Excerpts from analysts' reports

DBS Vickers upgrades Super Group from hold to buy, target S$ 1.68 (Prev S$ 1.63)

Analyst: Alfie YEO

• Valuation is compelling at -1SD of 2-year mean PE (or <20x PE), cheaper than peers • New strategy next year: launch new products to target new consumer segments • Low downside risk: conservative, below-consensus estimates • Upgrade to BUY with S$1.68 |

New strategy to ensure sustainability. We hosted Super’s management team at the DBSV Pulse of Asia Conference in Singapore this month, which drew keen interest from long funds.

New strategy to ensure sustainability. We hosted Super’s management team at the DBSV Pulse of Asia Conference in Singapore this month, which drew keen interest from long funds.

We acknowledge that there are near term headwinds as evidenced by its recent operating results, but Super is strengthening its business model to build up its brand, create new product lines, and capture new markets for the longer term.

It will launch new products to target new market segments next year to gain first-mover advantage, enlarge its addressable market, and sustain margins over the middle to long term.

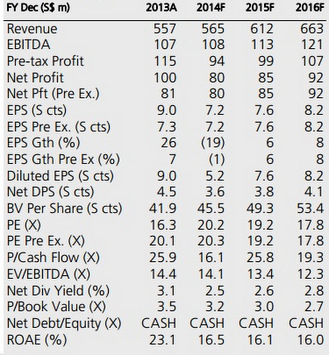

Compelling valuation, low downside risk. Valuation, in our view, looks attractive and is below average at -1SD of its 2-year mean PE.

David Teo, chairman of Super Group.

David Teo, chairman of Super Group.

NextInsight file photoOur FY15/16F earnings forecasts are below consensus, reflecting our conservative upside and TP.

The recent muted earnings growth outlook has been factored into consensus earnings and the current share price, in our opinion. Super is also trading below regional peers’ average valuation (at c.26x/24x FY14/15F).

Upgrade to BUY, TP S$1.68. At <20x FY15F PE, valuation looks attractive and downside risk seems low from our perspective.

Our TP is pegged to 22x FY15F PE, after rolling forward our valuation base to FY15F.

See also: @ Food Empire's AGM: Updates on greenfield projects and more....