@ 2Q results briefing: Sean Goh, Senior Vice President Corporate Planning, Development and Regional Marketing at Serial System. Photo by Leong Chan TeikSERIAL SYSTEM is hungry for acquisitions, going by its recent announcements of two deals: It has proposed to acquire 49% of Achieva Technology Pte Ltd and the entire distribution and trading entity of GSH Corporation.

@ 2Q results briefing: Sean Goh, Senior Vice President Corporate Planning, Development and Regional Marketing at Serial System. Photo by Leong Chan TeikSERIAL SYSTEM is hungry for acquisitions, going by its recent announcements of two deals: It has proposed to acquire 49% of Achieva Technology Pte Ltd and the entire distribution and trading entity of GSH Corporation.Serial's senior VP for corporate planning, development and regional marketing, Sean Goh, said Achieva fits Serial's objective of penetrating further into the cloud computing business, as Achieva is a distributor of cloud computing-related products for suppliers such as Intel and Western Digital.

In addition, Achieva has a presence in Australia, which Serial's electronic components distribution business doesn't have.

As for GSH's distribution business, it offers a unique synergy.

It currently distributes finished IT and lifestyle products of brands such as Apple in markets -- such as Central Asia, Vietnam, Cambodia and Bangladesh -- that Serial does not have a presence in.

Serial, on the other hand, is a distributor of components that are used to manufacture these end products of brands such as Apple, Xiaomi, Lenovo, LG, Haier and Samsung.

"Through GSH, we will not only sell components to our customers but we'll buy their finished products. It will no longer be a one-way business," said Mr Goh at a 2Q results briefing last Friday (Aug 22). "We can help the Chinese and Korean manufacturers, for example, to gain access to markets such as Central Asia for their finished goods."

The consideration for the acquisition of Achieva, which is a unit of listed Achieva Group, is S$5.1 million cash, which is its net asset value. For GSH's unit, the consideration will be net asset value (to be determined by PwC) plus US$2.38 million for an aggregate of US$14 million or so in cash.

With the inclusion of the Achieva and GSH entities, Serial System's presence will increase from 12 countries currently to 17.

And that's not the end. Serial continues to be keen also on establishing a presence in Europe and the US, in pursuit of which its Chairman and CEO, Derek Goh, travelled overseas during the period of the 2Q results briefing.

2Q results briefing @ Tower Club. Photo by Janine YongThese M&A moves underlie one prong in a three-pronged enhanced corporate strategy which Serial publicised in Jan this year. Mr Goh gave an update on progress in the other two areas:

2Q results briefing @ Tower Club. Photo by Janine YongThese M&A moves underlie one prong in a three-pronged enhanced corporate strategy which Serial publicised in Jan this year. Mr Goh gave an update on progress in the other two areas:• Expansion of product portfolio and adding more higher-value components: Aside from gaining access to Intel and Western Digital through Achieva, Serial has signed up to distribute products of Japan's Renesas Corp (the world's No.1 semiconductor manufacturer for the automotive industry), Molex and Hynix.

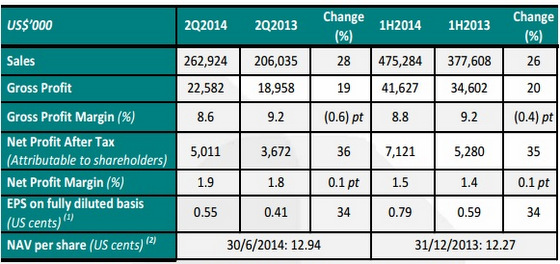

• Improving internal efficiencies: Expenses as a percentage of sales declined to 7.5% in 1H2014 from 8.1% in 1H2013.

In the past few years, new offices and building headcount have been put in place ahead of revenue growth, so it's expected that operating expenses, as a percentage, will lag behind sales growth going forward. In other words, Serial's net profit margin can be expected to rise.

Serial System said it is on track to achieving its FY14 target of full-year sales of US$1 billion. Its 2H is traditionally stronger than the 1H.

Serial System said it is on track to achieving its FY14 target of full-year sales of US$1 billion. Its 2H is traditionally stronger than the 1H.|

|

For Serial's 2Q Powerpoint materials, click here.

Recent story: SERIAL SYSTEM to acquire GSH businesses; TECHNICS wins contracts