Excerpts from analyst's report

Riverstone has "strongest EPS growth prospects, highest dividend yields and second-highest margins"

Riverstone has "strongest EPS growth prospects, highest dividend yields and second-highest margins"

|

§ Initiate with BUY. SGD1.21 TP, at 15x FY15E P/E, in line with peer average. § Earnings growth to speed up as doubling of capacity should ease growth constraints. § Strong focus on customisation and leadership in cleanroom gloves differentiate it from larger peers. |

Growth to speed up, as expansion eases constraints

Riverstone is set to double its capacity from 3.1b gloves at end-2013 to 6.2b gloves by 2016. This should ease its current capacity constraints to just 10%. With its cleanroom gloves accounting for a fraction of customers’ spending and no one customer accounting for more than 5% of its revenue, price suppression is usually remote.

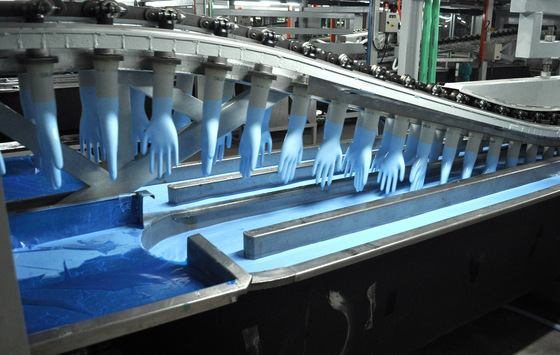

Workers stripping freshly-produced gloves from Riverstone's factory in Taiping. NextInsight file photo.This provides a strong foundation for its expansion to healthcare gloves, with rapidly growing demand. We expect EPS growth to accelerate to 21% in FY15E and 16% in FY16E when its new capacity kicks in.

Workers stripping freshly-produced gloves from Riverstone's factory in Taiping. NextInsight file photo.This provides a strong foundation for its expansion to healthcare gloves, with rapidly growing demand. We expect EPS growth to accelerate to 21% in FY15E and 16% in FY16E when its new capacity kicks in. Key risks: Major capacity expansion in the industry, ASP declines, failure to pass through higher raw-material prices and USD/MYR fluctuations. To be conservative, we have factored in 4-6% ASP declines for 2014E-15E.

Differentiated glove maker; High ASPs, high margins

Riverstone’s customised cleanroom and healthcare gloves contribute c.70% (including other cleanroom products) and 30% to its gross profits.

They differentiate it from the bigger glove makers and earn it an enviable position in the supply chain, even though it is the smallest player. Riverstone dominates the high-tech cleanroom glove segment with its high-ASP, high-margin gloves that should benefit from strong demand for mobile devices and storage solutions.

They differentiate it from the bigger glove makers and earn it an enviable position in the supply chain, even though it is the smallest player. Riverstone dominates the high-tech cleanroom glove segment with its high-ASP, high-margin gloves that should benefit from strong demand for mobile devices and storage solutions.

29% potential upside; Initiate with BUY

Riverstone’s FY15E P/E of 11.7x trails its peers’ 14.1x average, despite its strongest EPS growth prospects, highest dividend yields and second-highest margins. We value it at 15x FY15E P/E, on par with its peer average, for a TP of SGD1.21. Riverstone’s smaller market cap of USD274m than peers and strong product differentiation make it a viable takeover target, in our view.

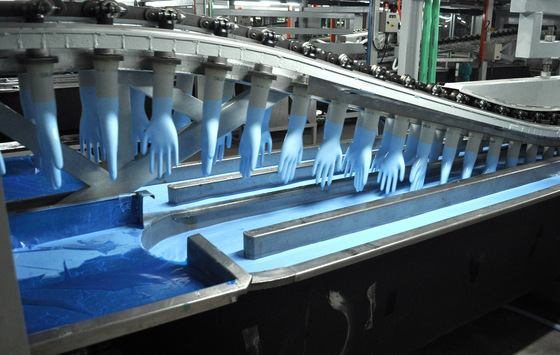

@ Riverstone's newly-completed factory in Taiping which will deliver 1 billion glvoes a year, boosting total capacity to 3.2 billion. NextInsight file photo.

@ Riverstone's newly-completed factory in Taiping which will deliver 1 billion glvoes a year, boosting total capacity to 3.2 billion. NextInsight file photo.

Full report here.

Recent story: RIVERSTONE: Ramping Up Production By 1 Billion Gloves A Year (+31% Y-O-Y)

@ Riverstone's newly-completed factory in Taiping which will deliver 1 billion glvoes a year, boosting total capacity to 3.2 billion. NextInsight file photo.

@ Riverstone's newly-completed factory in Taiping which will deliver 1 billion glvoes a year, boosting total capacity to 3.2 billion. NextInsight file photo.Under-owned by sovereign and institutional funds

The top four glove makers in Malaysia have sovereign wealth funds, including EPF, and other institutional funds as their substantial shareholders. We think there is room for Riverstone to narrow its valuation gap with peers, on greater institutional interest as it continues to deliver earnings growth and as its market value approaches that of the smallest of the top four glove makers, Supermax. Supermax has been trading at undemanding valuations due to political factors.

Full report here.

Recent story: RIVERSTONE: Ramping Up Production By 1 Billion Gloves A Year (+31% Y-O-Y)