Prior to his retirement, Chan Kit Whye worked more than 30 years as Regional Finance Director, Financial Controller and Manager in a multinational specialty chemical business. He previously played an active role in CPA (Australia) Singapore Branch, taking up positions in its Continuing Professional Development and Social Committees. Kit Whye is a Fellow of CPA Australia, CA of Institute of Singapore Chartered Accountants and CA of the Malaysian Institute of Accountants. He holds a BBus(Transport) Degree from RMIT, MAcc Degree from Charles Sturt University and MBA from Durham Business School.

Prior to his retirement, Chan Kit Whye worked more than 30 years as Regional Finance Director, Financial Controller and Manager in a multinational specialty chemical business. He previously played an active role in CPA (Australia) Singapore Branch, taking up positions in its Continuing Professional Development and Social Committees. Kit Whye is a Fellow of CPA Australia, CA of Institute of Singapore Chartered Accountants and CA of the Malaysian Institute of Accountants. He holds a BBus(Transport) Degree from RMIT, MAcc Degree from Charles Sturt University and MBA from Durham Business School.Raffles Education:

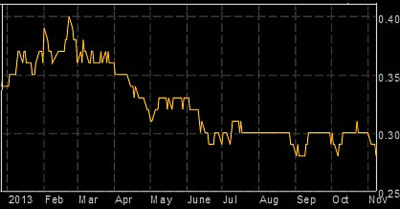

Raffles Education stock is down 16% year-to-date. Chart: BloombergI don't see any sign of turnaround. If you look at its Q1 2014 vs Q1 2013, the profit in Q1 2013 come mainly from $18 million gain from disposal of investment.

Raffles Education stock is down 16% year-to-date. Chart: BloombergI don't see any sign of turnaround. If you look at its Q1 2014 vs Q1 2013, the profit in Q1 2013 come mainly from $18 million gain from disposal of investment.Therefore as long as its quarterly revenue stays at around $32 million, the risk of running into a loss is there.

If you look at its cash flow, you will notice that the positive inflow come from "Course and education service deferred income" of $34 million. I believe this is the fees paid in advance by its students.

Without this component, its cash flow from operations is negative. If you look at its full year numbers for year ended 30 June 2013, its net profit had include FV gain of $42 million.

With that, FY June 2013 will be a loss of about $7 million. Free cash flow for full year is negative at $14 million vs prior year at negative $6 million.

Its Chairman, Chew Hua Seng, should stay focused and not meddle with business outside the sphere of its core business.

Otherwise, when things get worse, it is difficult to reverse. Don't try to be smart and think that he knows everything. Just look at Overseas Education Ltd, and see how they perform and manage its business. Keep it simple and improve on its core competencies.

| ST Engineering: ST Engineering YTD (nine months) net profit is flat as compared to prior year. I expect full year earnings per share will come in within the range 17.7 cents to 18 cents a share, as compared to prior year of 18.6 cents a share. Current PE of about 24 times appear high, while is price-to-book ratio is 6.8 times. Dividend yield is at 3.3%. |

China Merchants Pacific (CMP):

What are the risks that will reduce earnings and profits? Is CMP responsible for the eventual upgrading of the roads, such as resurfacing, repairs, etc?

If yes, did CMP make regular provision for such contingencies? Will the Chinese government clamp down on toll road price increase, or will they allow CMP to have a free hand to raise price?

If government implement controls or every want toll road operators to cut back on pricing, how does this going to hit CMP's profitability going forward?

I am impressed by the numbers, but do they have good controls in place to ensure that the numbers are accurate, reliable and fairly presented? Otherwise, it is worth to take a look at this counter.

The capital expenditure maintenance definitely has been factored in. Case to point the latest 3qtr results here > http://www.investmentmoats.com/money-management/dividend-investing/china-merchant-pacific-the-dividend-growth-thesis/

The Revenue of YTW is 860mil rmb while the profit is 81 mil hkd. This will definitely account for much maintenance works.

The chinese government is already clamping down on toll road increases, this will cap the upside supposely. But it has not affected CMP. Management addressed it here > http://www.investmentmoats.com/money-management/high-yield-investing-money-management/china-merchant-pacific-dividend-analysis-agm-updates-and-q1-report/

This addresses the toll-free holiday of 15 public holidays where they cannot collect tolls.

In the latest report from UOB Kayhian they believe these toll restriction have caused investors to underestimate toll roads. All the down side have been priced in probably.

On top of that, government may be looking in extending the toll concession, which bode well for CMP.

On top of that if you cannot grow by toll prices, volume will grow by affluence and population.

One area that you may not have consider is competition from high speed rail, which runs parallel to yongtaiwen. Well, you have seen these results is evidence of direct competition from the high speed rail, and they look good.

We tried to get as reliable data as possible, but cant help that it is so far away. It is as if you are investing in Saizen reit and Raffles MEdical hospital. How well do you assess their controls.

the only thing you can probably check are that perhaps traffic data can't easily fabricate. There are many traffic data nearby, such as ZheJiang Expressway's ningbo expressway: They are published monthly. if you are serioius about this, routinely check out the traffic data. it will tell u whether competitors are all shitting or not > http://www.zjec.com.cn/en/Traffic.aspx?c_kind=421&c_kind2=589