Analyst: Paul Yong, CFA

|

|

DBS Research View

Sources: Company, DBS Bank, Bloomberg Finance L.P If successfully completed (this is the second attempt to buy Jiurui Expressway), this would be a good acquisition for the company as it would:

Sources: Company, DBS Bank, Bloomberg Finance L.P If successfully completed (this is the second attempt to buy Jiurui Expressway), this would be a good acquisition for the company as it would:1) expand and diversify the Group's business,

2) lengthen the average remaining concession of the Group's roads from 12.7 years to 15.3 years,

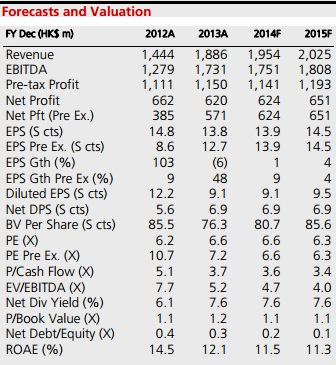

3) potentially help improve the Group's share trading liquidity, given most of the consideration is via share issuance (furthermore at a premium to current trading price), and 4) improve the Group's long-term earnings’ growth (although there could be some EPS dilution in FY14 and FY15).

Share dilution from this transaction assuming RCPS and convertible bonds are all fully converted is c.11%.

Jiurui Expressway incurred losses in 2013 (net loss before tax, MI and exceptional items of HK$27.8m) due to high interest costs but CMH (Pacific) should be able to restructure Jiurui's existing loans, and coupled with traffic growth in 2014, turn it around. Hence, we believe Jiurui should start contributing positively to the Group's bottom line from 2015 onwards.

No changes to our estimates, recommendation and TP for now. We will update our numbers and TP when this deal is completed. Maintain BUY and S$1.32 TP.