Excerpts from analysts' reports

DBS Vickers says Starburst is "armed and highly profitable"

DBS Vickers says Starburst is "armed and highly profitable"

|

|

Niche defence play. Starburst is one of the very few integrated suppliers who design, manufacture, install and upkeep anti-ricochet ballistic protection systems for firearm training facilities.

Niche defence play. Starburst is one of the very few integrated suppliers who design, manufacture, install and upkeep anti-ricochet ballistic protection systems for firearm training facilities. Since its inception in 1999, Starburst has built a track record with different defence departments in the region. A key aim of the company’s IPO this July is to raise funds to double its production capacity to undertake bigger contracts.

Beneficiary of higher defence spending in SEA & the Middle East. SEA is actively upgrading and modernizing facilities, partly to protect critical infrastructures whereas in the Middle East, the implementation of compulsory military services is propelling demand for new shooting ranges in Qatar, UAE and Kuwait.

Most of all, Saudi Arabia, the biggest spender on defence, continues to push up military budget by 21% in 2014.

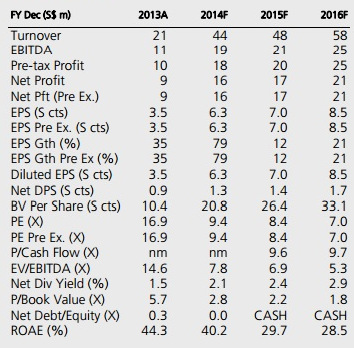

Steady earnings growth from FY14F-16F. Starburst is bidding for ten contracts worth >S$100m over the next 2-3 years and its recurring Maintenance income will expand along with a higher installed base. We believe its niche capability and higher barrier to entry would support net margins of >30%.

BUY, TP of S$0.77 is based on 11x FY15 PE, which is pegged to 25% discount to peers’ average of 15x forward PE. We estimate that Starburst will return 2.1% yield based on 20% payout on FY14 earnings.