Excerpts from CIMB's report

Analysts: Donald Chua (left) & Tan Xuan

Analysts: Donald Chua (left) & Tan Xuan

With developers trading at historically steep discounts, high-end market void of buyers and potential extension charges on unsold developments, we asked ourselves what will happen if this continues.

We come to two conclusions: 1) more reasons for privatisation of small-mid cap developers and 2) further weakness for high-end residential properties.

We remain Neutral on the sector, with Ho Bee as our top pick among small-mid cap developers.

Analysts: Donald Chua (left) & Tan Xuan

Analysts: Donald Chua (left) & Tan XuanWith developers trading at historically steep discounts, high-end market void of buyers and potential extension charges on unsold developments, we asked ourselves what will happen if this continues.

We come to two conclusions: 1) more reasons for privatisation of small-mid cap developers and 2) further weakness for high-end residential properties.

We remain Neutral on the sector, with Ho Bee as our top pick among small-mid cap developers.

Trends we observe

Weak volume for upscale residential properties and cheap valuations for property stocks are perhaps not surprises.

What might have been overlooked is the potential extension premium payable on unsold units. We expect extension charges to make a significant impact after 2016, with Wingtai, Wheelock and Guocoland most affected.

Under the worst-case scenario of units remaining unsold and no exemption given, the payment could amount to 10-70% of trailing 12-month earnings and operating cashflow in 2016-17.

What might have been overlooked is the potential extension premium payable on unsold units. We expect extension charges to make a significant impact after 2016, with Wingtai, Wheelock and Guocoland most affected.

Under the worst-case scenario of units remaining unsold and no exemption given, the payment could amount to 10-70% of trailing 12-month earnings and operating cashflow in 2016-17.

Small-mid cap developers to be taken private?

Including the most recent general offer of SingLand, we counted nine privatisations/partial offers within the property space in the past four years, with offer prices offering >20% upside on average.

We explore potential privatisation candidates in this note.

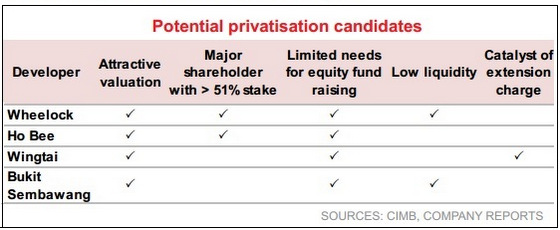

In ascending order, we believe Wheelock, Ho Bee, Wingtai and Bukit Sembawang could be next in line, each for different reasons - cheap valuation, presence of a major shareholder, low liquidity, limited need for equity raising and the catalyst of extension charge.

Singapore developers are currently trading at an average FY14 P/BV of 0.75x and 34% discount to our RNAV estimates, cheap in our view.

Aside from valuations, we believe developers have less need to tap the equity market for funds given their healthy balance sheets and FY14 net gearing averaging 24%.

The avoidance of extension charge can be a catalyst for privatisation in the case of Wingtai, albeit not as strong as compared to SC Global.

We explore potential privatisation candidates in this note.

"Ho Bee is our top pick within the small-mid cap developer space and its book is undervalued in our opinion, largely on the basis that Metropolis’s (above) book value of S$1,151 psf NLA (net lettable area) is conservative relative to our estimation of S$1,550 psf NLA (based on 4.2% cap rate and recent office transactions). While its unsold Sentosa developments remain a drag on earnings and share price, they are not subjected to QC and are currently being rented out." --- CIMB |

Singapore developers are currently trading at an average FY14 P/BV of 0.75x and 34% discount to our RNAV estimates, cheap in our view.

Aside from valuations, we believe developers have less need to tap the equity market for funds given their healthy balance sheets and FY14 net gearing averaging 24%.

The avoidance of extension charge can be a catalyst for privatisation in the case of Wingtai, albeit not as strong as compared to SC Global.

Further weakness within high-end properties

Given supply concerns and policy curbs, we expect a buyers’ market with little pricing power for the developers in 2014-16.

We have forecast a 10-15% drop in property prices in the next two years but expect high-end developments to be affected by a greater degree with looming extension charges and higher price sensitivity within upgraders.

We have forecast a 10-15% drop in property prices in the next two years but expect high-end developments to be affected by a greater degree with looming extension charges and higher price sensitivity within upgraders.