Page 1 of 2

After Friday's results briefing: Roxy-Pacific executive chairman Teo Hong Lim (2nd from right) and CFO Koh Seng Geok (in maroon tie) chat with analysts and investors.

After Friday's results briefing: Roxy-Pacific executive chairman Teo Hong Lim (2nd from right) and CFO Koh Seng Geok (in maroon tie) chat with analysts and investors.Photo by Leong Chan Teik

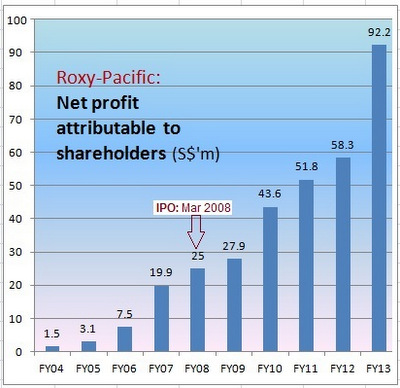

FY13 was a record year -- Roxy-Pacific's 9th. OF LATE, Chip Eng Seng Corp has been enthusiastically discussed in online forums as a stock to buy and to watch out for because the company is set to report bumper earnings this year.

FY13 was a record year -- Roxy-Pacific's 9th. OF LATE, Chip Eng Seng Corp has been enthusiastically discussed in online forums as a stock to buy and to watch out for because the company is set to report bumper earnings this year.Forumers could do well to delve into another stock, Roxy-Pacific Holdings, which is on track to report bumper earnings -- its 10th consecutive year of record profit.

Its recently-released 2Q profit was S$22.8 million on revenue of S$102.6 million. A dividend of 0.616 cent a share was declared which is unchanged from last year's interim dividend if one factors in the 1-for-4 bonus share issue that took place in Sept 2013.

The boutique property developer-cum-hotel-owner has piled up S$37.7 million in net profit in 1H this year.

Going forward, Roxy-Pacific has S$955.4 million in revenue to book till FY17 from the pre-sale of its property projects.

Revenue from the pre-sale of residential units will be recognised according to progress of construction while non-residential projects will be recognised only upon completion.

In the 2H of this year, on top of progessive billings, Roxy-Pacific is expected to book revenue from two projects at one go:

>> S$141.4 million from its 100% sold Centropod@Changi commercial project and

>> S$148.8 million from its joint venture's sale of 93% of the space in investment property No.8, Russell Street, Causeway Bay, Hong Kong.

The HK investment, done in late 2013, was among the early forays into overseas markets by Roxy-Pacific.

Chairman and CEO Teo Hong Lim shared insights into his company's overseas experiences in a Q&A session with analysts and investors last Friday.

One of these was the acquisition, completed in July 2014, of No. 59, Goulburn Street in Sydney for AUD90.2 million, Roxy-Pacific's maiden venture in Australia.

(See video below for more info on the building features, location and investment merits.)

Q: Will you hold the Goulburn Street building solely for investment income?

Teo Hong Lim (executive chairman & CEO): Overseas, one of our objectives was to do development projects in Sydney and Melbourne. It's not difficult to buy a building in Melbourne as there are many for sale. We looked at the market and found a lot of projects coming up, especially apartments. We decided to focus more on Sydney's CBD instead.

In Australia, many property players are property funds. All these years, development was not in play and funding was difficult to get. So a lot property funds locked in buildings with 10-year or 10+5+5 tenancies.

In Sydney, there are not many buildings which you can get vacant for development. Goulburn was a unique property -- it has tenancy of over three years and enables us to get a net yield over funding costs.

In three years, the tenancy for one of the major tenants will mature. It's a government tenant taking up more than half of the building space, from the 14th to 26th floor.

Our idea is to move in and do alteration to the building --- add more floors. The plot ratio is 10-11X but if you convert it to a hotel or residential building, you can go up to 15X. Indirectly, we have bought a landbank.

We bought this building at below AUD5,000 psm (or SGD500 psf) of built-up gross area. It's below replacement cost.

There are buildings nearby that were sold recently at AUD8000-9000 psm. Some were bought by funds which want to lock in the higher rental yield of those buildings.

Q: What is the net rental yield and if you get approval to increase the plot ratio, do you have to pay charges?

Teo Hong Lim: The charges are not as high as in Singapore, so that's not material compared to the whole project cost. If it's an office building or part residential or hotel, we have the view that if we can increase the space by 50%, your cost psm will drop.

Our building is 90% rented. Our net income will be AUD6.5 million a year with some upside if we can rent out the vacant space.

Q: What is the tax rate you will be paying?

Koh Seng Geok (Chief Financial Officer): It's 30%.