Main reference: Story in Sinafinance

A SEASONED INVESTOR with 22 years experience playing the A-share markets is worth lending an ear to when he offers to share some of his core investment strategies.

What makes his take different is that he wears the label “speculator” with pride.

Considered among China’s top ten most influential A-share investors, Hua Rong boastfully defines himself less as an investor and more as a share speculator.

Speculative trader Hua Rong. Photo: stcnHe began dealing in A-shares in 1991, which gives him a full 22 years of market experience.

Speculative trader Hua Rong. Photo: stcnHe began dealing in A-shares in 1991, which gives him a full 22 years of market experience.

During this nearly quarter century of investing, he’s lived to tell about five full-blown bull-bear cycles in his capacity over the period as – at different times – a securities trader, trust fund manager and private equity facilitator.

All along, he has been a frequent contributor to the financial pages of broadsheets, and with the birth of the Internet in the mid-90s, he has been a regular presence on share-trading enthusiast blogs.

That makes him the perfect guide to lead us through what it was like to rely so heavily on buying, holding and selling shares for one’s livelihood these past two-plus decades.

He shared with Sinafinance some of his key market strategies.

First of all, he is often quick to point out that he is a proud share speculator and has never considered it a dirty word.

“Speculative trading is just another type of investment opportunity. If there’ no opportunity, I won’t be speculating,” he said.

China's real estate stocks have made, and lost, fortunes for many PRC investors. Photo: CentalineHe’s always felt that a long-term share investing outlook in China, especially so-called “value investing,” is a high-risk, low-return strategy.

China's real estate stocks have made, and lost, fortunes for many PRC investors. Photo: CentalineHe’s always felt that a long-term share investing outlook in China, especially so-called “value investing,” is a high-risk, low-return strategy.

“Companies all have their own growth cycles and even longevity. No stock can forever rise, nor can it forever fall.

“Too many investors make the mistake of obsessing over beating the near-term moving average, and trying to hitch their wagon of fortunes to a particular counter or two.”

But Hua said loyalty to a specific listco was a foreign concept to a speculative trader like himself.

“Why should I be loyal to a company in my portfolio? What loyalty have they shown me?

“Holding onto a few ‘favorite’ stocks for a long time out of simple loyalty is a big mistake in my opinion. Instead, you should continuously and flexibly recycle your capital from one firm to another, always targeting those beginning a new up-cycle and dumping them as soon as the rise has run its course.”

Therefore, he said it was counterproductive to offer any insight into particular counters or sectors that brought him the best returns over the years as he was constantly jumping from share to share based on perceived uptrends.

Having endured the five bull/bear cycles in China since 1991, Hua said that he is more or less oblivious to the direction or level of the benchmark Shanghai Composite Index.

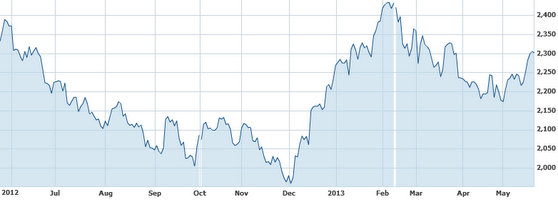

Recent China shares performance. Source: Yahoo Finance

Recent China shares performance. Source: Yahoo Finance

Instead, he targets individual shares that he feels – following sufficient homework on his part – are primed for an upswing.

Whether the broader market is heading up or down doesn’t really concern him, he said, as there are always underappreciated shares in both bull and bear markets.

And his goal, he said, was to begin truly appreciating these counters before others.

He doesn’t mince words when describing his “peer” investors, yet also concedes that his enviable performance since 1991 has sometimes come down to basic blind luck.

“The A-share markets are still immature, no matter what anyone says.

“Most investors are also immature and dare I say rather gullible and ignorant. Thanks to them, I have done quite well for myself in the market.”

At the end of the day, he said exercising due diligence prior to settling on any stock was of paramount importance.

“The most important thing prior to making any move is doing your homework first. If you haven’t done your homework, you have no business sitting down to take the exam.”