Analysts: Janice CHUA & LING Lee Keng

|

|

But risks prevail. However, it is still early days to conclude an imminent upturn in the earnings revision trend given prevailing risks in the macro environment. The key risk lies in a weak global recovery which would derail earnings of global cyclical stocks, and closer home, there is no respite in rising cost pressures as a result of the government’s restructuring initiatives.

Global cyclicals – SIA, ST Engineering, NOL - are companies which disappointed, as operating conditions and competition remain tough, in part due to the strong SGD. Although 2H prospects are brighter, there remains downside earnings risk for these companies. DBS Economist has cut Singapore’s 2014 GDP growth forecast from 4% to 3%, triggered by the weak NODX, strong SGD and cost pressures in Singapore.

Quality companies in margin expansion mode. Margin erosion was a key earnings dampener in 2Q. About half of the companies which disappointed, reported margin pressure due to rising costs.

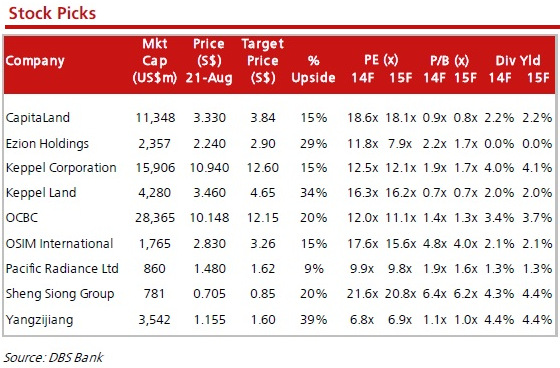

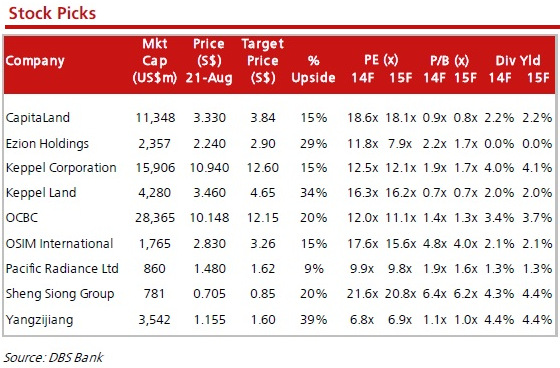

We like companies which have proven track record in outperforming its peers or delivering on margin enhancement despite challenging conditions. The key differentiating factors enabling these companies to outperform are:

a) focus on improving brand equity through product innovations – Osim, Keppel Corp,

b) strong track record in project execution and achieving productivity gains – Keppel Corp and Yangzijiang,

c) niche market positioning – Ezion,

d) early mover advantage to tap on new market opportunities – Pacific Radiance,Keppel Corp and

e) efficient cost management – Sheng Siong, OCBC.

Singapore property with China exposure. Signs of selective relaxation of mortgage credit and Home Purchase Restrictions (HPR) over the past month in some cities in China will be positive for Singapore developers. SG- listed developers – Capitaland and

Keppel Land - with significant exposure in China will benefit from positive newsflow and data-points are expected to continue providing support to share price going forward.