last Friday. Photo by Colin Lum.

Chang Yeh Hong, executive chairman of Nordic Group: "No erosion of the normal gross profit margin in 1H2015; 1H2014 had enjoyed an exceptional variation order from a customer."

Chang Yeh Hong, executive chairman of Nordic Group: "No erosion of the normal gross profit margin in 1H2015; 1H2014 had enjoyed an exceptional variation order from a customer."

Photo by Leong Chan TeikNEXT TUESDAY (Sept 8), shareholders of Nordic Group will find an interim dividend credited to their accounts.

At 0.4-cent a share, it equates to about 2.5% yield on a stock price of 16 cents.

It's decent, though not astounding, but what it signifies is the maiden payout under the company's policy of sharing 40% of its earnings as dividends.

Nordic earned 1 cent in earnings per share (or $4.0 million) in 1H2015, up 25% y-o-y.

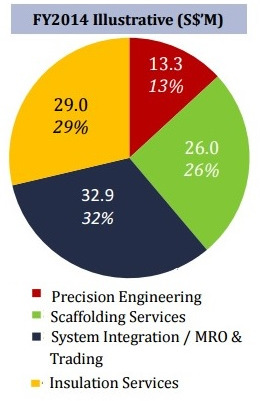

The 40% payout ratio is high and Mr Chang Yeh Hong, the executive chairman of Nordic Group, said this is possible because of the cashflow and recurring business of two subsidiaries -- MultiHeight Scaffolding and newly-acquired Austin Energy.

These businesses serve petrochemical companies operating on Jurong Island, providing scaffolding and insulation services which are required on an ongoing basis.

Have these customers placed a squeeze on the margins? Gross profit margins contracted 3.3 percentage points and 5.0 percentage points in 1H and 2Q, respectively. CEO Dorcas Teo. Photo by Leong Chan TeikMr Chang explained: "In 1H2014, we had an exceptional variation order from a customer which enhanced the margins. Our normal range is 32-33%, so there has been no erosion in 1H2015."

CEO Dorcas Teo. Photo by Leong Chan TeikMr Chang explained: "In 1H2014, we had an exceptional variation order from a customer which enhanced the margins. Our normal range is 32-33%, so there has been no erosion in 1H2015."

Aside from gross profit margin, all other metrics were up in 1H2015: "We are firing on all cylinders, and we are optimistic about the next six months," quipped Mr Chang.

|

|