DBS Vickers: "Hi-P could stage a spectacular turnaround in 2H"

Analyst: Tan Ai Teng

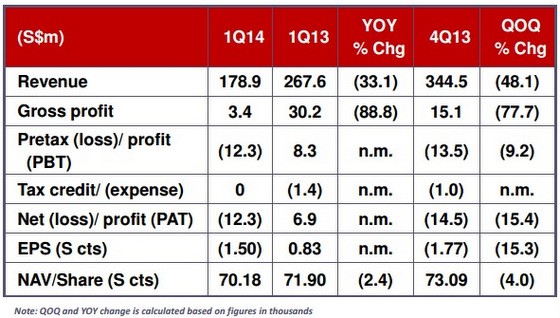

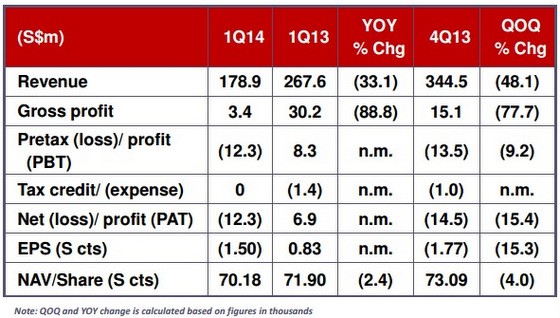

Hi-P is 61% owned by founder and chairman Yao Hsiao Tung. NextInsight file photoHi-P - poised for strong uplift in 2H, good to monitor for short term trade. Taking cue from management’s guidance for a more profitable 2014 than 2013 despite estimated losses of some S$18-20m in 1H14, we believe Hi-P will stage a spectacular turnaround in the second half.

Hi-P is 61% owned by founder and chairman Yao Hsiao Tung. NextInsight file photoHi-P - poised for strong uplift in 2H, good to monitor for short term trade. Taking cue from management’s guidance for a more profitable 2014 than 2013 despite estimated losses of some S$18-20m in 1H14, we believe Hi-P will stage a spectacular turnaround in the second half. Our industry checks indicated healthy orders across the board from a major China mobile phone OEM to consumer electronics and even market share gains from HDD customers.

We sensed that the company will benefit from the typical strength in the seasonally stronger 2H.

However, profitability in the last two quarters of the year would depend very much on production yield. Hi-P may still be ironing out efficiency issues in the early stages of ramp up in July but management is hopeful of improving yields.

We believe efficiency levels would remain stable, leading to even stronger operating results in 4Q14, especially if Hi-P can gain and cope with higher allocation from customers.

Hi-P’s operating environment is cyclical. Nimble investors can keep this stock on the radar for near term trade post release of 2Q results when the company can share some visibility into 2H.

Hi-P currently trades at 0.8x P/BV, the low end of its 4-year trading range of 0.72x to 1.9x P/BV, with historical mean at 1.1x P/BV.

Note: Hi-P will release its 2Q financial results via SGXNET before the opening of trading on 5 August 2014.

Previous story: HI-P: Posts 2Q2013 net profit of S$10.9m

Hi-P currently trades at 0.8x P/BV, the low end of its 4-year trading range of 0.72x to 1.9x P/BV, with historical mean at 1.1x P/BV.

Note: Hi-P will release its 2Q financial results via SGXNET before the opening of trading on 5 August 2014.

Previous story: HI-P: Posts 2Q2013 net profit of S$10.9m