Main reference: Story in Sinafinance

THERE ARE MORE THAN a few factors which sent China shares soaring end of last week -- and they could continue to provide buoyancy going forward.

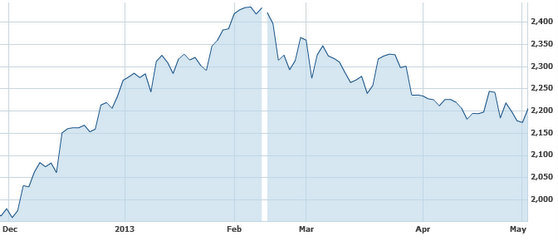

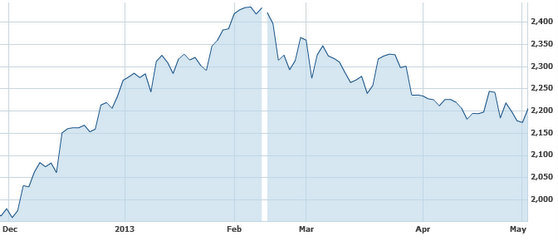

China’s benchmark Shanghai Composite Index was up 2.2% in Friday morning trade, finishing the over 1.4% higher to close the week at 2,206 points – just north of the psychologically significant 2,200 mark.

Hybrid automaker BYD's A-shares soared nearly 7% on Friday on rosier prospects.

Hybrid automaker BYD's A-shares soared nearly 7% on Friday on rosier prospects.

Photo: BYD

That still leaves the index down over 9% from early February levels, but still much better than the 1,949 nadir from last December.

Brokerages, one of the few bright spots among traded sectors so far this year, led Friday’s charge.

On the near-term horizon, there is a range of indications that Chinese share prices are set for a sustained climb.

Both the five- and ten-day moving averages were breached, and the 20- and 30-day averages are now tantalizingly within reach.

Leading the charge of late have not only been securities trading and consulting institutions, but also new energy and automobile plays.

If it wasn’t for the poor performance of telecom plays, Friday’s overall market gains would have been far more impressive.

The prime interest rate cuts by the European Central Bank have put a spark back in global equities of late, with Shanghai and Shenzhen shares being no exception.

Though frequently voicing support for the ongoing campaign to boost domestic consumption in the face of anemic external demand, China’s business leaders still realize the importance of exports to the country’s investment-driven growth strategy.

Another driver of the benchmark Index going forward is potentially further good news for China’s listed brokerages coming out of of a major securities industry conference to be held in Beijing this coming Wednesday.

China shares recent performance. Source: Yahoo Finance

China shares recent performance. Source: Yahoo Finance

The high-flying sector is expecting all the major names to be represented at the event, with more clarity and visibility on future trends and policy responses seen boosting client confidence in the sector, as well as driving more shareholders to consider buying shares in listed brokerages.

Yet another bright spot is the imminent release of detailed rules and regulations on the growing phenomenon of the renminbi-backed Qualified Foreign Institutional Investor (RQFII) scheme.

The program allows primarily Hong Kong-listed QFII funds to participate in yuan-backed A-share trading from offshore, thus helping skirt the decade-old traditional QFII regime which imposes investment quotas on foreigners.

Some 200 billion yuan is estimated to be on the verge of flooding into the Shanghai and Shenzhen bourses once the program is fully opened and ready for business.

This will be a tremendous boon to liquidity and will help light a fire under A-share funds.

Furthermore, the most recent outbreak of bird flu in Eastern China is diminishing with time, with a slowing infection rate and a steady stream of hospitalized patients being sent home sporting clean bills of health.

Constant television coverage of these discharged patients has tremendous influence in boosting overall investor confidence, if not just by the images’ ability to reduce overall market anxiety.

Less frightening news on the contagion front is an upside driver for a whole host of industries – from massive fowl raising and processing operations, to the restaurant sector as well as passenger airlines, hotels and travel agencies.

See also:

CHINA SHARES: No Bull, But Still Good Buys

Hybrid automaker BYD's A-shares soared nearly 7% on Friday on rosier prospects.

Hybrid automaker BYD's A-shares soared nearly 7% on Friday on rosier prospects. China shares recent performance. Source: Yahoo Finance

China shares recent performance. Source: Yahoo Finance NextInsight

a hub for serious investors

NextInsight

a hub for serious investors