UOB Kay Hian expects Wee Hur to report bumper profit in 2014.

Analyst: Loke Chunying

Bumper profit expected in 2014.

Bumper profit expected in 2014.

As the completed

contract accounting method is adopted for industrial

development properties, Wee Hur saw a 750% surge in net

profit for 2012 with the TOP and recognition of revenue for

Harvest@Woodlands.

Accordingly, investors can expect

another surge in profit in 2014 with the TOP of

Premier@Kaki Bukit (more than 95% sold), where Wee Hur

owns a 60% interest in the 74,943 sqm GFA industrial

development.

•

Consistent dividend payout.

Wee Hur has been

maintaining a dividend payout of at least 2 S cents since

2008. In its bumper profit year 2012, Wee Hur rewarded

shareholders with a total dividend of 4 S cents. We like

Wee Hur for its consistent dividend payout history and its

Assuming Wee Hur maintains its 2 S cents dividend payout

for 2013, it translates to a current dividend yield of 4.3%.

The next big project– Thomson View, third time’s the

charm?

In 2012, the JV between Wee Hur (51%) and

Lucrum Capital (49%) successfully acquired Thomson View

Condominium, a 99-year leasehold residential site sitting

on a land area of 540,314.4sf. After including the

differential and lease upgrading premium payable,

estimated cost of acquisition is S$712 psf ppr.

Goh Yew Lian, CEO of Wee Hur Holdings. NextInsight file photoAnother 99-

Goh Yew Lian, CEO of Wee Hur Holdings. NextInsight file photoAnother 99-year leasehold residential site at Bright Hill drive was sold

at a cost of S$719.9 psf ppr to a JV between UOL and

Singapore Land in 2012. With Thomson Grand (launched in

2011 and fully sold out with an ASP of S$1,330 psf) being

the only new launch in the vicinity for the past few years,

we expect the launch of Thomson View to be highly

anticipated by investors.

However, the Thomson View

project recently hit the brakes when 13 of the condo’s

owners filed for a stop order against the sale. With the stop

order, uncertainty over the project looms as risks of a sale

termination or a long dreaded legal battle emerged.

The

The

stop order is also likely to delay project launch and future

earnings. Any new property cooling measures announced

during this period may also deter buying sentiment.

Thomson View had been unsuccessful in its two previous

enbloc attempts in 2007 and 2011.

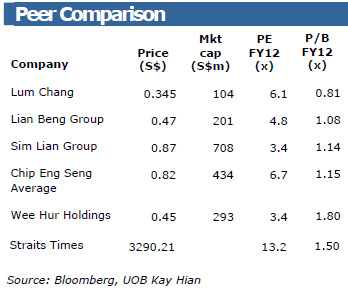

• Our view.While uncertainty looms over the future of

consistent dividend payout, any positive news about

Thomson View, there is definitely a heightened market

interest in Wee Hur. The stock has seen a jump in volume

since the start of the year. With an established track record

and a good practice of rewarding shareholders with

Thomson View will be a catalyst for the stock price.

_____________________________________________________________________________

Artist impression of a made-over Suntec City.

Artist impression of a made-over Suntec City.Morgan Stanley initiates coverage of Suntec REIT with expectations of higher dividend

Analysts: Wilson Ng, CFA, and Sean Gardiner

New top pick in S-REITS. Outperforming office assets well appreciated by the market but we think mall overhaul concerns are overdone. Our 2014/15 div forecasts are thus 12/15% above consensus.

Above consensus-dividends: We forecast +18/12% growth in 2014/15 as income from reopened spaces in Suntec Mall progressively flows through.

Renovations pose uncertainty for nearer-term dividends, but earmarked proceeds from the sale of Chijmes should more than cover any shortfall. We expect dividends to revert to pre-renovation levels at 9.7 c (annualized) by 3Q and surpass at 10.6 c by 2014.

Under-appreciated mall: At 0.9x P/B, the stock prices in a rent of only S$8.95 psf for Suntec Mall – 10% below passing rents and 30% lower than management’s target of S$12.59.

Price target of S$2.15/shr is derived by applying a target dividend yield of 5.5% -- half a standard deviation below the long-run average of 6.0% -- to our estimated 4Q13 annualized dividend/share of 9.8 c.