Yangzijiang Shipbuilding's annual report for FY2011 has been published. The chairman's statement offers highlights of the company's past five years since its listing on SGX as well as insights into the shipbuilding cycle that it now is in, and the prospects of its business.

Dear Shareholders,

The Group is celebrating its 5-year anniversary of listing on the Singapore Exchange this April in 2012. The past five years since our IPO in April 2007 have been very eventful and fruitful. We listed at a time of an unprecedented shipbuilding boom. Since then, the shipbuilding industry has seen two downturns. In the past years, ship owners and ship financiers alike have been cash-strapped, vessel prices have been falling and there is a dearth of newbuild orders.

The path for Yangzijiang has not been easy but I am pleased to report that the Group’s disciplined and down-to-earth approach to business has resulted in stellar earnings growth and a consistent dividend payout throughout the industry’s up and down cycles.

Improving shareholders value

In five years, we have multiplied our net profit attributable to shareholders more than 4 times to reach a record Rmb 4.0 billion in FY2011, translating into a very commendable five-year cumulative average growth rate (CAGR) of 46%.

During our IPO, we had only one yard on 20 hectares of land. Today, we have four yards on a total land area of 416 hectares. In 2007, we constructed containerships with a loading capacity of up to 2,500 TEU. Today, we have 10,000 TEU containerships in our order book.

In 2011, the Group ranked 329 among China Top 500 Enterprise. We ranked 102 in efficiency. We also received a SIAS award for transparency in investor relations. In 2010, we were the first PRC-majority owned company to list in Taiwan, and made headlines in our part in bi-lateral relations between China and Taiwan.

Today, we are the largest S-chip in terms of market capitalization and profitability. We are also a component stock on the MSCI Index.

Successful navigation in challenging environment

In 2011, China maintained its position as the global shipbuilding leader, dominating with a 45% market share in output and clinching 52% of newbuilding orders in DWT. Yet, it was a challenging year when newbuilding orders placed with PRC shipyards plunged 52% year-on-year. As many as one third of all Chinese shipyards did not secure any orders. Most orders went to the leading PRC shipyards. There are two reasons for this:

Firstly, ship owners wanted the assurance that a yard was financially strong enough to complete the capital-intensive process of building a seagoing vessel. From a 20% progressive payment schedule, market conditions have changed to a practice where the customer gives four milestone payments of 10% each, or one 30% upfront deposit. The remaining 60% to 70% is payable only upon vessel delivery. This shift of payment quantum to the end of the work cycle means that shipbuilding construction is now viable only to the best shipbuilders with very strong financial resources.

Secondly, Chinese government policy has led its banks to provide ship financing to reputable shipowners for their orders with leading PRC shipyards. This was a privilege that European and North American banks could not extend as the ship finance sector in the western hemisphere is plagued by sovereign debt woes at a time when freight rates have plunged and there is anemic demand for cargo transportation. In contrast, shipbuilding is one of the key industries that the Chinese government strongly supports within its stimulus package.

The Group’s orders from Asia grew from 50% as at 31 December 2010 to 55% as at 31 December 2011. In 2011, we successfully delivered 62 vessels (FY2010: 50 vessels) and retained our position as one of China’s five leading shipbuilding enterprises in DWT output. FY2011 Group revenue grew 16% year-on-year to reach Rmb 15.7 billion, with shipbuilding contributing 93%.

It is the Group’s Five-Year growth plan to have 60% of our revenue from vessel construction, 20% from ship breaking and another 20% from offshore engineering by 2015.

Leading shipbuilder

To maintain our leadership position in yard output, we acquired 15 hectares of land for Rmb 108 million to expand our second yard - New Yangzi Yard - in 2011. This will allow us to accommodate construction and mooring of ships up to 150,000 DWT and increase the capacity of our second yard, New Yangzi, by one million DWT in 2014. We shall also be spending Rmb 4 billion on a fourth shipbuilding yard, Xinfu. The Xinfu yard is expected to start operations in early 2013 and once fully operational, is expected to have an annual capacity of up to 3 million DWT or the equivalent of 10 VLCC’s or twelve 10,000 TEU containership vessels.

These initiatives shall more than double our newbuilding capacity over the next 3 years to reach 7.3 million DWT and strengthen our position as one of the largest shipbuilding enterprises in China.

Constructing high-end vessels

China leads the world in volumetric shipbuilding output, but our technology still trails behind developed nations. The Group’s vision is to surpass our peers in R&D and technological innovation, and we achieved a couple of firsts for Chinese yards in 2011.

One such breakthrough was the Super Green 8500 DWT vessel with a Groot Cross-Bow that we delivered to Carisbrooke Shipping in 2011. Featuring lower fuel consumption, lower carbon emissions and a smoother ride in heavy weather, the Super Green is the first of its kind built by a PRC yard.

We were also the first PRC shipbuilder to win orders for the 10,000 TEU containership, an area traditionally dominated by South Korean yards. In 2011, we secured contracts from Seaspan for seven 10,000 TEU containerships worth a total of US$700 million with options for another 18. If fully exercised, the additional 18 vessels shall generate another US$1.8 billion of revenue for the Group.

Replacement demand for newer, bigger and more fuel-efficient container vessels is growing steadily.

Demand for bulk carriers remains weak and vessel prices are under pressure because of a global bulk carrier supply glut.

It is thus the Group’s strategy to build more of the larger containerships such as the 10,000 TEU. We possess superior R&D capabilities and have been able to develop new vessel types with designs relevant to market trends. For example, we designed and are now producing energy-saving 4,800 TEU and 10,000 TEU containerships. Our new design reduces vessel fuel consumption by 40%, cuts carbon emissions by 30% and raises loading capacity by 20%.

To ensure that the Group remains at the forefront of technology, we acquired 60% in CS Marine Technology for Rmb 5 million last July. CS Marine Technology is in the business of marine consulting, design and engineering of shipbuilding and offshore structures. It offers high-value turnkey ship design and R&D services to complement the Group’s shipbuilding business.

The Group’s long-term goal is to offer a comprehensive product range with a focus on high-end vessels as advanced as those produced in developed nations such as Japan or South Korea. We hope to expand our product range to meet the demand dictated by global economic trends. For example, we hope to build VLCCs and oil & gas support vessels, as we believe that oil prices will remain firm.

Ship breaking venture

The Group has identified ship breaking, scrap metal trading and its related logistics support as important elements for the steel hedging strategy of our shipbuilding business.

During the last quarter, we invested Rmb 240 million to acquire 80% equity interest in a ship breaking associate company, Jiangsu Huayuan Metal Processing, making it a wholly owned subsidiary. Huayuan started scrap steel processing, trading and logistic services in 2011 and owns one of the few qualified ship demolishing companies in China. Over the next three years, we shall ramp up its production capacity from the current 200,000 units to 600,000 units of light displacement tonnage per year.

We believe we can be one of the top three ship breaking players in China and will have our ship breaking processes accredited by an international organization for the conservation of natural resources.

Offshore engineering venture

Offshore marine engineering is another area that the Group hopes to diversify into and eventually gain market share in. We have set up a joint venture company with Qatar Investment Corporation and intend to construct an offshore marine base in Taicang in phases at a total investment cost of Rmb 4 billion. The yard is located in China for cost efficiency, but we will tap on Singapore’s talent in marine and offshore engineering to develop market and provide technical support to the yard.

This offshore yard sits on a land area of about 156 hectares with 1,500 meters of coastline. We will hold an effective stake of 78% in the Taicang yard.

Financial asset management improves shareholders value

Shipbuilding is a highly capital-intensive industry, requiring huge capital outlay and working capital. Through our steady earnings growth and good receivables collection over several decades, the Group had accumulated cash and financial assets of Rmb 20.0 billion as at 31 December 2011.

Our held-to-maturity financial assets increased by 21.6% to reach Rmb 10.5 billion as at 31 December 2011. Interest income from held-to-maturity financial assets increased 70% year-on-year to reach Rmb 916.9 million. Its segment contribution to the Group’s revenue increased from 4% in FY2010 to 6% in FY2011. Depending on how the prospective yields of held-to-maturity investments change relative to our cost of borrowing, we may deploy funds from our investment portfolio to meet our shipbuilding needs for working capital.

Our strong balance sheet enabled us to venture into micro financing in 2008, when we saw opportunities made possible by China’s very tight debt financing environment. Relevant licenses were obtained and we have so far pumped Rmb 394.5 million into this venture.

Thanks to the prudent and astute management of our dedicated Chinese banking veterans who have in-depth knowledge of the banking regulations in China, revenue from our micro financing business multiplied close to 10 times in 2011 to reach Rmb 180 million.

Steady dividend payout and share buyback

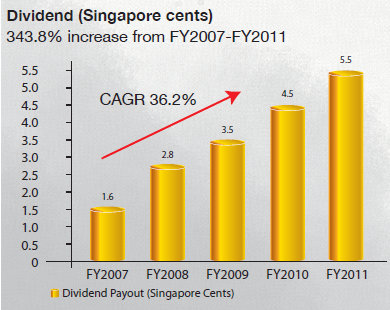

I wish to take this opportunity to thank shareholders who put their faith in us through the ups and downs of the shipbuilding cycle. Though our stock price has fluctuated significantly with market sentiment, our Treasury Department exercises the Group’s share buyback mandate at suitable market opportunities and this to a certain extent has supported Yangzijiang’s share price. To share the fruits of our success, the Board is proposing a dividend of 5.5 Singapore cents per share for FY2011.

The Group has a systematic and coherent diversification strategy in place and we are confident of maintaining long-term stable earnings growth for shareholders. With the unwavering support of our dedicated management team and workforce, our customers, suppliers and other business associates, we shall continue our past successes.

Let us join hands to sail the seas!

Mr Ren Yuanlin

Executive Chairman

Kudos to him and Yangzijiang!