Rock, who regularly posts in the NextInsight forum, contributed this article to NextInsight

|

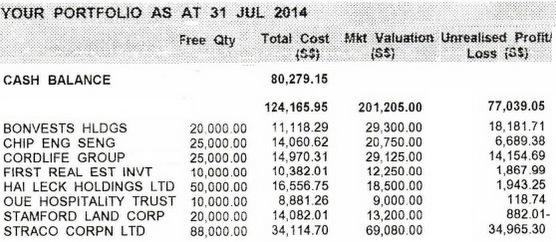

Total Profit Up To 31/7/2013 = $137,380 Total Contribution Till 2012 = $71,400 SRS Account Summary @ 31st July 2014 Profit From 31/7/13 to 31/7/14 = $60,154 Total Contribution Till 2013 = $84,150 |

THE BALANCE in my Supplementary Retirement Scheme (SRS) account, as at 31st July 2014, stood at a very nice $281,684.

In the prior 12 months, my profit was $60,154.

In total, since I started investing in 2007 with my SRS account monies, my total profit has increased to $197,534.

In the 12 months ending July 31 this year, my portfolio performance was a 27.15% gain.

If I exclude my latest cash contribution of $12,750 to the account, my gain actually was 28.8%.

My latest contribution of $12,750 was basically for income tax saving.

For the year, my cash holding was on the high side @ $80,279.

My performance was achieved despite the many volatile periods in the stock market. In the past 12 months or so, there were tapering of QE3, slowing growth in China, geopolitical tensions between Russia and Ukraine, fighting in Syria, Iraq and Gaza Strip and not forgetting Singapore Government property control measures. Extremes: Straco profit +102%, Stamford Land loss - 6%.

Extremes: Straco profit +102%, Stamford Land loss - 6%.

Changes in my SRS portfolio:

Sold off:

Biosensors -- 30,000 shares sold at a loss. Biosensors is facing headwinds in the China market and its profit margin is impacted.

Cambridge Industrial Trust -- 20,000 shares sold as share price increased, and yield reduced.

Reduced:

Cordlife - Reduced from 58,000 shares to 25,000. Cordlife's overseas business expansion needs time to take off. Cordlife is on my radar screen, and when its overseas business starts to contribute to its top- and bottom-lines, then I will increase my holding of this stock.

2nd Chance - Sold off all 45,000 shares. The company has sold off its properties and the future direction of its business is in question.

Increased: Straco was Rock's best-performing stock of the year. Above: Shanghai Ocean Aquarium, belonging to Straco. Photo: InternetStraco - Increased from 48,000 shares to 88,000.

Straco was Rock's best-performing stock of the year. Above: Shanghai Ocean Aquarium, belonging to Straco. Photo: InternetStraco - Increased from 48,000 shares to 88,000.

I have highlighted in the NextInsight forum that Straco is a perpetual dividend raiser stock. From 0.25 cent a share for FY2006, Straco's dividend has increased to 2 cents a share for FY2013.

Another positive fundamental is, its net profit margin is one of the best, at nearly 50%.

Chip Eng Seng - Increased 10,000 shares to 25,000. CES' dividend yield is the highest among second-liner property companies. The future of property market in Singapore will depend on the Government's property control measures.

Bought into:

First Reit - 10,000 shares. First REIT being in health-care business is resilient and its yield of about 7.5% is almost the highest ($200 dividends on the way to me).

Hai Leck Holding -- 50,000 shares. Company is debt-free, offers good yield and supports oil, gas and chemical industries.

For the year, Straco was my best performing stock.

Previous story: ROCK: How I made $137,380 with $71,400 in my SRS account