This article was recently published on A Path to Forever Financial Freedom, and is republished with permission. The writer (left), who is in his late 20s, has a MBA degree.

This article was recently published on A Path to Forever Financial Freedom, and is republished with permission. The writer (left), who is in his late 20s, has a MBA degree.THIS WEEK, I made a purchase of 15,000 shares of Kingsmen Creative at a price of $0.98.

After recently adding Silverlake into the portfolio (Link Here), I am delighted to add another company that fits my criteria of strong business moats, high free cash flow generating capability, strong Return on Equity figures, and a superb strength of the balance sheet. More on those will be explained in a short while. This adds to the collection of similar companies I have in my portfolio such as CMPH, Vicom, Silverlake, Nam Lee Metals, etc.

This analysis and decision was made after talking to a fellow blogger and good friend on the qualitative and quantitative nature of its business, including how they operate as a business and how the market perceived to value this sort of industry.

If you have been following the recent SEA Games which was held in Singapore, Kingsmen should not be foreign to you. The company has been bidding some of the world's most important events in recent years and their niche industries allowed them to become one of the leading sponsors of the Games.

Business Overview

Kingsmen Creative is one of the leading service contractors that specialize in many prominent events in Singapore and the rest of Asia, including conceptualizing the interior behind many of the high end fashion brand names such as Chanel and H&M, events and exhibitions such as the Formula 1 and theme parks such as the Universal and Disneyland in Shanghai. Their main core business and operations are in:

» Research and Design

» Retail and Corporate Interiors

» Exhibitions and Events

» Thematic and Museums

» Alternative Marketing

Financials Overview

I come from a profession that deals with financials all the time, so I'm a pretty sucker for financial numbers that look impress me. Since I am pretty sensitive to numbers, I usually bide around my analysis using a bottom up approach from the company's financial figures.

I have tabulated a summary table for the company's financial figures for the past 8 years (from 2007 to present) and included some of the most important financial metrics I usually require to analyse. (Image here)

The company has been generating very good and steady increase of topline figures across the years, with increasing revenue while maintaining a respectable margin since the past 8 years and more. This is important because this shows how the company deals with external events such as competition entrance into the market share which could eat into their margins if they are not being competitive.

Their bottomline profit margin tends to stay around 6% over the years and as you will see later, it is important that they maintain a steady growth of their topline while keeping costs in check if they want to grow their earnings. Failure to do so will be detrimental to their growth as we've recently seen in companies such as Japan Food Holdings, who are struggling to keep afloat their high headcount costs which eat into the profit margin.

The Return on Equity (ROE) is an important metric that I usually keep an eye on. Over the years, they have been generating a respectable ROE in the range of 23% while maintaining their financial leverage low. In some of my previous analysis of other companies, I usually like to break the ROE down into 3 financial levers to check the efficiency of the figures, namely Profitability, Operating Efficiency and Financial Leverage. I'll skip this exercise for this analysis in view that I had their margins and financial leverage checklist in place. The company has had some cash hoarding and accumulating for a number of years now, which typically strengthen their balance sheet but drags down the ROE of the company. In this sense, this is very similar to what Vicom is currently doing.

The company business model is built upon an asset light environment, with talent resource an important asset metric to the company. The company has a low capex requirement, which means that the company is capable of generating high free cash flow as long as their topline and bottomline increase. If we take a look at the historical P/FCF as reference, they have been hovering in the range of 8x (with exception to 2009) for the past couple of years, and this is attractive in my view. Not many companies are able to generate such consistent FCF for a number of years in today's environment.

The company has been generating their earnings yield (opposite to the P/E metrics) consistently for a number of years at an average of about 11% now, distributing about half of them as dividends to shareholders while retaining the rest to grow the company. This is important for investors seeking a dividend growth company because you want your company to grow, and also ultimately your dividends. The company is able to operate in a distribution business model like Reits by distributing out all its earnings as dividends at 10%, but it wouldn't make sense for them to do so. This is a company that has an ambition to grow and investors would need to be patient to grow together with them.

Risks

As with all companies, risks are pertinent when it comes to dealing with permanent loss of income, which will ultimately impact the bottomline and shareholder's profitability. In my view, the main risks for Kingsmen would come from these factors:

» Rising Headcount Costs

As mentioned earlier, talent retention is the main asset for Kingsmen and with rising manpower cost evident in today's environment, the company may struggle to keep afloat their costs in check. Their bottomline margin is at around 6%, so they would need to find ways to increase their topline figures in order to tide the wave of a rising cost environment.

» Slowdown in global activities

The amount of pies across the various global activities has to somewhat increase for this to make sense, otherwise it'll be a case of fighting for the equal number of pies amongst the rising number of competitors. My friend highlighted that this is a niche industry with high barriers of entry and high switching costs by customers, so customer retention and loyalty play a somewhat important role for that to happen. The opposite case goes the same when Kingsmen is trying to gain more market share from its competitors and face the same barriers.

Valuation

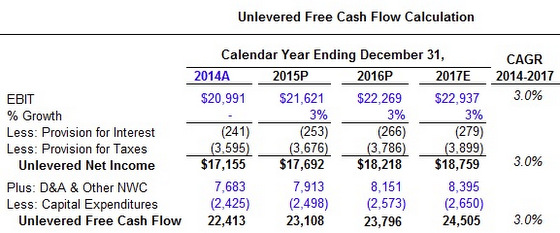

I am using Discounted Cash Flow (DCF) for valuing the company due to its predictability and consistency of its FCF generating capability.

I am setting my criteria by using an unlevered FCF for the next 5 years starting from 2014, growing them at a terminal growth rate of 3% based on the profit figures, discounting them using a Weighted Average Cost of Capital (WACC) of 10% and using a Terminal EBITDA multiple of 10x, which is the average normalized multiple for the past 8 years.

Sensitivity analysis of standard deviation +1 and -1 has been added for further reference and analysis.

Assumptions:

WACC = 10%

Terminal Growth Rate = 3%

EBITDA Multiple = 10x

EV/EBITDA = 9.3x

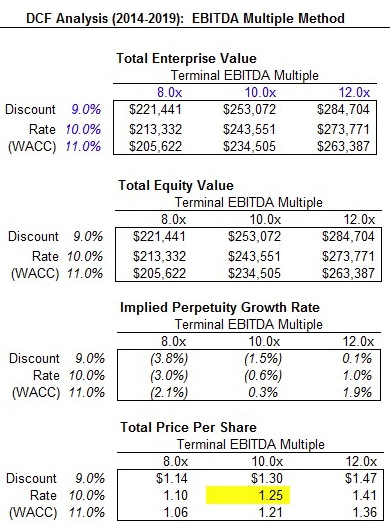

Based on the above assumptions, the intrinsic value came up to $1.25.

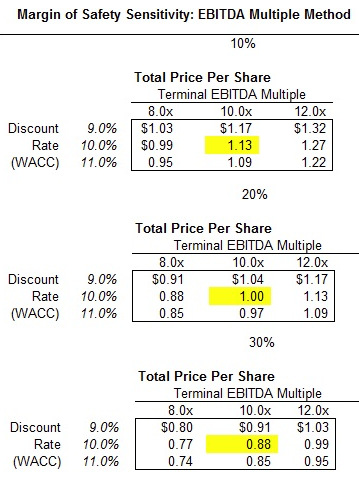

Assuming we are taking in some margin of safety discounts to our initial assumptions, we now get an intrinsic value of $1.00.

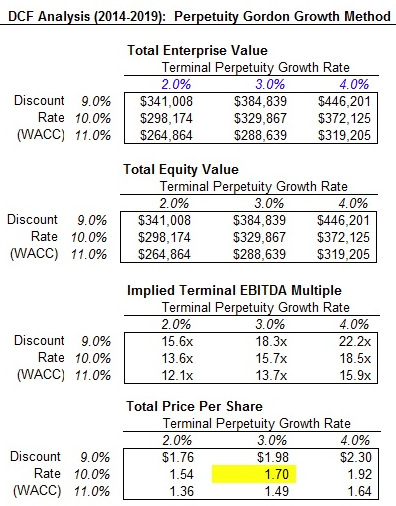

Based on the Gordon Perpetuity Model of using a terminal perpetuity growth rate of 3%, we now get an intrinsic value of $1.70, which presents a 70% upside and comes in line for long term investors who are willing to hold this for the long term.

Conclusion

The share price has increased about 10% since I started monitoring it a couple of years back when the share price was less than $0.90. I still think it presents value at this price and management has proven their capability time and again that they are able to withstand challenges in an uncertain global environment. Balance sheet has also strengthen quite remarkably since a couple of years back.

This should be a good company to own if you are thinking of the long term. I think you should not expect any fireworks you've seen in other companies but instil a steel of patience to grow together with the company. As for myself, I'm really excited to be able to add on companies with a strong moat into the portfolio.

I'll be updating my portfolio shortly with this purchase.

What do you think of this company? Will you decide to invest your hard earned money in this sort of company?

Despite having CD status, the price just dropped to 0.86 today due to lousy results and reduced dividends.