Excerpts from analysts' reports

AmFraser initiates coverage of Sin Heng with 30-c target price

Analyst: Royston Tan

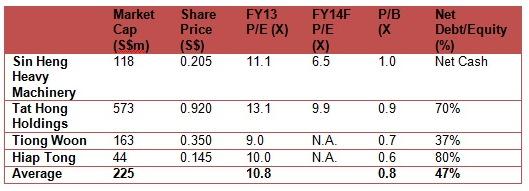

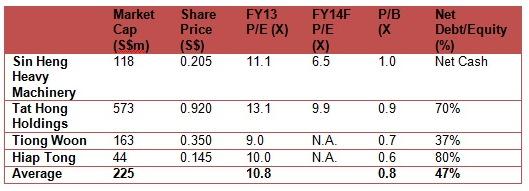

Sin Heng is one of the leading heavy lifting service providers in Singapore, focusing on the mid‐to‐high lifting capacity segment. Its core business activies are in the renting and trading of cranes, aerial lifts and other heavy lifting equipment.

AmFraser initiates coverage of Sin Heng with 30-c target price

Analyst: Royston Tan

Sin Heng is one of the leading heavy lifting service providers in Singapore, focusing on the mid‐to‐high lifting capacity segment. Its core business activies are in the renting and trading of cranes, aerial lifts and other heavy lifting equipment.

Complementary business model. Sin Heng is the only crane operator among its listed peers that is actively engaged in the trading business. The trading segment, despite being a lower margin business, requires less capital to operate. It also provides an additional income source and ensures that the company’s rental fleet is kept young and its crane products relevant.

Complementary business model. Sin Heng is the only crane operator among its listed peers that is actively engaged in the trading business. The trading segment, despite being a lower margin business, requires less capital to operate. It also provides an additional income source and ensures that the company’s rental fleet is kept young and its crane products relevant.Growing the business in emerging countries. Sin Heng provides an indirect opportunity for investors to gain exposure to the growth of emerging countries. Sin Heng will likely be a beneficiary of the boom in infrastructure spending in the region, with its branded crane equipment already the leading standard in the infrastructure arena.

Partnership with Toyota Tsusho. Synergistic effects could be achieved from the partnership with Toyota Tsusho Corporation (“TTC”), who also holds a 27% stake in the company.

Sin Heng CEO Don Tan (left) after signing a business alliance in May 2012 with Toyota Tsusho's Yuji Hamamoto (deputy division officer, Machinery, Energy & Project). NextInsight file photoSin Heng will be able to benefit from the wide network TTC has established over the years which grants it access to valuable market information. TTC also has a strong presence in countries like Thailand and Myanmar and can likely aid Sin Heng’s foray into these high growth areas.

Sin Heng CEO Don Tan (left) after signing a business alliance in May 2012 with Toyota Tsusho's Yuji Hamamoto (deputy division officer, Machinery, Energy & Project). NextInsight file photoSin Heng will be able to benefit from the wide network TTC has established over the years which grants it access to valuable market information. TTC also has a strong presence in countries like Thailand and Myanmar and can likely aid Sin Heng’s foray into these high growth areas.

Sin Heng CEO Don Tan (left) after signing a business alliance in May 2012 with Toyota Tsusho's Yuji Hamamoto (deputy division officer, Machinery, Energy & Project). NextInsight file photoSin Heng will be able to benefit from the wide network TTC has established over the years which grants it access to valuable market information. TTC also has a strong presence in countries like Thailand and Myanmar and can likely aid Sin Heng’s foray into these high growth areas.

Sin Heng CEO Don Tan (left) after signing a business alliance in May 2012 with Toyota Tsusho's Yuji Hamamoto (deputy division officer, Machinery, Energy & Project). NextInsight file photoSin Heng will be able to benefit from the wide network TTC has established over the years which grants it access to valuable market information. TTC also has a strong presence in countries like Thailand and Myanmar and can likely aid Sin Heng’s foray into these high growth areas.Weaker Yen in its favor. The JPY depreciation in the past one year has benefited Sin Heng in the form of lower purchase costs. High quality Japanese cranes are also now more cost competitive relative to China‐made ones.

Buyers will be more receptive to purchase these cranes from suppliers like Sin Heng due to the narrower cost disparity.

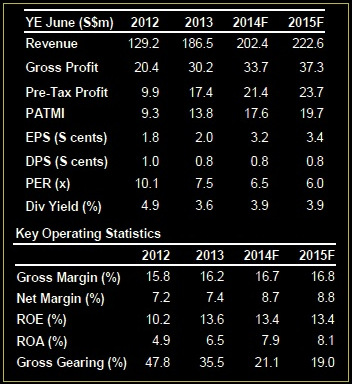

Initiate BUY with FV S$0.300. We forecast earnings to grow at a CAGR rate of 20% from 2013‐2015. On a valuation of 9.4X (5–year historical mean) FY14 P/E, we derive a TP of S$0.300, representing a 50% upside from current level inclusive of an expected dividend yield of 3.9%.

Sources: Bloomberg, Company, AmFraser

Sources: Bloomberg, Company, AmFraser

Previous story: SIN HENG seals alliance with Toyota Tsusho (new 27% stakeholder)

Sources: Bloomberg, Company, AmFraser

Sources: Bloomberg, Company, AmFraserPrevious story: SIN HENG seals alliance with Toyota Tsusho (new 27% stakeholder)

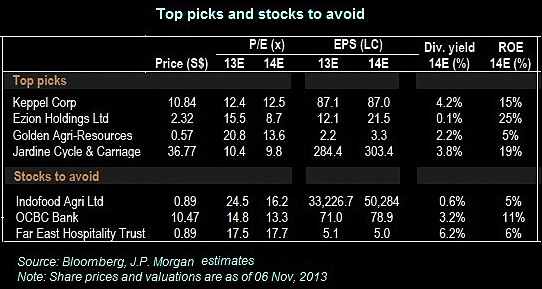

JP Morgan's Stock Ideas for the Year of the Horse

Best idea: Keppel Corp Ltd -- Overweight

Analyst: Ajay Mirchandani AC

Analyst: Ajay Mirchandani AC

Price: S$10.84, PT: S$13.30

Investment thesis: Strong order momentum in jackups along with growing semisub orders. Keppel’s strong track record in rig deliveries is one reason why many rig owners prefer Keppel over Chinese yards.

Drivers/catalysts: i) Better O&M margins. ii) Product mix. iii) Potential drillship/FLNG orders. iv) Orders from new Mexico yard.

Valuation and risks: Our Dec-14 PT is based on SOTP, which uses DCF to value the rig-building business, 12x P/E for ship repair and other, property at NAV, Keppel Land at our PT, and infrastructure at 1.5x book.

Key risks include a worse-than-expected delay in new orders and a collapse in oil prices.

Key risks include a worse-than-expected delay in new orders and a collapse in oil prices.