Excerpts from latest analyst reports......

DBS Vickers on locking in gains and buying on pullbacks.

Analysts: TAN Ai Teng & LING Lee Keng

Lock in gains on outperformers. Among the best performing stocks YTD, some stocks have risen very close to their fundamental target prices.

In the absence of further re-rating catalysts, we recommend taking profit on Wheelock, Raffles Med and Super Group.

Not surprisingly, REITs are among the outperformers in this market.

However, in view of limited upside to target prices and lack of strong re-rating catalysts, we would also lock in gains on CDL Hospitality Trusts, Cache and Ascendas India Trust.

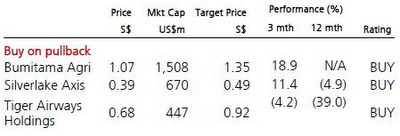

Buy on pullback, stocks with visible and stronger earnings drivers/catalysts. Here, we look for tangible earnings growth, firmly backed by company-specific drivers or catalysts.

Our bottom-up picks are Bumitama, Tiger Airways and Silverlake.

CIMB says too early to turn positive on SAKARI RESOURCES

Analyst: Lee Wen Ching

Moderating expectations: SAR believes that FY12 ASP could come in at the lower end of its US$85-90 guidance rather than its previous expectation of ASP meeting the higher end of this range.

Management further hinted that Jembayan’s volumes could be scaled back to 8.0-8.5Mt vs. its earlier 9Mt guidance if coal prices remain weak.

Oversupply impedes recovery: We believe that it could be too early to turn positive on SAR as coal prices could fall further.

China’s fragile growth outlook, coupled with excess supply from non-traditional markets, remain roadblocks to recovery.

An interim dividend of 2 US cts has been declared.

We adjust our FY12-14 EPS on opex updates and lower our target price to S$1.00 (9x CY13 P/E, 1SD below 3-yr mean).

Maintain Underperform with coal price weakness as a de-rating catalyst.

Recent story: Sold down in 1H2012: WILMAR, SAKARI, OLAM, EU YAN SANG, Q&M