SIAS RESEARCH has a target price of 60.5 cents for property developer Roxy-Pacific, which represents upside of 44% from the recent trading price of 42 cents.

Roxy-Pacific touched a record high price of 45.33 cents (adjusted for 1-for-2 bonus issue) last month.

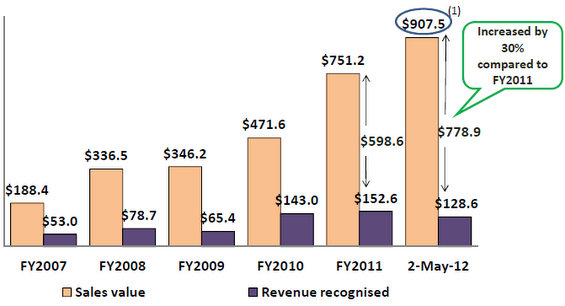

Following Roxy-Pacific’s 1Q results, SIAS Research noted that as at 2 May, Roxy had S$778.9m of progress billings to be recognized as revenue or as a share of associates’ profit up to 2016.

SIAS Research deputy lead analyst Lu Jinshu wrote: “We continue to assert that our valuation of Roxy is conservative. We have incorporated a 20% discount from the grossed up valuation of S$721.1m to arrive at S$576.9m.”

He had not incorporated into his calculations the development value of the recently announced enbloc acquisition of Jade Towers in Upper Serangoon for S$106.27m.

OCBC Investment Research, in maintaining its ‘buy’ call on Roxy-Pacific, said it had raised its fair value from 41.33 cents (adjusted for bonus issue) to 45 cents, mostly due to expected contributions from Jade Towers and a lower RNAV discount of 25%.

“We continue to favor Roxy for its spot-on execution and note torrid sales conversion at recently launched projects, Eon@Shenton, Natura@Hillview and the Millage,” wrote OCBC analysts Eli Lee and Kevin Tan.

As for its hotel contribution, average occupany rates increased to 92.8% in 1Q12 from 91.6% in 1Q11. Average room rates also came up 8.3% YoY to S$201.5.

Overall revenue per available room rose 9.8% to S$187.0.

"We maintain a positive outlook for the hotel sector in FY12 and expect steady performance ahead," wrote the OCBC analysts.

To read the full SIAS and OCBC reports, click here.

Recent story: ROXY-PACIFIC chalks up another $150 m sales, ASL Marine target is 83 cents

DBS Vickers optimistic on World Precision Machinery, Yangzijiang Shipbuilding

DBS VICKERS said World Precision Machinery's 1Q profit came in above its expectations, and maintained its 'buy' call and 68-cent target price for the stock (recently traded at 54 cents).

The research house said World Precision Machinery's RMB220m orderbook is healthy, which is why "we are positive of a strong 2Q12 ahead."

DBS Vickers believes the company is on track to achieve its forecast of 20% profit growth this year as it continues to see good interest in mid size contracts from major automotive parts suppliers for domestic car brands.

World Precison Machinery "remains attractive at 5x FY12F vis-à-vis 20% PATMI growth and a decent yield of 6%."

In another brief comment, DBS Vickers said Yangzijiang Shipbuilding 1Q result was in line with its expectations.

The shipbuilder has secured US$206m new orders year to date.

"Current order book is healthy at 96 vessels worth US$4.5bn, translating to a healthy book-to-bill ratio of 1.8x. Offshore plans in progress. We continue to like Yangzijiang as one of the most well run Chinese shipyards."

DBS Vickers' target price for Yangzijiang stock is $1.55.

Recent stories:

WORLD PRECISION: First photo essay on its operations

YANGZIJIANG: Celebrates 5 stellar years of growth on Singapore bourse