Excerpts from analysts' reports

OSK-DMG initiates coverage of HanKore with 16.1-c target

Analysts: Sarah Wong & Terence Wong, CFA A visit to Hankore by Singapore analysts in Dec 2013 has led to 2 initiation reports -- by OSK-DMG and UOB KH. File photo

A visit to Hankore by Singapore analysts in Dec 2013 has led to 2 initiation reports -- by OSK-DMG and UOB KH. File photo

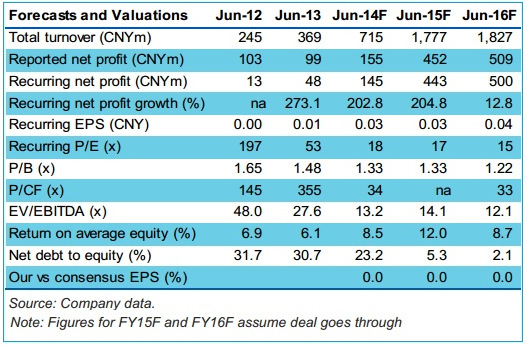

In a game-changing deal, HanKore is set to acquire all of China Everbright International Ltd’s water assets. Assuming the acquisition takes place successfully, we expect a 21% fully diluted EPS CAGR in earnings until FY16. Trading at 17x FY15F P/E, HanKore is undervalued against a peer average of 30x. We initiate coverage with a BUY, based on 25x FY15F earnings.

Game-changing catalyst. In a reverse takeover (RTO) deal, HanKore will acquire all water assets of HK-listed China Everbright International Ltd (CEI), which turns the former into CEI’s subsidiary. With an SOE backing, it now possesses a strong differentiator in parentage.

Strong surge in recurrent waste water treatment income from organic/inorganic capacity expansion and tariff rate hikes. We expect a strong, systematic ramp-up of running capacity on organic plants to 1.14m tonnes/day by 2QFY16 from the existing 590,000 tonnes/day, as well as a lift in tariff rates on completion of HanKore’s upgrading and plant expansion initiatives. In addition, contribution from CEI’s portfolio of 1.84m tonnes/day capacity will greatly boost revenues from FY15F onwards. Water treatment revenues will hit CNY258m in FY14F and CNY1.1bn in FY15F, significantly up from FY13’s CNY201m.

Newly-acquired EPC business to drive the company forward. Recently acquired EPC arm Jiangsu Tongyong Environment Group (JTEG) will allow HanKore to recognise CNY456m in revenue in FY14F – a sharp 170.5% spike from FY13F’s CNY168.6m – and on higher gross margins of around 25% vs 9.1% previously. HanKore’s pipeline of expansion plans, valued at CNY1.5bn, should further boost JTEG’s EPC orderbook, as well as its own revenue and earnings visibility.

Undervalued and an under-covered gem; initiate coverage with a BUY and SGD0.161 TP. Trading at 17x FY15F EPS, HanKore is undervalued against a peer average of 30x. We believe its strong growth profile and the top-tier SOE parentage backing does not warrant such a low valuation. We initiate coverage with a BUY and SGD0.161 TP pegged at 25x FY15F EPS.

Key risks and future catalysts. Risks include lumpy recognition from its EPC arm, while future catalysts include potential M&As of transfer-operate-transfer (TOT) projects as well as tariff rate hikes.

Recent story: HANKORE (buy), SUNTEC REIT (sell): What analysts now say

Stock Price

AEM Holdings (AWX) 1.840 -0.020 (-1.08%) Best World (CGN) 2.480 0.000 (0.00%) Boustead Singapore (F9D) 0.950 -0.005 (-0.52%) Broadway Ind (B69) 0.145 0.005 (3.57%) China Aviation Oil (S) (G92) 0.865 -0.005 (-0.57%) China Sunsine (QES) 0.390 -0.005 (-1.27%) ComfortDelGro (C52) 1.390 -0.010 (-0.71%) Delfi Limited (P34) 0.875 0.000 (0.00%) Food Empire (F03) 1.120 -0.010 (-0.88%) Fortress Minerals (OAJ) 0.310 0.000 (0.00%) Geo Energy Res (RE4) 0.300 0.005 (1.69%) Hong Leong Finance (S41) 2.420 -0.010 (-0.41%) Hongkong Land (USD) (H78) 3.420 0.010 (0.29%) InnoTek (M14) 0.505 0.000 (0.00%) ISDN Holdings (I07) 0.300 -0.005 (-1.64%) ISOTeam (5WF) 0.047 0.000 (0.00%) IX Biopharma (42C) 0.039 -0.004 (-9.30%) KSH Holdings (ER0) 0.245 0.000 (0.00%) Leader Env (LS9) 0.049 0.000 (0.00%) Ley Choon (Q0X) 0.055 -0.001 (-1.79%) Marco Polo Marine (5LY) 0.068 -0.003 (-4.23%) Mermaid Maritime (DU4) 0.135 0.002 (1.50%) Nordic Group (MR7) 0.305 0.000 (0.00%) Oxley Holdings (5UX) 0.090 0.001 (1.12%) REX International (5WH) 0.124 0.000 (0.00%) Riverstone (AP4) 0.930 0.005 (0.54%) Southern Alliance Mining (QNS) 0.480 0.000 (0.00%) Straco Corp. (S85) 0.490 0.000 (0.00%) Sunpower Group (5GD) 0.230 0.000 (0.00%) The Trendlines (42T) 0.063 0.000 (0.00%) Totm Technologies (42F) 0.019 -0.002 (-9.52%) Uni-Asia Group (CHJ) 0.810 -0.035 (-4.14%) Wilmar Intl (F34) 3.160 0.000 (0.00%) Yangzijiang Shipbldg (BS6) 1.750 -0.020 (-1.13%)