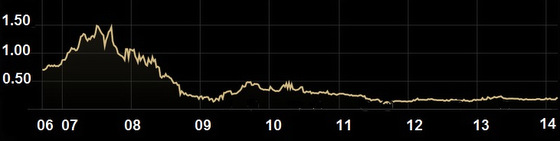

Stock chart of Best World reflects its decline in profitability. In its heyday in 2007, Best World made S$13.5 million net profit. In 2013: S$1.4m.

Stock chart of Best World reflects its decline in profitability. In its heyday in 2007, Best World made S$13.5 million net profit. In 2013: S$1.4m.

Chart: Morningstar.com

The best days of Best World International happened a long time ago -- in 2007, when the stock price traded as high as $1.50 and counted names like Asdew Acquisitions and Gay Chee Cheong among its top 20 shareholders.  Billionaire Sam Goi.

Billionaire Sam Goi.

File photo.If there is any good news of late, it is the emergence of Sam Goi among the top 20 shareholders, as disclosed in the recently-released 2013 annual report of the company which is a direct seller of premium skincare, wellness products, etc.

The tycoon was ranked No.14 with 2.536 million shares.

It's a relatively small stake for him, as it amounts to about S$482,000 in value based on the recent price of 19 cents a share.

His emergence as a stakeholder broadly coincides with Best World's moves, first announced in Aug 2013, to acquire 100% of Zhejiang SolidGold Pharmaceutical, a GMP-certified manufacturer of dietary supplements in China.

Zhejiang SolidGold holds 36 dietary supplement licences, and has a retail distribution network of 153 agents and distributors throughout 31 provinces in the PRC.

It achieved RMB 33.4 million in revenue and RMB 2.3 million in net profit after tax in FY2013, net of expenses for fulfilling the conditions precedents of the acquisition exercise.

With the acquisition, Best World is one step closer to becoming a licensed direct selling company in the PRC's multi-billion dollar industry and one of the world’s largest direct selling markets.

Best World, which paid RM35 million cash for the acquisition, said a direct selling licence could take between 24 months and 36 months to attain.

As part of the agreement, Shi Jinyu, the MD and owner of a 81.71% stake in Zhejiang SolidGold, subscribed for new Best World shares at 19.9 cents apiece.

L-R: Best World Co-chairman and CEO Dora Hoan and Co-chairman Doreen Tan.

L-R: Best World Co-chairman and CEO Dora Hoan and Co-chairman Doreen Tan. Photo: annual report.He thus appears in the No.2 position on Best World's shareholder list with 15,500,717 shares, or a 7.04% stake.

All told, Mr Shi pocketed net cash of S$2.6 million -- ie, S$5.7 million consideration received as vendor of Zhejiang SolidGold minus his S$3.08 million purchase of Best World shares.

In addition, he is entitled to performance bonus amounting to the net profit of Zhejiang SolidGold in 2014 and 2015, subject to certain conditions.

A rationale for this unusual bonus was given by Best World: "SJY will be utilising his extensive experience, in-depth industry knowledge and established network in the dietary supplements industry in the PRC to assist the Company to obtain the relevant healthcare product manufacturing permits and other permits and licences which are not only necessary for the business of SolidGold, but are also essential for the application for a direct selling licence in the PRC."

Best World's No.1 shareholder remains D2 Investment, which holds 75.47 million shares, and is a 50-50 vehicle of co-founders Dora Hoan and Doreen Tan.

On top of that, both individuals own 12.352 m shares in their own names. In aggregate, they own 45.5% of Best World.

The company currently has a market cap of S$42 million, and held $25.8 million in net cash as at end-1Q2014.

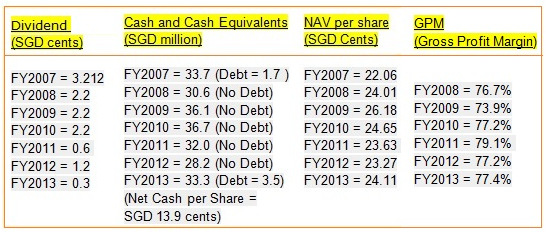

Best World metrics compiled by Boon @ Valuebuddies.com

Best World metrics compiled by Boon @ Valuebuddies.comFor details of the Zhejiang SolidGold transaction, see Best World's announcement here.

Previous story: BEST WORLD INT'L and its 3-year Myanmar connection