Excerpts from latest analyst reports...

UOB: SINOPEC’S 1H profit tops forecast

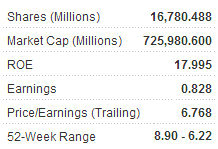

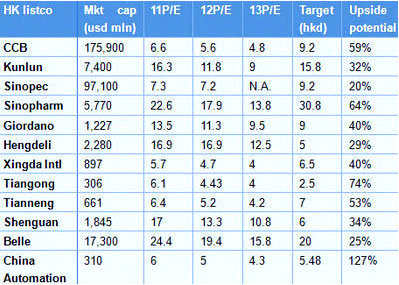

UOB Kay Hian said that China Petroleum & Chemical Corporation Ltd (Sinopec; HK: 386; SHA: 600028; NYSE: SNP) produced first half results “much better than expected.”

Sinopec, Asia’s largest oil refiner, saw January-June net profit 10% ahead of forecasts due to much lower than expected refining losses from inventory gains and high efficiency.

“Meanwhile, the E&P and marketing segment all registered better than expected results,” UOB said.

“The worst is over, a much better 2H11 can be expected due to two reasons: the refining segment will break even after Brent corrected to 105usd/bbl, and fuel pricing reform will accelerate in 2H11, which will help eliminate refining losses.”

Sinopec is currently trading at around 8.5xFY12PE and is at a very “compelling valuation” vs the company's historical average of 10x, UOB added.

UOB is maintaining a 'buy' recommendation on Sinopec with a target price of 9.20 hkd.

See also: CHINA REFINERS, KUNMING MACHINE: What Analysts Now Say...

UOB: New assets to be catalysts for KUNLUN

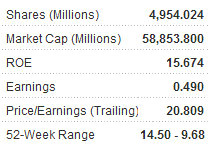

UOB Kay Hian said that it is maintaining its ‘buy’ call on crude oil and natural gas explorer and producer Kunlun Energy Ltd (HK: 135) with a target price of 15.8 hkd.

“Backed by strong support from parent PetroChina, Kunlun Energy is set to transform into a mid- to downstream natural gas play by acquiring relevant assets, driving up its revenue by 10-15x in 2015,” UOB said.

It added that Kunlun is expected to enjoy an “earnings boom” in 2012.

“Kunlun’s CNG&LNG terminals will become operational from 2012 onwards, bringing in 32% CAGR earnings upside in 2012-13.”

Continued assets acquisition are likely to be catalysts for Kunlun going forward.

“Despite the newly acquired 60% stake of PetroChina Beijing Gas Pipeline Co Ltd, Kunlun Energy will continue to acquire other pipelines (possibly including Zhongwu, West-to-East), Kunlun Gas and other terminals.

See also: SINO OIL & GAS, SAMSONITE: What Analysts Now Say...

UOB: CHINA AUTOMATION has ‘cheap valuation, strong fundamentals’

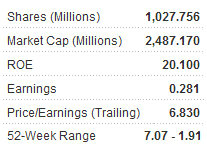

UOB Kay Hian said that China Automation Group (HK: 569) is a bargain in the sector.

“The share price has underperformed since July 11, and downside risk is limited as CAG is trading at book value now. We maintain our ‘buy’ recommendation for the stock given its cheap valuation and strong fundamentals.”

China Automation is the largest integrated solutions provider of petrochemical safety and control systems, and is one of the leading providers of railway signaling systems.

“The suspension in railway construction will curtail demand for CAG’s products in the railway sector. However, the sector is expected to remain as an economical mode for mass and long distance transport in China and the long-term outlook for railway products remains positive,” UOB added.

See also: CHINA HIGH PRECISION: HK Listco’s 1H Off Charts On Indicator Sales