EMPLOYEES OF Neo Group observe a daily ritual which is uncommon in Singapore: They recite the company pledge and sing the company song.

I have not got a chance to observe that but, in view of the positive industry dynamics, I met up for an exclusive interview with Mr Neo Kah Kiat, Founder, Chairman & CEO of Neo Group, which listed on Catalist in July 2012.

I also met Ms Christine Quak, Assistant Director of Marketing Communications. Here are my key takeaways:

Food catering – three segments, different target audience, same aim

With reference to the table below, Neo Group has three brands, namely Neo Garden Catering, Orange Clove and Deli Hub.

Neo Group serves an average 10,000 headcounts per day and can serve up to a maximum of 15,000 headcounts.

Food catering industry – room to grow

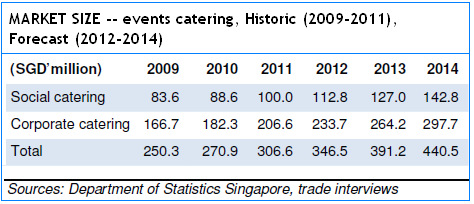

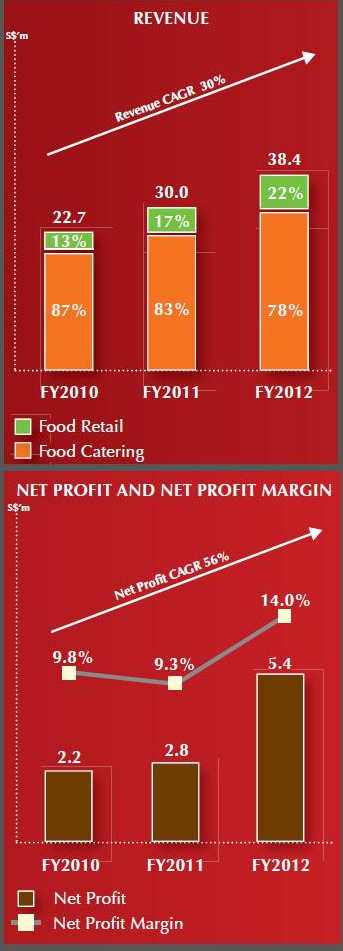

According to Euromonitor, rising affluence and changing consumer lifestyles continue to fuel the demand for social catering. There is increasing demand for social catering for functions such as birthday parties, baby showers, festive season gatherings and even wedding events. It is estimated that growth in the overall events catering industry (comprises of social and corporate catering) is likely to grow at a compound annual growth rate of 12.9% from 2012 - 2014.

In addition, based on 2011 sales, the top five events caterers in Singapore only command about 21.6% market share with Neo Group, leading the pack with 9.0% market share. The next largest competitor is Select Group which commands a 4.7% market share. Thus, in such fragmented industry, management believes that there is room to grow through acquisitions, joint ventures and / or strategic alliances.

Barriers to entry (actually) exist for food catering

Most people would think that there are no significant barriers to entry for events caterers. However, management emphasized that barriers to entry exist for events caterers, especially for those caterers who wish to grow beyond the size of S$5m.

Firstly, events catering is a labour intensive business. With the reduction of Dependency Ratio Ceiling (“DRC”) for the services sector from 50% to 45%, for every ten Singaporeans or permanent resident employees, companies can only employ eight foreign workers, two less than before the enactment of DRC. This is likely to compound the labour problems faced by event caterers, especially for those who wish to scale up their business.

Secondly, for a company to expand, management believes it is a prerequisite to have robust information technology (“IT”) systems to ensure seamless transition from marketing, sales, kitchen, delivery and after sales customer services. The cost of such IT systems is likely to preclude some players from purchasing them.

Thirdly, the presence of entrenched incumbents in the industry also serves as deterrent to new entrants. Most consumers are likely to employ the services of established players due to their reputation and services and few may explore the services of new entrants especially for important events such as marriage and baby showers.

Fourthly, with the new NEA’s time stamping regulation, effective 15 Feb 2012, food caterers have to purchase expensive time stamping machines. Similar to IT systems, such expenses may discourage new entrants from entering into the food catering industry.

Last but not least, the repetitive, mundane nature of the work, coupled with long working hours increases the difficulty for employees to stay motivated and maintain job satisfaction leading to high turnover rate.

In a nutshell, all of the above factors serve as barriers to entry for new entrants and also barriers for small existing players to scale up their operations.

What’s in the pipeline?

Firstly, management intends to redevelop the property at 30B Quality Road to consolidate most of their central kitchens, offices, logistics and warehouses so as to increase efficiency.

The redevelopment, expected to commence in 1Q2013, is to be gradually completed over the next three years.

When fully operational, this is likely to increase their capacity to 30,000 headcounts a day.

I also enquired on their current utilization rate and am assured that they are currently operating at about 55% utilization rate. In other words, they are still able to grow organically in the near term, without the additional capacity from the proposed development at 30B Quality Road.

Secondly, management targets to expand their food retail business by increasing the number of Umisushi from 16 to 30 outlets by 2016.

Management is optimistic about this business segment as they believe it complements their food catering business. Furthermore, with the increasing shift in consumer preference for convenience food, management believes their Umisushi retail outlets would bridge these consumer needs.

Thirdly, management believes there are still untapped opportunities for food catering business such as institutions, yacht catering etc. Consequently, management remains sanguine on their business prospects.

Intends to distribute >=60% of net profits as dividends for next 3 years

Barring unforeseen circumstances, the company intends to recommend and distribute not less than 60% of net profits as dividends for the next three financial years.

Unique company culture unites employees

I also enquired on their company pledge. Management affirms that all the employees have to recite a daily pledge. They also have a company song. In addition, they have monthly sports day, as well as, birthday celebrations for their employees. Management wants their employees to be happy and enjoy working with them. This also helps their employees to maintain a high level of job satisfaction.

Some noteworthy points to consider

Notwithstanding the above points, below are some noteworthy points for investors to consider which I drew reference from its prospectus.

- Higher financing costs in FY13F, compared to FY12 as the Group took up a bank loan of about S$7.04m for the acquisition of the property at 30B Quality Road;

- Higher expenses in FY13F, compared to FY12 due to compliance costs as a listed company and listing expenses;

- FY12 results were boosted by the sales recognized from two Lunar New Year peaks occurring in that financial year. This will not recur in FY13F.

Conclusion: time is the judge

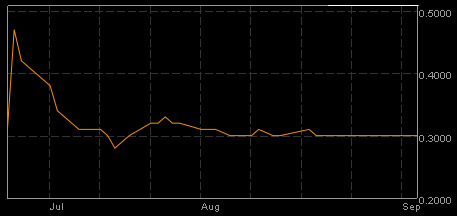

Neo Group closed at $0.300 on 24 Aug 12. It was listed on 11 Jul 12 and hit an intraday high of $0.490 on debut (IPO price was $0.300). As with most investments, especially newly listed ones, time is required for the investment community to fully understand the company and for the company to deliver results on a sustainable basis. If Neo Group can consistently deliver results as reliably as it caters food to the consumers, it is likely that the investment community would appreciate the company and its stock in due course.

Visit remisier Ernest Lim's blog http://www.ernestlim15.blogspot.com/

Recent articles by Ernest Lim:

STX OSV slides despite sale of stake at a likely higher price than market

CHINA ANIMAL HEALTHCARE: Trading at less than half peers' FY12PE