Excerpts from analysts' reports

Maybank Kim Eng says of Nam Cheong: "Optimism reinforced; reiterate BUY"

Maybank Kim Eng says of Nam Cheong: "Optimism reinforced; reiterate BUY"

|

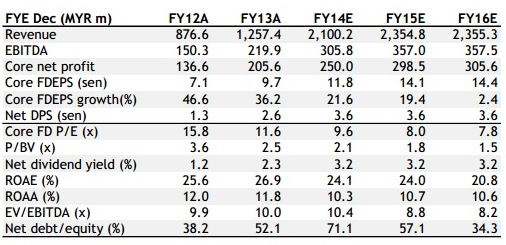

§ EPS raised by 23-26% over FY15E-16E on positive vessel sales and contract win outlook. |

What’s New

We raise FY14E/15E/16E EPS estimates by 1%/23%/26% to reflect our increasingly positive view on the contract win outlook for Nam Cheong.

We see a high chance of Perdana Petroleum exercising its options for two additional build-to-order (BTO) accommodation work barges (AWBs), bringing total orders to four units worth USD168m. We also expect the 2016 building programme to consist of at least 30 vessels worth USD585m vs our previous conservative assumption of 26 vessels worth USD515m.

We see a high chance of Perdana Petroleum exercising its options for two additional build-to-order (BTO) accommodation work barges (AWBs), bringing total orders to four units worth USD168m. We also expect the 2016 building programme to consist of at least 30 vessels worth USD585m vs our previous conservative assumption of 26 vessels worth USD515m.

What’s Our View

Nam Cheong should benefit disproportionately from a recovering OSV market, due to an added support from the Malaysian OSV operators, which are profiting from Petronas’s spending push.

In our recent conversation, management continues to exude confidence in vessel sales for the next two years, reinforcing our positive view. We believe that it would maintain its track record of selling all its build-to-stock vessels before delivery.

In our recent conversation, management continues to exude confidence in vessel sales for the next two years, reinforcing our positive view. We believe that it would maintain its track record of selling all its build-to-stock vessels before delivery.

Other than the option for two additional AWBs from Perdana Petroleum, we have not factored in any future BTO contracts, suggesting room for earnings upside.

Our TP is raised to SGD0.55 after ascribing a higher FY15E P/BV of 2.2x (previously 1.9x). In our view, a higher multiple is warranted given its better ROE profile (20% assumed sustainable ROE vs. 17% previously) post our earnings upgrades.

Reiterate BUY.

Reiterate BUY.

Recent story: Higher target prices for CWT and NAM CHEONG