Analysts: Jarick Seet & Terence Wong, CFA

|

|

Home-grown M&E and manufacturing company. Libra is a home-grown company principally engaged in two main business segments, M&E services and the manufacturing and supplying:

M&E services, including the contracting and installation of ACMV systems, fire alarms and fire protection systems, electrical systems and sanitary and plumbing systems (M&E services)

The manufacturing and sale of ACMV ducts and trading of ACMV-related products (manufacturing)

Building and construction solutions

Libra Group's stock (19.1 cents) trades at a trailing PE of 7.4X. Market cap is S$19 million only, so it's a micro-cap. Chart: FT.com

Libra Group's stock (19.1 cents) trades at a trailing PE of 7.4X. Market cap is S$19 million only, so it's a micro-cap. Chart: FT.com

Libra Group's stock (19.1 cents) trades at a trailing PE of 7.4X. Market cap is S$19 million only, so it's a micro-cap. Chart: FT.com

Libra Group's stock (19.1 cents) trades at a trailing PE of 7.4X. Market cap is S$19 million only, so it's a micro-cap. Chart: FT.com  Chu Sau Ben, executive chairman and CEO. Turnaround in place after restructuring. Last year, Libra underwent a major shake-up that saw the return of founder and majority shareholder Chu Sau Ben replacing William Lee Kay Choon. Chu also took over the helming of the company. The key management team has also undergone drastic changes and up to 20% of the staff has been replaced to beef up productivity.

Chu Sau Ben, executive chairman and CEO. Turnaround in place after restructuring. Last year, Libra underwent a major shake-up that saw the return of founder and majority shareholder Chu Sau Ben replacing William Lee Kay Choon. Chu also took over the helming of the company. The key management team has also undergone drastic changes and up to 20% of the staff has been replaced to beef up productivity. As at 1H14, though, there was a 30% increase in overall manpower and a 90% jump in revenue, which may indicate a significant improvement in productivity.

Our projection is for a more than 100% revenue growth for FY14. Meanwhile, 1H14’s net profit after tax (NPAT) also surged, rising to SGD2.9m from SGD0.9m in 1H2013.

FY13-16F revenue and NPAT may soar at 3-year CAGRs of c. 68% and c.232% fuelled by aggressive contract wins from the mechanical and electrical engineering (M&E) segment as well as more growth from its new building and construction solutions business. In addition, cost-cutting from the restructuring of the team and an increase in productivity/margins ought to fuel its NPAT growth.

Significantly undervalued. Initiate coverage with BUY and SGD0.31 TP based on 6.1x FY14F P/E. We derive our TP from a FY14F P/E of 6.1x which represents a 50% discount to its local peers’ average.

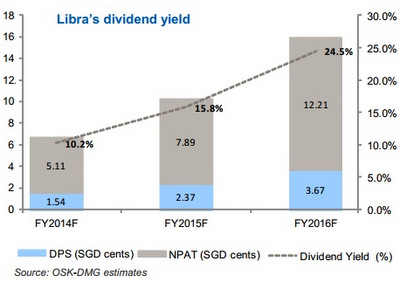

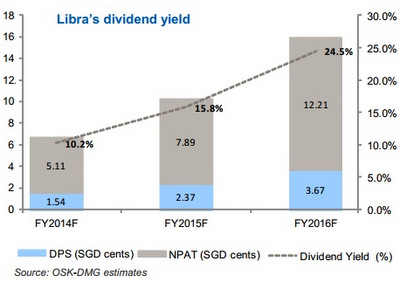

Dividend yields calculated based on share price of 15 cents.During our meeting with management, Libra said it is keen to reward shareholders with stable dividends in proportion to its growth.

Dividend yields calculated based on share price of 15 cents.During our meeting with management, Libra said it is keen to reward shareholders with stable dividends in proportion to its growth.

The company has so far paid out a 0.5 cents interim dividend and we expect it to pay another 1.0 cents this year, bringing FY14’s dividend yield to 10.2%. Going forward, we continue to expect dividend yields of 15.8% and 24.5% for FY15 and FY16 respectively.

Dividend yields calculated based on share price of 15 cents.During our meeting with management, Libra said it is keen to reward shareholders with stable dividends in proportion to its growth.

Dividend yields calculated based on share price of 15 cents.During our meeting with management, Libra said it is keen to reward shareholders with stable dividends in proportion to its growth. The company has so far paid out a 0.5 cents interim dividend and we expect it to pay another 1.0 cents this year, bringing FY14’s dividend yield to 10.2%. Going forward, we continue to expect dividend yields of 15.8% and 24.5% for FY15 and FY16 respectively.

Key Risks: uncertainty regarding its overseas business expansion, reliance on certain key personnel, and raw material price volatility are a few key risks. On page 11 of the report we further describe these risks.

Full report here.

Full report here.