|

|

2011 bonds

In 2011 the newly-incorporated Garden Fresh (a wholly-owned subsidiary of Sino Grandness) turned to the bond market after failing to borrow from banks to grow its beverage business. Sun Hung Kai shared Sino CEO Huang's optimism that with its niche loquat juice, Garden Fresh should be able to get itself listed. SHK subscribed for the 3-year zero coupon convertible bonds with a principal amount of RMB 100m in the hope of owning a substantial stake of Garden Fresh.

To spur Garden Fresh to be expeditious in its IPO journey, the following reward structure was introduced:

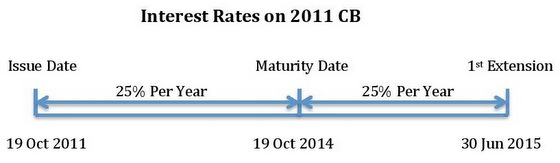

(a) if Garden Fresh does not file for listing, bondholders will receive RMB 100m plus interest compounded at 25% per annum on the maturity date; and

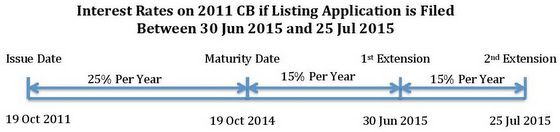

(b) if an application for listing is filed but not approved by the relevant stock exchange subsequently, the interest rate will be lower, at 15%.

The bond agreement also spelt out conditions regarding the subscription price of Garden Fresh shares. In the event that the shares are issued at a price-earnings ratio lower than 9, bondholders can decide to opt for their RMB 100m principal amount plus interest compounded at 10% per annum (instead of receiving Garden Fresh shares).

19 Oct 2014 -- first maturity date of 2011 bonds

When the 2011 bonds matured on 19 Oct 2014, holders owning bonds of RMB 19.5m principal sum decided on redemption with interest of RMB 18.4m, which nearly matched the principal sum.

Holders of the remaining RMB 80.5m bonds exercised their rights to extend the maturity date to 30 June 2015.

30 June 2015 -- extended maturity date of 2011 bonds

Last week, on 26 June, Sino Grandness disclosed that "bondholders holding RMB80,500,000 in principal amount of the convertible bonds have notified the Company of their intention to extend the maturity date of the convertible bonds from 30 June 2015 to 25 July 2015."

The new maturity date is of a special significance: 25 July 2015 is also the maturity date of another tranche of 3-year zero coupon convertible bonds issued in 2012 for a principal amount of RMB 270m.

On page 50 of its 2014 annual report, Sino Grandness indicated that it "is of view that it will have sufficient resources to repay the convertible bonds in the event of a full redemption in cash upon the maturity dates".

The company also indicated that it "may negotiate with the convertible bondholders for partial redemption and/or extension".

If Garden Fresh is successfully listed, bondholders will have an aggregate 23.4% stake in Garden Fresh. Given that Garden Fresh should fetch a good valuation for its high profit from strong beverage sales, Sino ought to minimise the dilution of its stake in this subsidiary.

CEO Huang Yupeng at a briefing for investors.

CEO Huang Yupeng at a briefing for investors.

NextInsight file photo.However, Sino’s CEO has indicated before that bondholders are keen to have stakes in Garden Fresh.

The CEO is believed to be of the view that an equitable arrangement should be found to accommodate the wishes of the bondholders and, at the same time, protect Sino shareholders' interests.

After all, without the bond proceeds, Garden Fresh would not have grown its sales as significantly as it has done, and built two factories.

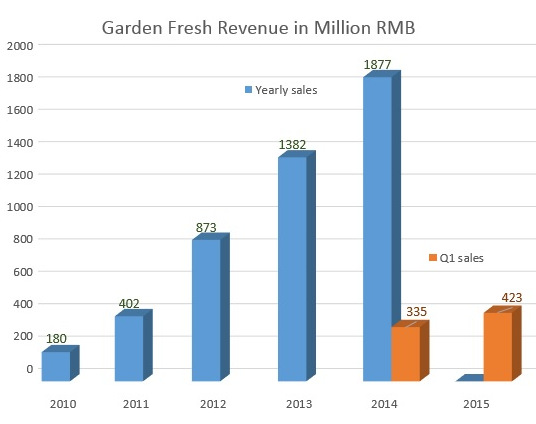

(Sales of Garden Fresh juices surged to RMB 1,877m in 2014, from RMB 180m in 2010, a nine-fold increase in a space of four years. Growth momentum continued in 1Q 2015.)

At this point, it is likely that Sino and the bondholders have reached an agreement on the shareholding structure of Garden Fresh.

Assume, for discussion’s sake, that the agreement is for Garden Fresh to redeem half of the bonds, resulting in bondholders having an 11.7% stake (instead of 23.4%).

If 2011 bondholders redeem on 30th June 2015, they will receive the principal amount plus 25% compounded interest for the period between 19 Oct 2011 and 29 Jun 2015 as no listing application has been filed.

On the other hand, if the listing application is filed during the 25-day extended period, Garden Fresh can redeem on 25 July and the 25% compound interest applies up to 19 Oct 2014 only; for the period between 20 Oct 2014 and 24 July 2015, a lower 15% compounded interest applies.

If indeed the 2011 bondholders will be given a reduced stake in Garden Fresh, they are foregoing their rights (on 30 Jun 2015) to redeem -- at a higher rate of return of 25% compound interest -- the portion of the bonds that will not be converted into Garden Fresh shares. Is this concession the negotiated sacrifice in exchange for a stake in Garden Fresh?

IPO process

There have been persistent concerns among shareholders that the IPO process is moving too slowly.

In March 2014, professionals engaged by Sino commenced their preparatory work for listing Garden Fresh on the Hong Kong Stock Exchange. As at 31 Dec 2014, the professionals have been paid RMB 12.8m.

Hit by several earlier scandals involving some listed companies, the Exchange has criminalised reckless actions leading to the inclusion of false or misleading info in IPO prospectuses, and this has resulted in IPO professionals exercising more effort in their due diligence.

To lower their risk, IPO professionals are said to have done due diligence on a bigger sample of the 280 distributors of Garden Fresh. As the selected distributors are scattered over various provinces, it took a long time to interview all of them. Moreover, the professionals also wanted to find out from some ex-distributors the reasons for their dropping out. This work has turned out to be long-drawn as ex-distributors had no incentive to respond.

Garden Fresh has also taken the extra step of having market surveys done by two firms instead of one as originally planned. The first survey was done by Frost & Sullivan.

Then short-seller Newman9 published a report which, among other things, made references to Euromonitor’s previous market report which made no mention of Garden Fresh at all. Sino Grandness had explained to investors that Euromonitor and other market research firms had specific survey objectives which would have precluded them from inquiring into niche and new products such as loquat juice.

Sino Grandness then engaged Euromonitor to survey the overall juice market and the loquat juice segment, the results of which will be made public in the IPO prospectus.

CEO Huang has indicated that the IPO process is close to completion after more than a year of hard work.