Yangzijiang became the first PRC shipyard to secure a 10k TEU containership vessel (above) in 2011. It is now ready to take orders for 14k and 16k TEU vessels. Company photo

Yangzijiang became the first PRC shipyard to secure a 10k TEU containership vessel (above) in 2011. It is now ready to take orders for 14k and 16k TEU vessels. Company photoYANGZIJIANG SHIPBUILDING is redirecting resources from its non-shipbuilding businesses to defend its position in the shipbuilding industry.

Yangzijiang executive chairman Ren Yuanlin. NextInsight file photoAt a media briefing yesterday (Wednesday), Yangzijiang executive chairman Ren Yuanlin said that the Group will focus on its core strengths as a shipbuilder to ensure that it remains on the white list of enterprises receiving government support for the industry.

Yangzijiang executive chairman Ren Yuanlin. NextInsight file photoAt a media briefing yesterday (Wednesday), Yangzijiang executive chairman Ren Yuanlin said that the Group will focus on its core strengths as a shipbuilder to ensure that it remains on the white list of enterprises receiving government support for the industry.On 15 July, it announced that it had divested its entire 50% stake in Wujiang Jingke Real Estate Development Co Ltd for Rmb 200 million.

The Group intends to gradually reduce its investments in non-core businesses.

Yangzijiang's change in corporate direction was triggered by a recent development in China's policy to revive its shipbuilding industry, which is struggling with overcapacity.

Last year, China’s Ministry of Industry and Information Technology said that shipbuilding enterprises that comply with the standards set out by the government will be put on a white list for favorable policy support, such as bank credit and export rebates.

Those that fail to make the white list will face difficulty in obtaining bank financing.

"The white list standards are highly exacting, mirroring practices found in South Korean and Japanese shipyards," said Mr Ren.

Mr Ren expects the PRC shipbuilding industry to be left with only about 300 yards after the consolidation, from about 1,600 last year.

“Making it into the white list is even more difficult than receiving accreditation as a High/New Technology Enterprise,” he said.

The white list of top shipyards will be announced at the end of the year.

Government accreditation makes a big difference in the PRC shipbuilding industry.

Yangzijiang’s wholly-owned subsidiary, Jiangsu New Yangzi Shipbuilding Co Ltd, qualifies for a preferential tax rate of 15% as a High/New Technology Enterprise, compared to a standard rate of 25%.

On Wednesday, the Group posted a surge of 54% year-on-year in 2QFY2014 profit after tax to reach Rmb 1.2 billion, even though revenue had slipped by 3% to Rmb 4.3 billion.

The surge in net profit was largely due to tax refund arising from its High/New Technology Enterprise accreditation.

In FY2013, Jiangsu New Yangzi Shipbuilding had paid the standard 25% tax rate.

After renewal of the accreditation, it received a one-off tax refund amounting to a whopping Rmb 349 million, which amounted to some 28% of net profit.

As China's largest private shipbuilder with a strong financial position, Yangzijiang stands a high chance of making the white list.

Year-to-date, the Group has won the most new orders among PRC yards.

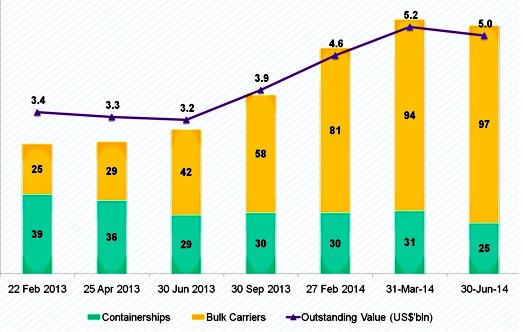

As at 30 June 2014, its outstanding order book amounted to US$5 billion for 122 vessels. It also held cash reserves of Rmb 2.6 billion.

It is also hard at work in improving its technological capability.

In 2011, Yangzijiang scored a first by being the first PRC yard to secure an order for the 10k TEU containership, breaking into a former stronghold of Korean shipyards.

It recently completed the design prototype and testing for 3 new products - the 84k cubic meter LPG vessel, as well as for 14k and 16k TEU containerships.

Yangzijiang has had strong orderbook momentum even though the industry has been struggling with a vessel supply glut.

Yangzijiang has had strong orderbook momentum even though the industry has been struggling with a vessel supply glut.Recent story: YANGZIJIANG, SINGAPORE AIRLINES, SMRT: What Analysts Now Say