MARKETS MAY be choppy, but with crude oil prices at more than US$100 a barrel, the oil & gas sector remains abuzz with activity as oil prices are still well above breakeven level for ultra-deep water oil exploration and production work.

Stable growth in upstream capital expenditure by oil majors and firm charter rates for offshore support vessels (OSVs) augur well for oil & gas players. Here are some SGX-listed stocks that have been beneficiaries of the oil & gas buzz.

ASL Marine – Order book near 2008 shipbuilding boom levels

ASL Marine has shipyards in Singapore, Batam and Guangdong, with shipbuilding revenue contributing 61% to top line for 9M2012 (year end Jun). It also has ship repair, conversion and ship chartering businesses.

There is high demand for offshore support vessels (OSVs), which make up 56% of its shipbuilding order book.

Its newbuilding orderbook was S$642 million as at May 2012, near levels it enjoyed during the 2008 shipbuilding boom (Jun 2008: S$693 million). Of this, S$454.5 million was secured in FY2012.

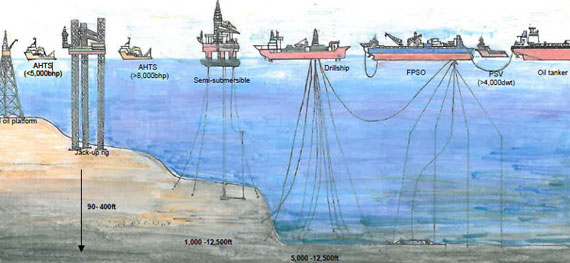

Given its yard capacity, the 40 vessel orders will take up to the first quarter of 2014 to be delivered. Its OSV orders include Offtake Support & Supply Vessels, AHTS, Emergency Response & Rescue Vessels and Platform Supply Vessels.

Firm charter rates for OSVs are also helping its ship chartering business. This segment contributed 20% to ASL Marine’s 9M2012 topline. All the four analysts who issued an update to ASL Marine’s 3Q2012 results maintained their ‘Buy’ and ‘Outperform’ calls with consensus target price at 81 cents.

All the four analysts who issued an update to ASL Marine’s 3Q2012 results maintained their ‘Buy’ and ‘Outperform’ calls with consensus target price at 81 cents.

Based on the stock’s recent close price at 58.5 cents, there is an upside of 38% to analysts' consensus target price.

Related story: CIMB Lifts ARA Target; Lim & Tan Eyes MIDAS Near 30 Cts; ASL Marine $8 M Profit

Keppel – All time high order book

Keppel Corp’s order books are at now at an all time high of about S$15 billion, with the latest a preliminary order worth about $4 billion from Sete Brasil Participacoes SA.

Last month, the world No.1 oilrig builder announced that Sete Brasil, part-owned by Petroleo Brasileiro, had signed a letter of intent to buy five semi-submersible rigs from it.

Demand for offshore units remains “hot” this year, Keppel CEO Choo Chiau Beng said in January, after the company won record orders totaling more than S$10 billion last year.

At S$10.01, the stock has 33% upside to its consensus target price of S$13.30.

Technics – Stellar earnings growth, high dividend yield, subsidiary listing

Unlike software systems integration, hardware integration can be a very lucrative business if one is a niche player riding on the stable growth in offshore spending.

Oil & gas engineering and procurement integration services provider, Technics Oil & Gas, has just that - a niche in integrating process modules for FPSOs. In Southeast Asia, it is a leading player for supplying and installing FPSO gas compression systems, the vessel's key process module.

It also manufactures super-sized gas compression systems, topsides and process modules of more than 500 MT each.

Technics has shown a strong earnings record over the past marine and offshore cycle: It has a 5-year revenue CAGR of 20%. 1H2012 net earnings grew 19% year-on-year to S$10.3 million and net profit margins have remained above 10% in the past 3 years.

At its recent stock price of 89.5 cents, dividend yield is a good 6.7%.

The upcoming Gretai Securities Market listing of the Group’s contract engineering segment (Norr and Wecom group of subsidiaries) holds promise for cash injection into Technics.

Norr is engaged in design, engineering, procurement and manufacturing and supply of ship automation for hydraulic and electrical equipment while Wecom specializes in repair and maintenance work.

On 17 May, AmFraser maintained its ‘Buy’ call on Technics with a target price of S$1.22, translating into upside of 36%.

Related story: TECHNICS, ANWELL, DMX: What Analysts Say Now...

CH Offshore – Potential takeover target with good dividend yield

CH Offshore suffered a revenue decline due to vessel sales, and maintenance and upgrading works to its chartering fleet for the first 9 months of FY2012 but the stock remains interesting for its strong cash balances, good dividend payout and attractive valuation.

Other than owning vessels for charter to support and service the offshore oil and gas industry, it also provides seismic surveys, towing and anchor handling of drill rigs and equipment, and transportation of supplies and personnel as well as supporting services for the construction of platforms and the laying of pipelines.

At a recent stock price of 41 cents, dividend yield based on the past 12 months’ payout works out to a good 6.7%.

A relatively low price to cash of 3X also makes it an attractive takeover target for players who want exposure to the AHTS market. It had cash balances of about S$86 million as at 31 Mar.

On 7 May, DBS Vickers issued a ‘Buy’ call on CH Offshore with a target price of 50 cents, translating to stock price upside of some 22%.

Mencast – Aggressive M&A expansion

Mencast is a maintenance, repair & overhaul (MRO) services provider for the marine and oil & gas industry.

Two years ago, it went on an aggressive acquisition path that resulted in revenue tripling to S$56.3 million over the past 3 years since its 2008 IPO.

Most of the revenue growth came in FY2011, when its newly acquired subsidiaries, Top Great and Unidive made maiden revenue contribution of S$29.2 million.

In May, it inked a S$8.4 million deal to acquire 70% in Vac-Tech, which provides industrial services to the refining and petrochemical industry, such as hydro jetting, tank desludging, heat exchanger and air fin cooler cleaning, decontamination and pipeline cleaning.

Since listing, Mencast has enjoyed good net margins ranging from high teens to mid twenties (FY2011: 18%).

UOBKH has a ‘Hold’ recommendation on Mencast with a price target at 63 cents. The stock last closed at 60 cents.

Related story: MENCAST, ROXY-PACIFIC: Latest Happenings....

MTQ – Acquisition adds to growth

MTQ is another marine & offshore services provider that has gone on the acquisition path to maintain growth.

It specializes in oilfield engineering services, including repair, manufacture and rental of oilfield equipment. Its niche area is on high pressure drilling equipment, notably Blow-Out Preventors and Subsea services.

It is also the largest authorized aftermarket distributor and repair services provider of turbocharger and diesel fuel injection systems and is an authorized repair workshop for reputable brands like Cooper Cameron, Aker Solutions, Varco-Shaffer, Vetco-Grey and QVM.

FY2012 (Mar year end) revenue surged a good 40% to S$128.4 million after it acquired Premier Sea & Land, a provider of oilfield equipment primarily used in drilling applications.

Net profit attributable to shareholders was up 37% at S$14.6 million. Net margin was 11%.

Earlier this year, it also increased its share stake in ASX-listed Neptune Marine Services to 17.4%. Neptune is an Aussie offshore engineering solutions provider to the global oil and gas, marine and renewable energy industries with operations spanning Australia and UK.

Related story: MTQ CORP: Net Profit For FY12 Up 37%, Steady Cashflow And Dividend