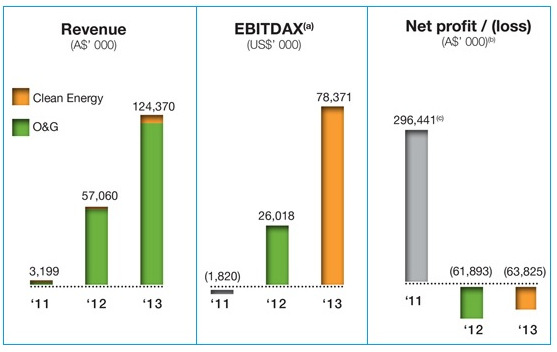

It had suffered net loss of AUD 63.8m in FY2013 (ended June). In its most recent quarter, 3QFY14, it reported a loss of AUD 43.2 million.

This bumps up its 9MFY14 loss to AUD 158.1 million.

As a result, its Net Asset Value shrank from AUD 85.64 cents to AUD 57.48 cents a share.

Shareholder Sebastian Chong, in a post in April at www.shareowl.com, said: "Now holding only a small no. of shares. Looks like this is a high risk high return stock. Because Linc's exploration and production expenditures are so high, the NAV goes down quickly each year. If this kind of loss continues for another 2.5 years, the NAV will be zero."

Linc Energy is an exploration and production company working hard to find oil, coal and gas in far-flung places around the globe, such as Alaska and Wyoming.

(a) EBITDAX is an important supplemental measure of Linc Energy's performance that is frequently used to evaluate companies in its industry. It represents net income before net interest expense, income tax expense, depreciation, depletion and amortisation, dry hole expense and unrealised commodity loss (gain). The EBITAX only relates to Linc Energy's

(a) EBITDAX is an important supplemental measure of Linc Energy's performance that is frequently used to evaluate companies in its industry. It represents net income before net interest expense, income tax expense, depreciation, depletion and amortisation, dry hole expense and unrealised commodity loss (gain). The EBITAX only relates to Linc Energy'sUS oil & gas business.

Earnings of such companies are most challenging to forecast with any reasonable accuracy for most investors -- and it's hard for most investors to say what should be its fair value.

Even 'expert' analysts have widely differing takes on the future success of Linc Energy's efforts: In January, JP Morgan had a target price of S$1.45 while Credit Suisse, S$2.14

(Note that JP Morgan and Credit Suisse were joint sponsors of the IPO.)

Given Linc Energy's continued losses, it's not surprising that its stock price performance has been weak: It recently traded at S$1.24 compared to a high of S$1.585 in Dec 2013.

Interestingly, another 'expert' has decided that Linc Energy is worth investing in at current levels.

The 'expert' is Genting Strategic Investments (Singapore) Pte Ltd which, on 14 May, bought 5,788,000 shares on the open market at S$1.264 apiece.

With that, Genting Strategic raised its stake in the company to 14.01%.

Only in December 2013 had Genting Strategic made its initial purchase by subscribing for 50.715 million shares, or an 8.88% stake, in the IPO of Linc Energy at S$1.20 each.

Genting Strategic, the 100% investment arm of KL-listed Genting Berhad, has been involved in oil and gas exploration and production through Genting Oil & Gas since 1996.

Linc Energy's powerpoint presentation can be read here.

Recent story: OKP's net cash at $42 m, LINC ENERGY explains directors' share sales