Lian Beng's 55%-owned industrial property development, M-Space, helped boost FY2014 revenue.

Lian Beng's 55%-owned industrial property development, M-Space, helped boost FY2014 revenue.

OSK-DMG has maintained its ‘Buy’ call on Lian Beng Group after the leading construction player upped its FY2014 dividend per share by 80% year-on-year to 2.25 cents.

Analyst Sarah Wong had a target price of S$1.17 on Lian Beng in her report issued on 24 July after the company released its FY2014 results.

This translates into upside of some 61% compared to its recent stock price of 72.5 cents.

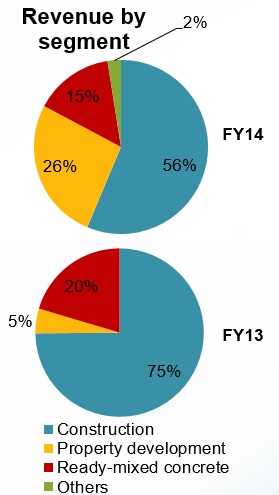

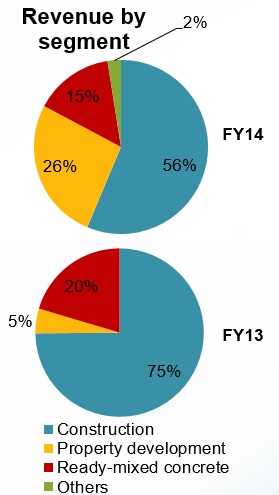

Lian Beng’s FY2014 revenue was up 49% year-on-year at S$753.9 million, thanks to across-the-board growth.

Executive chairman Ong Pang Aik. NextInsight file photoGroup revenue was boosted by the following:

Executive chairman Ong Pang Aik. NextInsight file photoGroup revenue was boosted by the following:

> Construction revenue rose 13% to S$424.7 million.

> Ready-mix concrete revenue rose 7% to S$111.0 million on increased production capacity.

> Property development revenue rose 745% to S$199.5 million on recognition of its fully-sold 55%-owned industrial property development, M-Space, as well as sales from property development projects The Midtown and Midtown Residences, Spottiswoode Suites and Lincoln Suites.

Profit before tax was up 43% at S$141.5 million, while net profit attributable to shareholders was up 19% at S$87.1 million.

During 4QFY2014, the Group changed its accounting policy for investment properties from the cost method to the fair value model to align with industry practice.

Executive director Ong Lay Koon.

Executive director Ong Lay Koon.

NextInsight file photoDisregarding fair value gains, FY2014 Group profit before tax would have improved 117.7% instead.

As at 31 May, cash and cash equivalents were S$176.7 million while order book was S$1.2 billion.

Update

In May, the Group entered into an agreement to acquire, through a 32%-owned consortium, 92.8% of the aggregate strata area of Prudential Tower which can provide attractive rental returns and potential gains from subsequent strata sale.

In June, it completed the acquisition, through an 80%-owned subsidiary, of a property along Leng Kee Road.

The Group’s new asphalt plant is likely to be completed by the end of this year.

At Lian Beng Group’s results briefing last week, executive chairman Ong Pang Aik and executive director Ong Lay Koon fielded questions from investment professionals. Here is a summary of the Q&A session:

Lian Beng's property development was boosted by the completion and recognition of industrial development, M-Space.Q: Why did you terminate the Cambodia project to develop real estate?

Lian Beng's property development was boosted by the completion and recognition of industrial development, M-Space.Q: Why did you terminate the Cambodia project to develop real estate?

There were problems in getting the title deeds.

Q: What is next year’s outlook for your property development segment?

The property revenue contribution for FY2014 came from projects that are already completed.

Midtown and Spottiswoode have been recognized partially, and revenue recognition will continue into FY2016.

We only start recognizing property development revenue after construction commences.

Q: What is the progress of your granite quarry production?

There is some production now. We are shipping in new machinery and expect to ramp up production to 3 million tons a year at the end of October.

Q: Will we continue to see fair value adjustment next year?

We only adjusted the value of the Mandai project because it generates recurring revenue and has been classified as investment income. If the income goes up this year, we will readjust the project value.

Recent story: LIAN BENG To Gain $23.3 M; HANKORE Stock Price Implies No CEI Deal

Lian Beng's 55%-owned industrial property development, M-Space, helped boost FY2014 revenue.

Lian Beng's 55%-owned industrial property development, M-Space, helped boost FY2014 revenue. Executive chairman Ong Pang Aik. NextInsight file photoGroup revenue was boosted by the following:

Executive chairman Ong Pang Aik. NextInsight file photoGroup revenue was boosted by the following: Executive director Ong Lay Koon.

Executive director Ong Lay Koon. Lian Beng's property development was boosted by the completion and recognition of industrial development, M-Space.Q: Why did you terminate the Cambodia project to develop real estate?

Lian Beng's property development was boosted by the completion and recognition of industrial development, M-Space.Q: Why did you terminate the Cambodia project to develop real estate? NextInsight

a hub for serious investors

NextInsight

a hub for serious investors