AmFraser analyst: Renfred Tay (left)

AmFraser analyst: Renfred Tay (left)3Q14 blows past expectations. Sunsine’s reported 3Q14 revenue of RMB582.2m (+32% yoy) and net profit of RMB83m (+206% yoy), versus our estimates of RMB555m (+5% variance) and RMB71m (+17% variance), respectively. Key variance from our projections came from, higher than expected rubber accelerator (RA) sales volume, lower than expected raw material costs, depreciation and tax.

Further increase in capacity. Last week, Sunsine announced additional capacities of 15,000 tons/year for 6PPD (an AO), 4,000 tons/year of MBTS (RA). An additional 8,000 tons/year of DCBS (RA) will also be completed by year end. These were largely within our expectations although we were positively surprised by the addition of 4000 tons/year of MBTS and 5000 tons/year of 4010 (an AO).

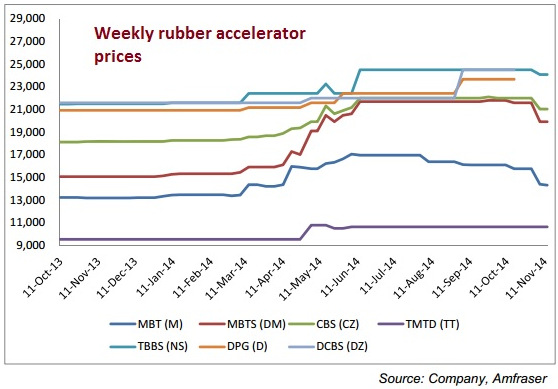

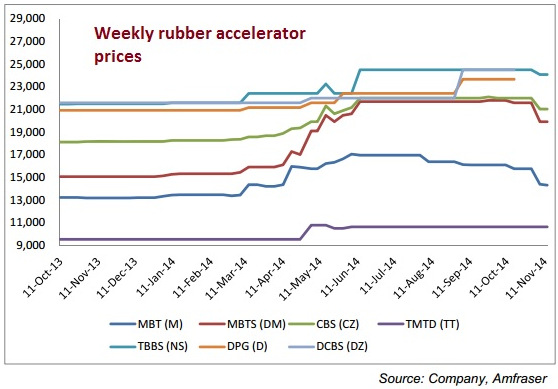

The start of RA price weakness? RA prices across categories have declined 0-9% since the start of November. This coincided with the US slapping a tariff on tire imports from Chinese tire makers for unfair trade practices. We therefore believe the fall in RA prices has more to do with weaker demand from Chinese tire makers, rather than an increase in supply of RA.

Rubber accelerator prices have softened but China Sunsine expects to continue to enjoy good profitability from the fall in the price of aniline (a key raw material) and its expanded production capacities for rubber accelerators and anti-oxidants.

Rubber accelerator prices have softened but China Sunsine expects to continue to enjoy good profitability from the fall in the price of aniline (a key raw material) and its expanded production capacities for rubber accelerators and anti-oxidants.

@ 3Q briefing by Sunsine's financial controller Tong Yiping. NextInsight photo.Having said this, we also take note that the proportion of Sunsine’s RA export volume has also risen in 9M14 (42% vs 38% a year ago), indicating more sales to non-Chinese customers.

@ 3Q briefing by Sunsine's financial controller Tong Yiping. NextInsight photo.Having said this, we also take note that the proportion of Sunsine’s RA export volume has also risen in 9M14 (42% vs 38% a year ago), indicating more sales to non-Chinese customers.

We remain sanguine on Sunsine’s outlook despite the fall in RA prices as it could potentially accelerate consolidation within the industry and weed out weak players.

Rubber accelerator prices have softened but China Sunsine expects to continue to enjoy good profitability from the fall in the price of aniline (a key raw material) and its expanded production capacities for rubber accelerators and anti-oxidants.

Rubber accelerator prices have softened but China Sunsine expects to continue to enjoy good profitability from the fall in the price of aniline (a key raw material) and its expanded production capacities for rubber accelerators and anti-oxidants.  @ 3Q briefing by Sunsine's financial controller Tong Yiping. NextInsight photo.Having said this, we also take note that the proportion of Sunsine’s RA export volume has also risen in 9M14 (42% vs 38% a year ago), indicating more sales to non-Chinese customers.

@ 3Q briefing by Sunsine's financial controller Tong Yiping. NextInsight photo.Having said this, we also take note that the proportion of Sunsine’s RA export volume has also risen in 9M14 (42% vs 38% a year ago), indicating more sales to non-Chinese customers. We remain sanguine on Sunsine’s outlook despite the fall in RA prices as it could potentially accelerate consolidation within the industry and weed out weak players.

Slight adjustments to our earnings. We now expect lower RA prices in 4Q14 and even lower prices in FY15 (-12% vs -7% previously).

However due to higher margins from the fall in the price of Aniline (a key raw material) and higher than expected RA and AO capacities, we raise out FY14 net profit estimates by 6% to RMB225m from RMB216m previously and FY15/16F earnings estimates by 0.4% and 2.6% respectively.

However due to higher margins from the fall in the price of Aniline (a key raw material) and higher than expected RA and AO capacities, we raise out FY14 net profit estimates by 6% to RMB225m from RMB216m previously and FY15/16F earnings estimates by 0.4% and 2.6% respectively.

TP unchanged at $0.69 on target PE multiple of 7x, Maintain BUY. We also expect dividends to rise by 50% from 1.0Scts to 1.5Scts per share, on the assumption of a 15% pay out ratio, which will provide a potential dividend yield of 3%.

Good turnout at Sunsine's 3Q briefing at Capital Tower. NextInsight photo.

Good turnout at Sunsine's 3Q briefing at Capital Tower. NextInsight photo.

Recent story: CHINA SUNSINE: Prospects getting more robust, in capacity expansion mode

Good turnout at Sunsine's 3Q briefing at Capital Tower. NextInsight photo.

Good turnout at Sunsine's 3Q briefing at Capital Tower. NextInsight photo.Recent story: CHINA SUNSINE: Prospects getting more robust, in capacity expansion mode

Q4 results may not be as good as Q3, nevertheless it will be a record year for China Sunsine. A few of the attendees were pushing for an increase dividend payout in view of the record year. FC will feedback this message to the chairman.

Do note profit margin cannot continue at current high levels due to easing of shortage and competitors increasing their supply. FC also mentioned they are fine if margins retrace to low 20s level instead of 30s in the last qtr.

My take.. I will continue to be vested and can add if there is a bigger price pullback. Strong eps and NAV of about 40ct (SGD) should be a good buffer.