Main reference: Story in Securities Times

WHAT SECTORS and themes will be the growth plays down the road in China’s stock market?

A lot of A-share investors are asking this question these days.

“How can we tell the difference between a growth stock and a value stock, and which are better portfolio strategies and bets long term?”

Of course, if anyone truly knew the full answer to this question, he would already be the next Warren Buffett. Comtec Solar CFO Keith Chao replies to investor queries with Chairman and CEO John Zhang to his left. China's solar sector is strongly supported by the new PRC leadership.

Comtec Solar CFO Keith Chao replies to investor queries with Chairman and CEO John Zhang to his left. China's solar sector is strongly supported by the new PRC leadership.

NextInsight file photo

However, the answer – however comprehensive – isn’t necessarily one or the other, or a zero sum game.

Nor is it taking a blind “dartboard” approach to stock picking, or over-diversifying.

In this strategy, there is little upside to the individual investor because the stake held in the surging counter is so insignificant.

Instead, a successful share-buying strategy is more likely to be a healthy and risk-sensitive admixture of the two within a diversified and sustainable portfolio.

However, longer-term thinking investors should start being more bullish on growth or growth potential stocks over value stocks.

The new national government in Beijing has repeatedly stated that steady economic growth was one of its top priorities.

Chinese presidents, premiers and Cabinets are typically given around a decade to leave their mark on history.

Therefore, with Beijing’s strong pro-growth policies, its repeated calls to pursue the “Chinese Dream” including helping bridge the growing economic divide, and outright support for several key industries, growth stocks should be the key component of investors’ portfolios over the next few years.

Thanks to the supportive incubator that Beijing is helping set up, growth stocks are likely to outperform value stocks, cyclical stocks and even blue chips in the years ahead.

Therefore, in many cases, policy will be a better guide and a more reliable driver for share prices than even core financial performance.

One of the most useful offshoots from the Wall Street meltdown in the summer of 2008 was the way in which it revealed in full splendor China’s dangerous overreliance on foreign consumers.

When wallets stopped opening in North America, Europe and Japan, export orders dried up seemingly overnight.

Not only did this reveal a perilous overcapacity situation in Chinese factories, but also left provincial governments saddled with new and crippling debt from pre-Crash overinvestment.

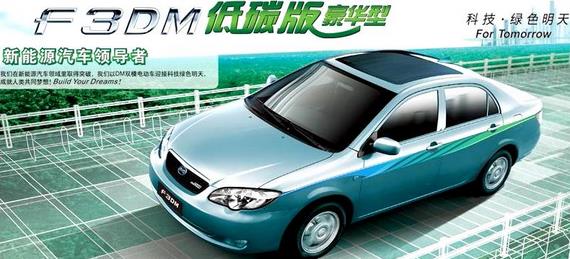

Shenzhen and Hong Kong-listed BYD Auto enjoys strong PRC government support for hybrid vehicle technology. Photo: BYD

Shenzhen and Hong Kong-listed BYD Auto enjoys strong PRC government support for hybrid vehicle technology. Photo: BYD

Therefore, growth stocks that target the 1.3 billion strong consumers within China’s borders are likely to outperform the overall market going forward.

They are not entering this brave new world of domestic sales alone, but enjoy strong and steady support from a central government key to diversify China’s economic growth away from external demand.

Newly emerging industries including renewable energy producers and hybrid vehicles are frequently touted by the new national leadership as the way of the future.

Pollution control systems are also getting vigorous government support.

Also, China’s hugely over-fragmented domestic pharmaceutical industry is a frequent talking point among politicians, many of whom support drastic sector consolidation to make drugmakers leaner and stronger.

Keeping a close eye on policy changes and proposals will be key to successful investing this decade.

Ten years is an eternity as far as markets are concerned, and assuming Beijing continues to favor certain sectors over others, getting in on the ground floor sooner rather than later is a wise move.

See also:

IT Firms Lead China Tech Rally